Daily Forecast - 07 March 2016

S&P March contract

Emini S&P Fibonacci & 100wma at 2007 was the greatest challenge for bulls in this 3 week bear market bounce. WE TOPPED EXACTLY HERE. First downside target 1988/87 then 1984 & minor support at 1979/78. However a break below 1974 targets 1968/67 then strong support at 1961/59.

Any gains should be limited with first resistance at 1994/95 then trend line resistance at 2002/03. If we continue higher the most important resistance of the week is at 2007/2009. In fact only a daily close above the 200 day moving average at 2018 would force me to believe the overbought conditions are being ignored & bulls can push higher to 2035.

E Mini Nasdaq March contract

Emini Nasdaq must hold above longer term trend line resistance at 4315/20 for bulls to retain control. We could then target 4340/45 & perhaps as far as last week's high at 4357. A break higher this week in overbought conditions may only take us to strong resistance at 4376/80. A good chance of a high for the day & also for the 3 week recovery. This is where the selling could resume so be very careful. Shorts need stops above 4395 but really we need a weekly close above here to confirm bulls remains in control for now. A break above 4400 targets an excellent selling opportunity at 4428/30.

Failure to hold above 4310 is less positive & risks a retest of 3 day lows at 4298/93. Further losses target the 4 week recovery bull trend line at 4283/80. Failure to hold & in particular to close above here is an added negative signal & targets 4260/55.

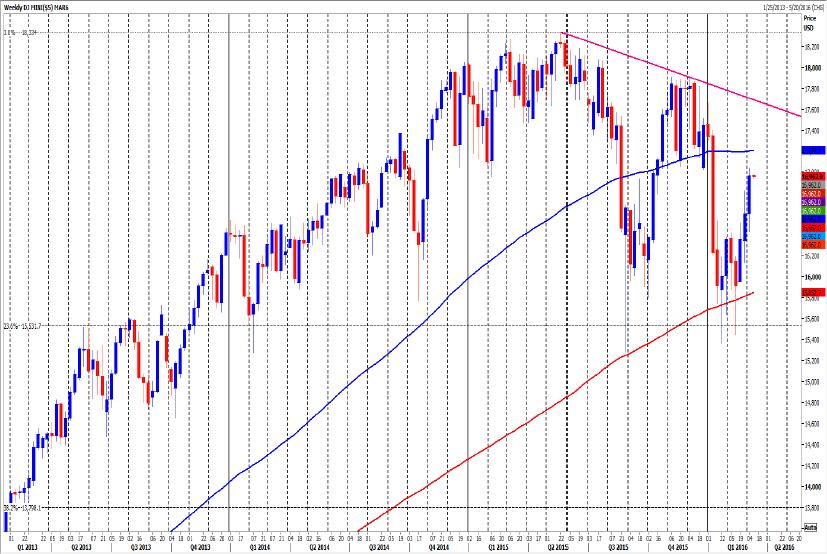

Emini Dow Jones March contract

Emini Dow Jones strong resistance up to 17000 but if we can beat 17040/050 we look for a test of the 200 day moving average at 17120/130. We also have short term trend line resistance at 17150/160 so this area should be a big challenge for bulls. Only a CLOSE above the 100 week moving average at 17210 could be seen as more positive for this week.

First support at 16900/890 is only minor & below targets better support at 16830/820. However if we continue lower look for a test of the important 4 week recovery trend line at 16750/740. A break below here is a bigger sell signal & initially targets 16670/660.

The contents of our reports are intended to be understood by professional users who are fully aware of the inherent risks in Forex, Futures, Options, Stocks and Bonds trading. INFORMATION PROVIDED WITHIN THIS MATERIAL SHOULD NOT BE CONSTRUED AS ADVICE AND IS PROVIDED FOR INFORMATION AND EDUCATION PURPOSES ONLY.

Recommended Content

Editors’ Picks

EUR/USD hovers around 1.0700 after German IFO data

EUR/USD stays in a consolidation phase at around 1.0700 in the European session on Wednesday. Upbeat IFO sentiment data from Germany helps the Euro hold its ground as market focus shifts to US Durable Goods Orders data.

USD/JPY refreshes 34-year high, attacks 155.00 as intervention risks loom

USD/JPY is renewing a multi-decade high, closing in on 155.00. Traders turn cautious on heightened risks of Japan's FX intervention. Broad US Dollar rebound aids the upside in the major. US Durable Goods data are next on tap.

Gold price trades with mild negative bias, manages to hold above $2,300 ahead of US data

Gold price (XAU/USD) edges lower during the early European session on Wednesday, albeit manages to hold its neck above the $2,300 mark and over a two-week low touched the previous day.

Worldcoin looks set for comeback despite Nvidia’s 22% crash Premium

Worldcoin price is in a better position than last week's and shows signs of a potential comeback. This development occurs amid the sharp decline in the valuation of the popular GPU manufacturer Nvidia.

Three fundamentals for the week: US GDP, BoJ and the Fed's favorite inflation gauge stand out Premium

While it is hard to predict when geopolitical news erupts, the level of tension is lower – allowing for key data to have its say. This week's US figures are set to shape the Federal Reserve's decision next week – and the Bank of Japan may struggle to halt the Yen's deterioration.