Daily Forecast - 04 April 2016

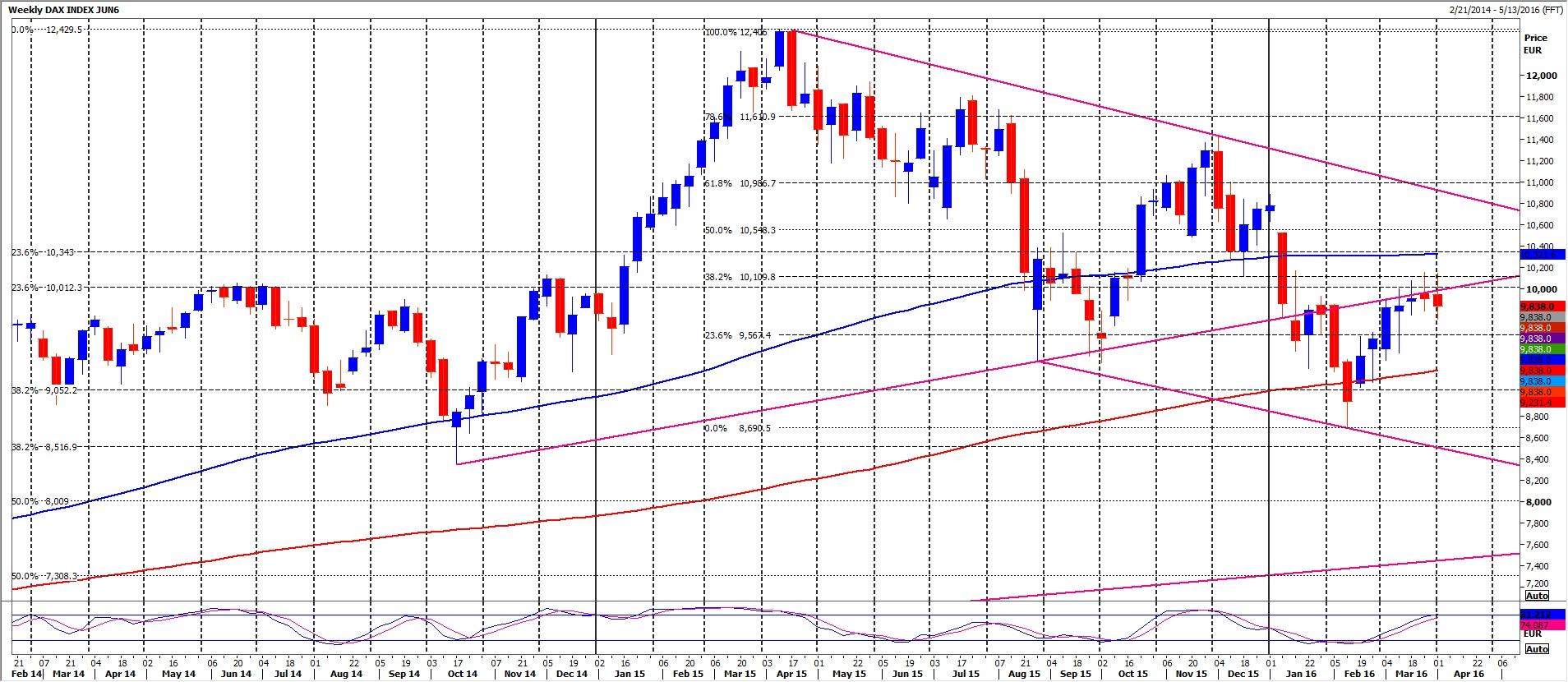

Dax June Contract

Dax must hold above 9815/05 today to remain stable. Minor resistance at 9875 but above here targets 9925 then stronger resistance at 9965/75 & the main challenge for bulls today. Shorts need stops above 10000. A break higher targets 10040/050 then 100 day moving average resistance at 10090/10100. Try shorts with stops above 10145.

Failure to hold above 9800 is more negative & targets 9740/35 then last week's low at 9713. Further losses this week target 9675/70 then good support at 9600/9590. This is the best chance of a low for the week but longs need stops below the gap at 9550.

Eurostoxx June Contract

EuroStoxx now oversold so a short term recovery is possible. Holding above 2880 targets resistance & the main challenge for bulls today at 2900/05. Shorts need stops above 2916. Further gains target 2922/25 then strong resistance at 2950/55.

Holding below 2875 however risks a retest of minor support at 2846/42. A break below last week's low at 2840 reinforces the 1 year bear trend & targets 2831/27, 2817/15 & mid-late February lows at 2803/2799.

