Daily Forecast - 06 April 2016

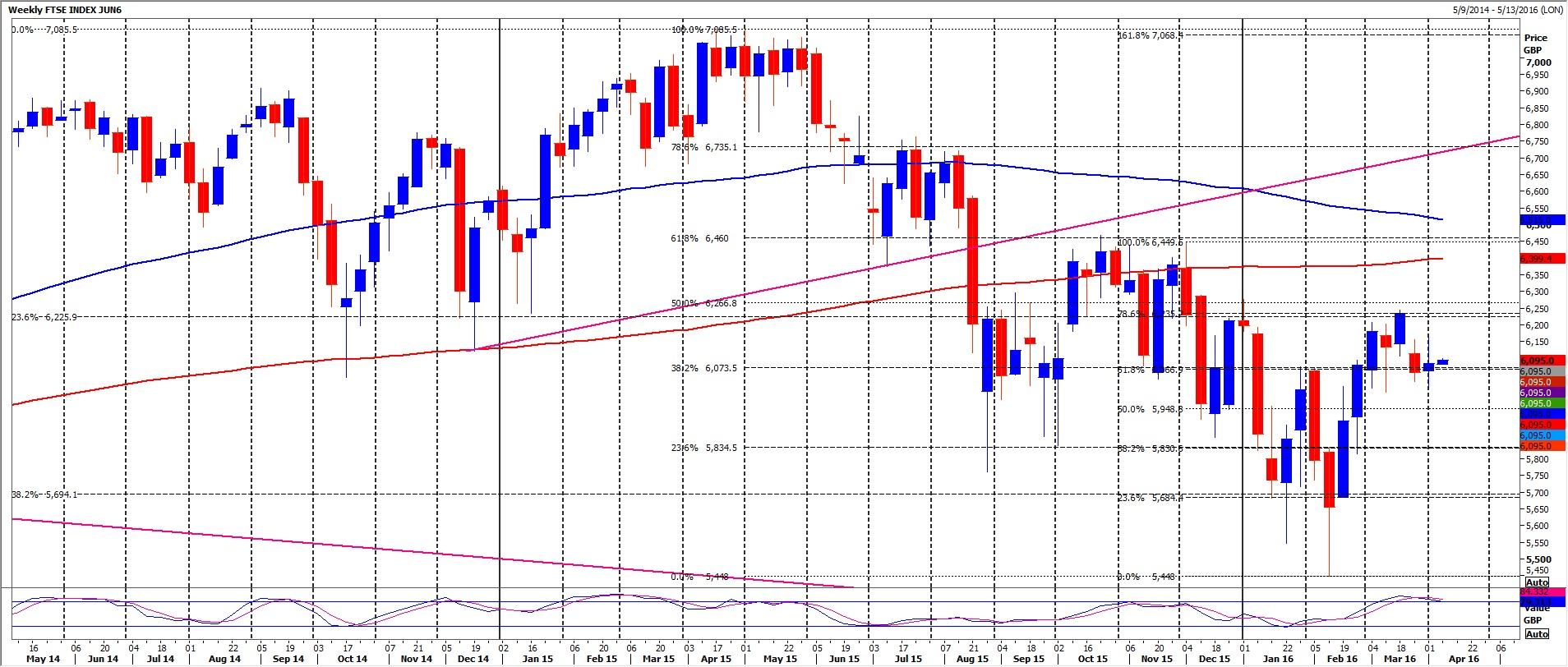

Ftse June Contract

FTSE first resistance at 6055/59 but above here targets 6073/76 then quite strong resistance at 6090/95. This is probably the best chance of a high for the day but shorts need stops above 6125. A break higher targets 6150/55 today.

Failure to beat first resistance at 6055/59 targets minor support at 6038/35 before more important support at the March low at 6000/5999. A break below 5990 this week risks a slide good support at 5945/40.

S&P June Contract

Emini S&P made a recovery to the 2047/49 level which is the main challenge for bulls today. A break higher is a positive signal & targets minor resistance at 2055/57 but if we continue higher look for 2062 before the recovery high at 2071. A break above here this week targets late December highs for the March contract at 2074/75. If we continue higher look for 2082/83 then 2090/91.

Failure to beat quite strong short term resistance at 2047/49 targets 2042/41 before support at 2034/32 for an excellent buying opportunity. Longs need stops below 2027. Just be aware that an unexpected break lower targets 2020 then 2012, but 2010/08 is an excellent buying opportunity again.

Dax June Contract

Dax initially held good support at 9600/9590 perfectly & we wrote: This is the best chance of a low for the week but longs need stops below the gap at 9550. Yesterday's low was 9556 but we did close below 9590. Therefore risks are to the downside & a break below 9550 targets 9510/00 then 9430/20. If we continue lower look for a retest of March lows at 9395. A break below here targets quite good support at 9330/25 then only minor support at 9260/50.

Bulls need to push prices above 9600 to get back in the game today & target 9650/60 before resistance at 9695/9705. Watch for a high for the day but if shorts need stops above 9725 & if continue higher look for strong resistance in the short term at 9760/70.

