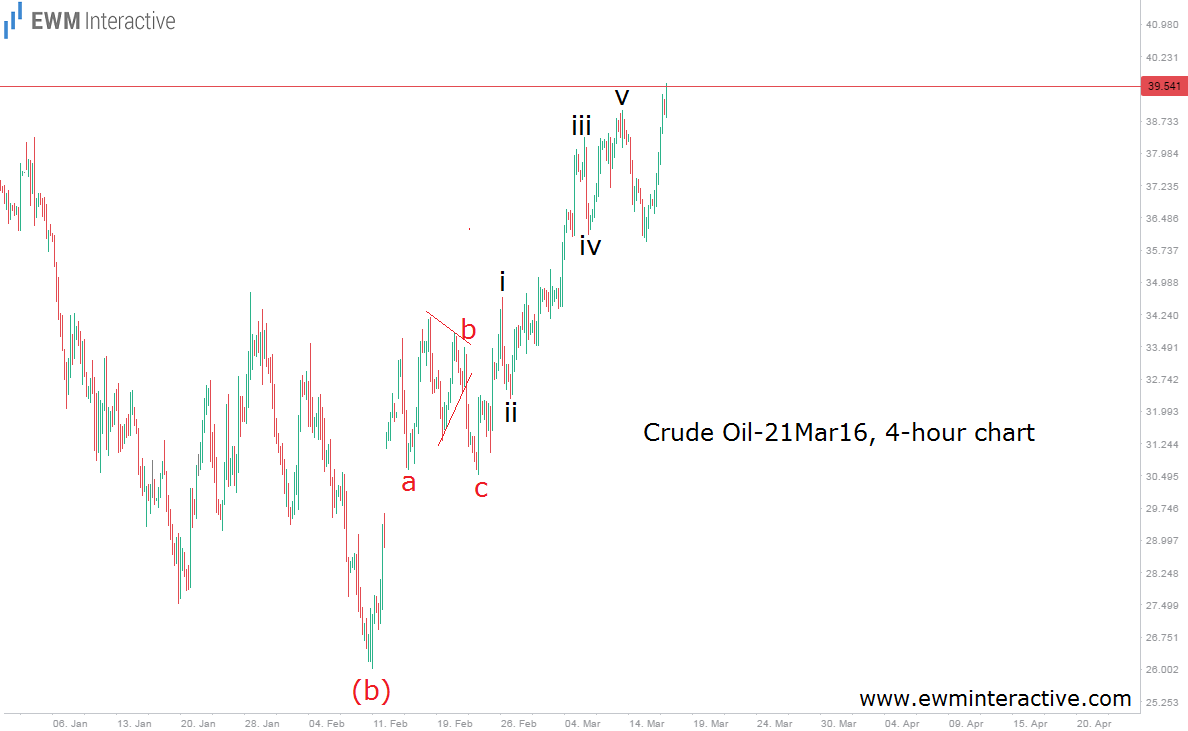

The start of this week was not the best possible for crude oil, since the price fell as low as 35.95 dollars a barrel on March 15th. However, the bulls managed to regroup and take the commodity to new highs near 39.63 so far. Some might explain oil’s price swings with the OPEC supply freeze negotiations. Others may add that the reports about the inventories, imports and exports caused the market to move in this particular way. But all the post-factum explanations are a bit useless. In our opinion, traders are far more interested in whether the development in the price of crude oil could have been predicted. Our answer is YES and we can prove it with the chart below.(some of the marks have been removed for this article).