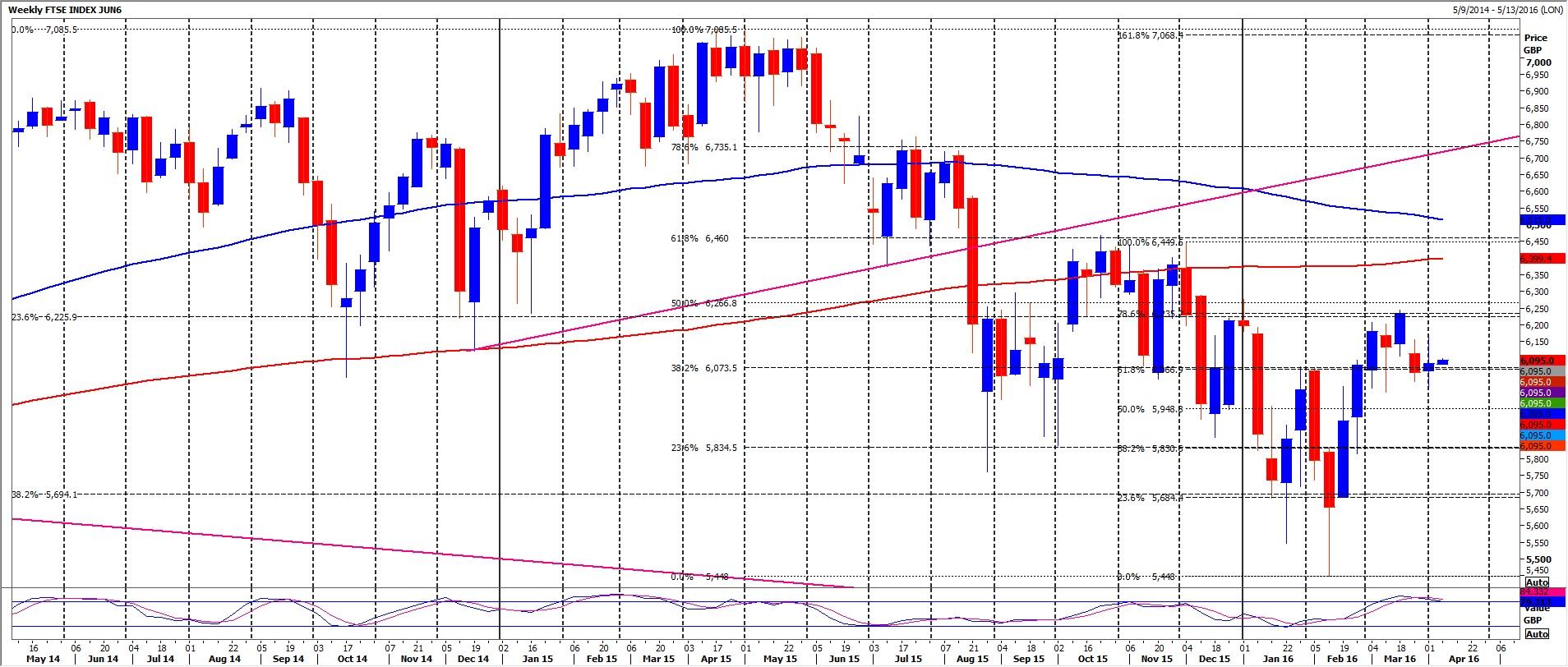

Ftse June Contract

FTSE first resistance at 6100 but above 6105 targets 6126/30, perhaps as far as minor resistance at 3 week highs of 6155/63. On a break higher this week look for a gap to fill at 6190/95 then strong 200 day moving average resistance at 6205/10.

Failure to hold above 6095 targets good support at 6058/53. A break below 6040 however could re-target 6018 before last week's low at 6010 & important support at the March low at 6000/5999. A break below 5990 this week risks a slide good support at 5945/40.

The contents of our reports are intended to be understood by professional users who are fully aware of the inherent risks in Forex, Futures, Options, Stocks and Bonds trading. INFORMATION PROVIDED WITHIN THIS MATERIAL SHOULD NOT BE CONSTRUED AS ADVICE AND IS PROVIDED FOR INFORMATION AND EDUCATION PURPOSES ONLY.

Recommended Content

Editors’ Picks

AUD/USD jumps above 0.6500 after hot Australian CPI data

AUD/USD extended gains and recaptured 0.6500 in Asian trading, following the release of hotter-than-expected Australian inflation data. The Australian CPI rose 1% in QoQ in Q1 against 0.8% forecast, providing extra legs to the Australian Dollar upside.

USD/JPY hangs near 34-year high at 154.88 as intervention risks loom

USD/JPY is sitting at a multi-decade high of 154.88 reached on Tuesday. Traders refrain from placing fresh bets on the pair as Japan's FX intervention risks loom. Broad US Dollar weakness also caps the upside in the major. US Durable Goods data are next on tap.

Gold price cautious despite weaker US Dollar and falling US yields

Gold retreats modestly after failing to sustain gains despite fall in US Treasury yields, weaker US Dollar. XAU/USD struggles to capitalize following release of weaker-than-expected S&P Global PMIs, fueling speculation about potential Fed rate cuts.

Crypto community reacts as BRICS considers launching stablecoin for international trade settlement

BRICS is intensifying efforts to reduce its reliance on the US dollar after plans for its stablecoin effort surfaced online on Tuesday. Most people expect the stablecoin to be backed by gold, considering BRICS nations have been accumulating large holdings of the commodity.

US versus the Eurozone: Inflation divergence causes monetary desynchronization

Historically there is a very close correlation between changes in US Treasury yields and German Bund yields. This is relevant at the current juncture, considering that the recent hawkish twist in the tone of the Fed might continue to push US long-term interest rates higher and put upward pressure on bond yields in the Eurozone.