USD JPY has been in a strong uptrend for the last two months. Is it time for the bulls to take a rest? Traders may want to see what the probabilities show.

Our job as analysts is to try to determine when the trend is most likely to reverse or make a pull-back. In order to do that, we use a method, called the Elliott Wave Principle. It is probably the most advanced price-pattern recognition technique. According to it, trends move in five-wave sequences, called impulses. Every impulse is followed by a correction in the opposite direction. So, in the case with USD JPY, we have to see, if there is a complete five-wave move. If there is one, we should prepare for a pull-back.

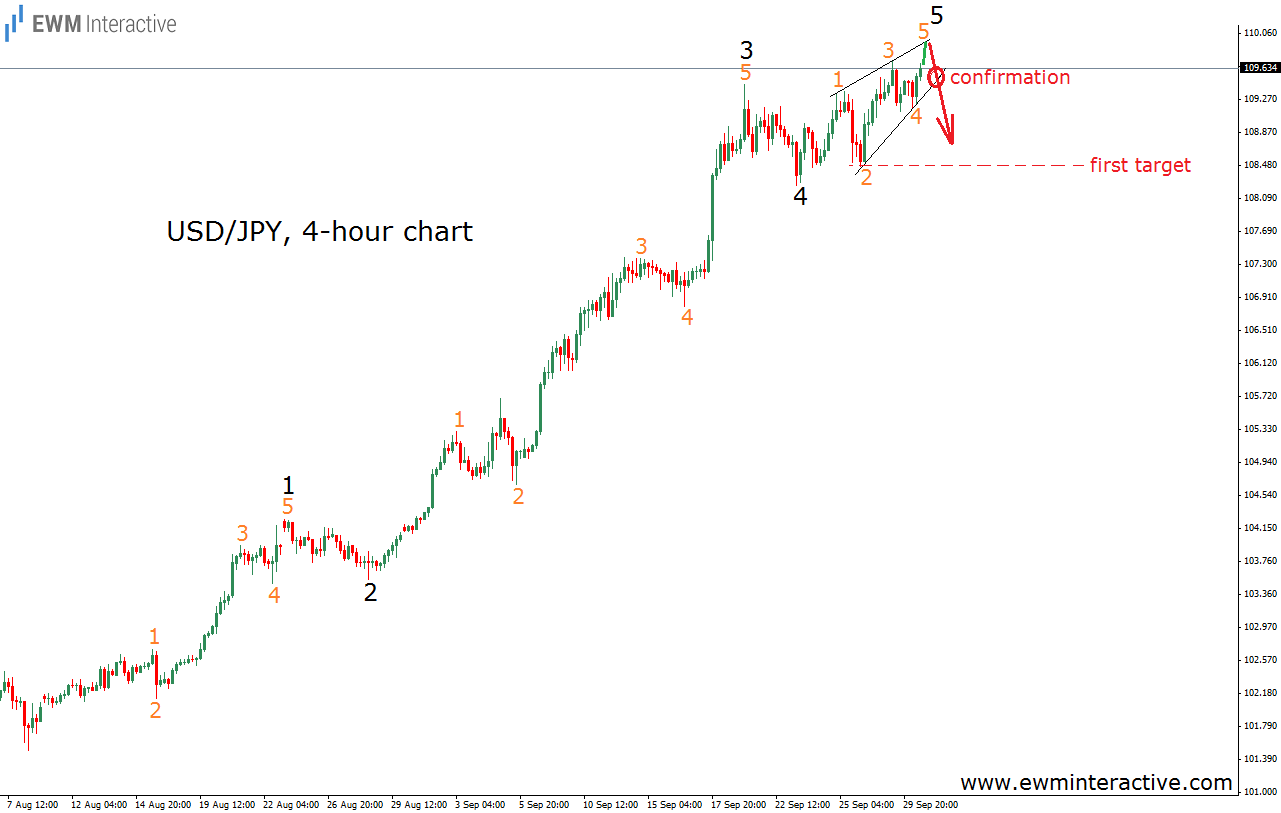

And the 4-hour chart shows a very clear impulsive rally, which seems to be approaching the end of its fifth wave. Fifths waves take the form of either a regular “five” or an ending diagonal. Judging from the wave structure, it looks more like the second possibility. Those of you, who have read our article about ending diagonals, probably know that this is a very tricky pattern. That is why there are three different approaches, when it comes to trading, depending on what type of trader you are. The more aggressive your style is, the earlier you pull the trigger – at the top of wave 5 of the diagonal. Conservative traders prefer to wait for the extreme of wave 4 to give away before initiating a trade. And the third choice is the one we fancy – to wait for the lower line of the diagonal to be broken. There is no right or wrong way to trade this pattern. It all depends on you personal risk tolerance and trading style.

If this is the correct count, USD JPY should make a new high above 109.74, but the 110.00 area may serve as a strong resistance and a reversal zone. The first target to the downside is around 108.50.

Trading financial instruments entails a great degree of uncertainty and a variety of risks. EMW Interactive’s materials and market analysis are provided for educational purposes only. As such, their main purpose is to illustrate how the Elliott Wave Principle can be applied to predict movements in the financial markets. As a perfectly accurate method for technical analysis does not exist, the Elliott Wave Principle is also not flawless. As a result, the company does not take any responsibility for the potential losses our end-user might incur. Simply, any decision to trade or invest, based on the information from this website, is at your own risk.

Recommended Content

Editors’ Picks

EUR/USD holds steady near 1.0650 amid risk reset

EUR/USD is holding onto its recovery mode near 1.0650 in European trading on Friday. A recovery in risk sentiment is helping the pair, as the safe-haven US Dollar pares gains. Earlier today, reports of an Israeli strike inside Iran spooked markets.

GBP/USD recovers toward 1.2450 after UK Retail Sales data

GBP/USD is rebounding toward 1.2450 in early Europe on Friday, having tested 1.2400 after the UK Retail Sales volumes stagnated again in March, The pair recovers in tandem with risk sentiment, as traders take account of the likely Israel's missile strikes on Iran.

Gold price defends gains below $2,400 as geopolitical risks linger

Gold price is trading below $2,400 in European trading on Friday, holding its retreat from a fresh five-day high of $2,418. Despite the pullback, Gold price remains on track to book the fifth weekly gain in a row, supported by lingering Middle East geopolitical risks.

Bitcoin Price Outlook: All eyes on BTC as CNN calls halving the ‘World Cup for Bitcoin’

Bitcoin price remains the focus of traders and investors ahead of the halving, which is an important event expected to kick off the next bull market. Amid conflicting forecasts from analysts, an international media site has lauded the halving and what it means for the industry.

Geopolitics once again take centre stage, as UK Retail Sales wither

Nearly a week to the day when Iran sent drones and missiles into Israel, Israel has retaliated and sent a missile into Iran. The initial reports caused a large uptick in the oil price.