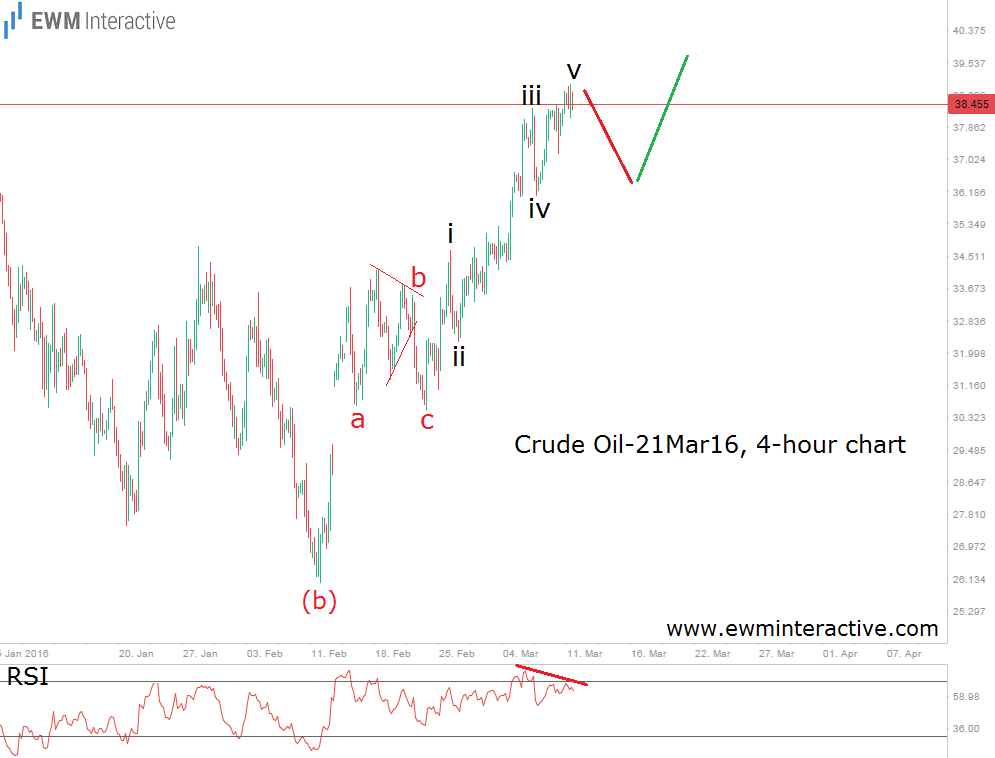

Our premium clients received this chart on Monday, March 14th. As visible, the Elliott Wave Principle suggested we should expect a decline to around 36.00, before the bulls return to take oil to a new high. The relative strength index also helped us prepare for the weakness at the start of the week, by showing a bearish divergence between the last two swing highs. Now let’s see an updated chart, which will show us how crude oil has been developing during the last four days.

It turns out everything has been going according to plan. This is an excellent example of the fact, that the Wave principle can help you predict not only just one single, but two consecutive price moves in the opposite directions, without caring about all the explanations afterwards. That is one of the many reasons this forecasting method is our favorite. And we believe it deserves your trust too.

Trading financial instruments entails a great degree of uncertainty and a variety of risks. EMW Interactive’s materials and market analysis are provided for educational purposes only. As such, their main purpose is to illustrate how the Elliott Wave Principle can be applied to predict movements in the financial markets. As a perfectly accurate method for technical analysis does not exist, the Elliott Wave Principle is also not flawless. As a result, the company does not take any responsibility for the potential losses our end-user might incur. Simply, any decision to trade or invest, based on the information from this website, is at your own risk.

Recommended Content

Editors’ Picks

AUD/USD rises to two-day high ahead of Aussie CPI

The Aussie Dollar recorded back-to-back positive days against the US Dollar and climbed more than 0.59% on Tuesday, as the US April S&P PMIs were weaker than expected. That spurred speculations that the Federal Reserve could put rate cuts back on the table. The AUD/USD trades at 0.6488 as Wednesday’s Asian session begins.

EUR/USD now refocuses on the 200-day SMA

EUR/USD extended its positive momentum and rose above the 1.0700 yardstick, driven by the intense PMI-led retracement in the US Dollar as well as a prevailing risk-friendly environment in the FX universe.

Gold struggles around $2,325 despite broad US Dollar’s weakness

Gold reversed its direction and rose to the $2,320 area, erasing a large portion of its daily losses in the process. The benchmark 10-year US Treasury bond yield stays in the red below 4.6% following the weak US PMI data and supports XAU/USD.

Bitcoin price makes run for previous cycle highs as Morgan Stanley pushes BTC ETF exposure

Bitcoin (BTC) price strength continues to grow, three days after the fourth halving. Optimism continues to abound in the market as Bitcoiners envision a reclamation of previous cycle highs.

Australia CPI Preview: Inflation set to remain above target as hopes of early interest-rate cuts fade

An Australian inflation update takes the spotlight this week ahead of critical United States macroeconomic data. The Australian Bureau of Statistics will release two different inflation gauges on Wednesday.