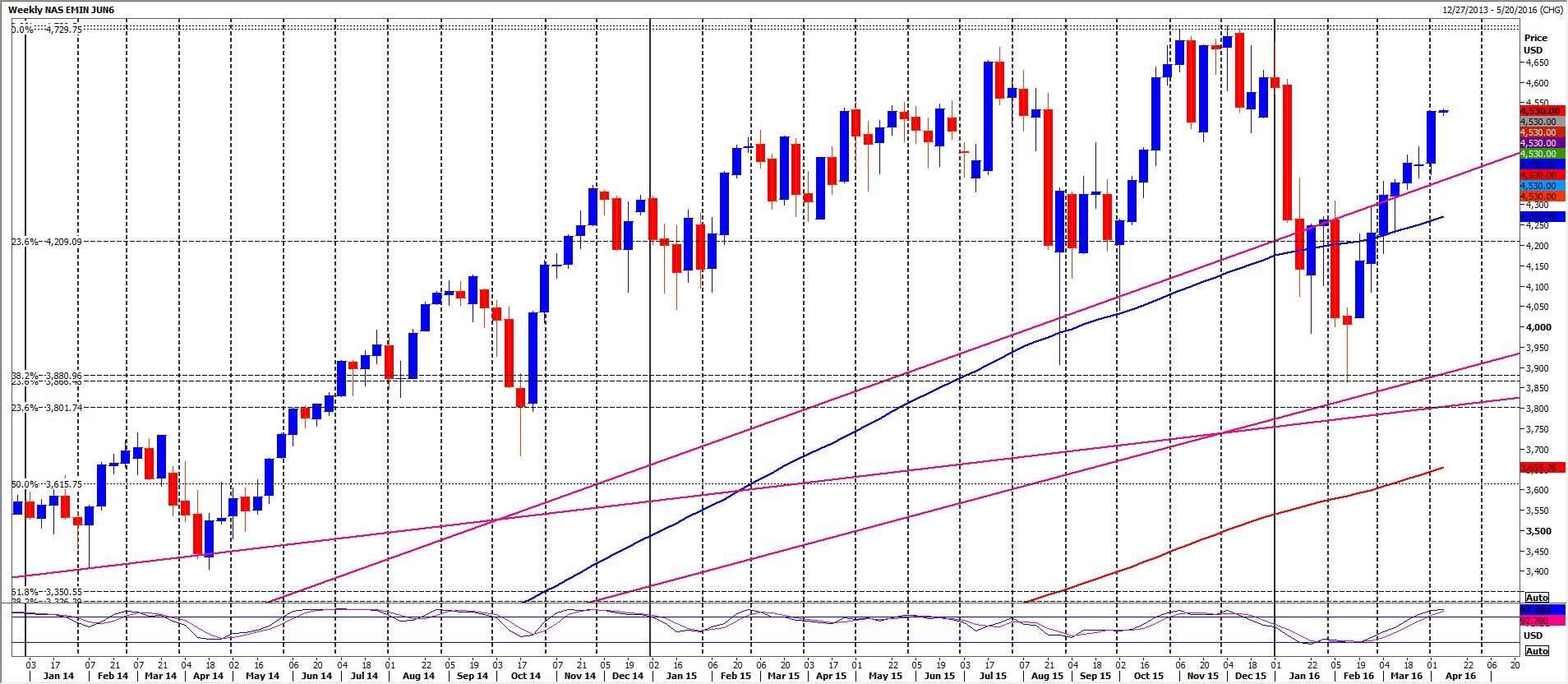

E Mini Nasdaq June Contract

Emini Nasdaq bulls remain in control as we trade back up to the target of 4495/96. if we continue higher look for 4509/10 before 4528/29 then recovery highs of 4542/44. If we continue higher look for 4551/53, 4566 & 4570/73.

However failure tom hold above 4585 risks a slide back to 4470/69. This is more important today & 4460/55 is more minor support. So be ready to sell a break below here today to target 4444/4441 then a buying opportunity at 4436/34.

Emini Dow Jones June Contract

Emini Dow Jones same levels apply for today with first resistance at 17610/620 but above here targets 17660/670 & 17690/699. If we continue higher look for a retest of the recovery high at 17753. A break above 17760/765 targets mid December highs at 17810/820. Further gains this week run in to strong resistance at November/December highs at 17905.

Holding below 17600 keeps the short term pressure on for a retest of first support at 17530/520. Longs need stops below 17485! A break lower targets 17450/440 then strong support at 17399/390.

The contents of our reports are intended to be understood by professional users who are fully aware of the inherent risks in Forex, Futures, Options, Stocks and Bonds trading. INFORMATION PROVIDED WITHIN THIS MATERIAL SHOULD NOT BE CONSTRUED AS ADVICE AND IS PROVIDED FOR INFORMATION AND EDUCATION PURPOSES ONLY.

Recommended Content

Editors’ Picks

AUD/USD risks a deeper drop in the short term

AUD/USD rapidly left behind Wednesday’s decent advance and resumed its downward trend on the back of the intense buying pressure in the greenback, while mixed results from the domestic labour market report failed to lend support to AUD.

EUR/USD leaves the door open to a decline to 1.0600

A decent comeback in the Greenback lured sellers back into the market, motivating EUR/USD to give away the earlier advance to weekly tops around 1.0690 and shift its attention to a potential revisit of the 1.0600 neighbourhood instead.

Gold is closely monitoring geopolitics

Gold trades in positive territory above $2,380 on Thursday. Although the benchmark 10-year US Treasury bond yield holds steady following upbeat US data, XAU/USD continues to stretch higher on growing fears over a deepening conflict in the Middle East.

Bitcoin price shows strength as IMF attests to spread and intensity of BTC transactions ahead of halving

Bitcoin (BTC) price is borderline strong and weak with the brunt of the weakness being felt by altcoins. Regarding strength, it continues to close above the $60,000 threshold for seven weeks in a row.

Is the Biden administration trying to destroy the Dollar?

Confidence in Western financial markets has already been shaken enough by the 20% devaluation of the dollar over the last few years. But now the European Commission wants to hand Ukraine $300 billion seized from Russia.