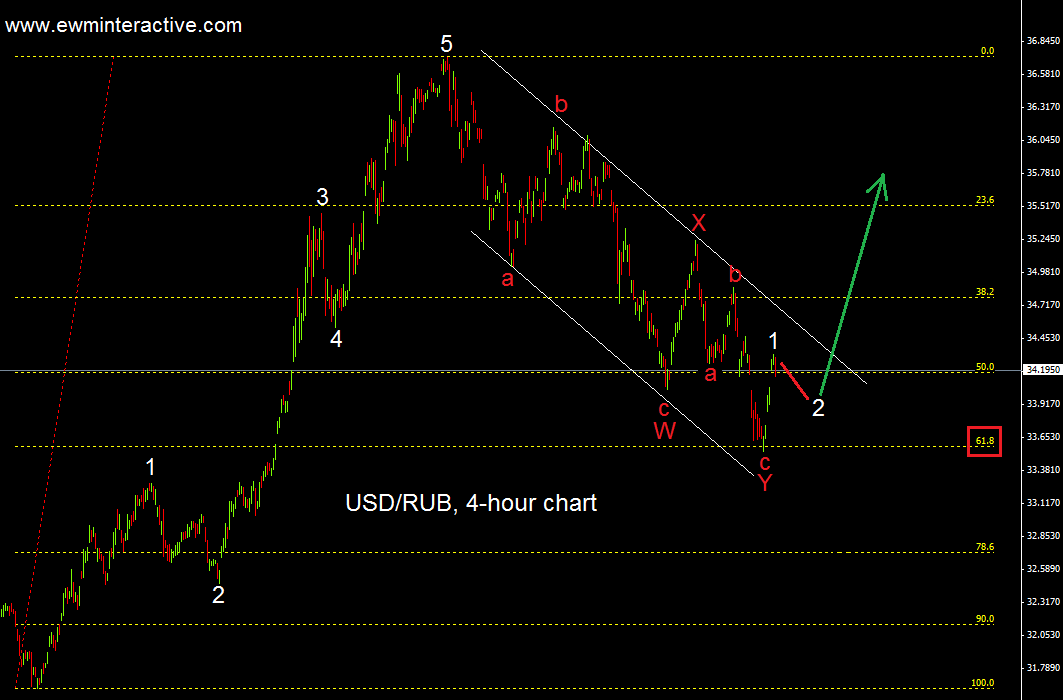

On July 2nd we published “USDRUB ready to resume the uptrend”, saying that “having the wave structure and the Fibonacci level in mind, we expect that corrective channel to be broken to the upside soon. If this is the correct count, USDRUB may exceed the top of 36.716.” The next chart will show you how the USD RUB exchange rate looked like, when we made that forecast.

From the position of the Elliott Wave Principle we had all we need to form a bullish expectation. It was a textbook example of the 5-3 Elliott Wave cycle. Now let’s see how the situation developed during the past two months.

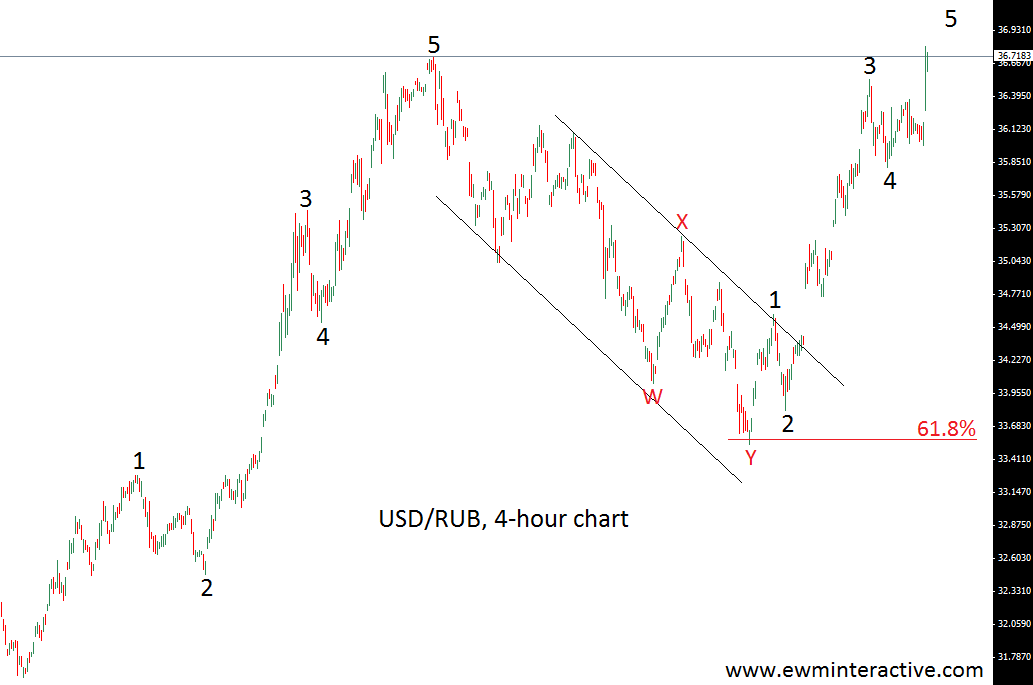

As you can see, the 61.8% Fibonacci level provided a strong enough support for the US dollar to start rising against the Russian ruble. Yesterday, on August 28th, the USD RUB forex pair went to a new high above 36.716, thus reaching our minimum target. Looking back to the beginning of July, we may say this is an excellent example of the Wave Principle’s ability to recognize new trends in their early stages, which is exactly what every trader needs, right?

Trading financial instruments entails a great degree of uncertainty and a variety of risks. EMW Interactive’s materials and market analysis are provided for educational purposes only. As such, their main purpose is to illustrate how the Elliott Wave Principle can be applied to predict movements in the financial markets. As a perfectly accurate method for technical analysis does not exist, the Elliott Wave Principle is also not flawless. As a result, the company does not take any responsibility for the potential losses our end-user might incur. Simply, any decision to trade or invest, based on the information from this website, is at your own risk.

Recommended Content

Editors’ Picks

AUD/USD remained bid above 0.6500

AUD/USD extended further its bullish performance, advancing for the fourth session in a row on Thursday, although a sustainable breakout of the key 200-day SMA at 0.6526 still remain elusive.

EUR/USD faces a minor resistance near at 1.0750

EUR/USD quickly left behind Wednesday’s small downtick and resumed its uptrend north of 1.0700 the figure, always on the back of the persistent sell-off in the US Dollar ahead of key PCE data on Friday.

Gold holds around $2,330 after dismal US data

Gold fell below $2,320 in the early American session as US yields shot higher after the data showed a significant increase in the US GDP price deflator in Q1. With safe-haven flows dominating the markets, however, XAU/USD reversed its direction and rose above $2,340.

Bitcoin price continues to get rejected from $65K resistance as SEC delays decision on spot BTC ETF options

Bitcoin (BTC) price has markets in disarray, provoking a broader market crash as it slumped to the $62,000 range on Thursday. Meanwhile, reverberations from spot BTC exchange-traded funds (ETFs) continue to influence the market.

US economy: slower growth with stronger inflation

The dollar strengthened, and stocks fell after statistical data from the US. The focus was on the preliminary estimate of GDP for the first quarter. Annualised quarterly growth came in at just 1.6%, down from the 2.5% and 3.4% previously forecast.