Daily Forecast - 19 February 2016

E Mini Nasdaq March contract

Emini Nasdaq first resistance at 4175/80 is the main challenge for bulls today. Only above here is more positive again & targets 4215 then 4228/30. We should struggle here again with bears in longer term control, but if we continue higher today look for 4250/55. A break above 4260 keeps bulls in short term control to target resistance at 4280.

Holding below 4180/70 is more negative as we test trend line support at 4145/40. If we continue lower look for better support at 4115/11 which could hold the downside but a break below 4100 could target 4088/86 then good support at 4055/50.

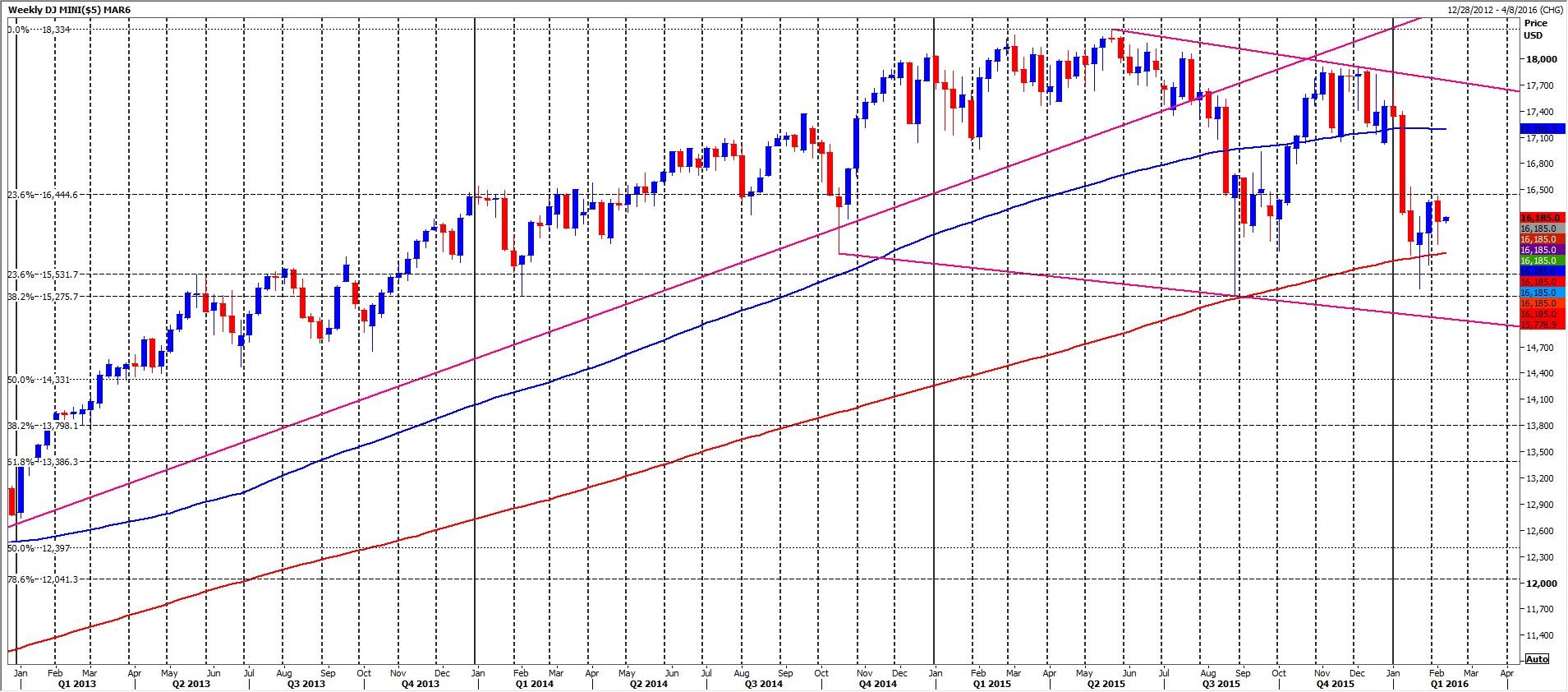

Emini Dow Jones March contract

Emini Dow Jones has quite good trend line support at 16330/325 which may just hold the downside but below here targets strong support at 16255/245. Longs need stops below 16200. Further losses target 16150 then 16090/085. If we continue lower there is quite good support at 16020/16000.

Holding good trend line support at 16330/325 targets resistance at 16450/470. Shorts need stops above 16520 again today. A break higher is a buy signal & targets 16630/640 then 16666. If we continue higher look for 16710 then strong resistance at 16775/785 for a selling opportunity.

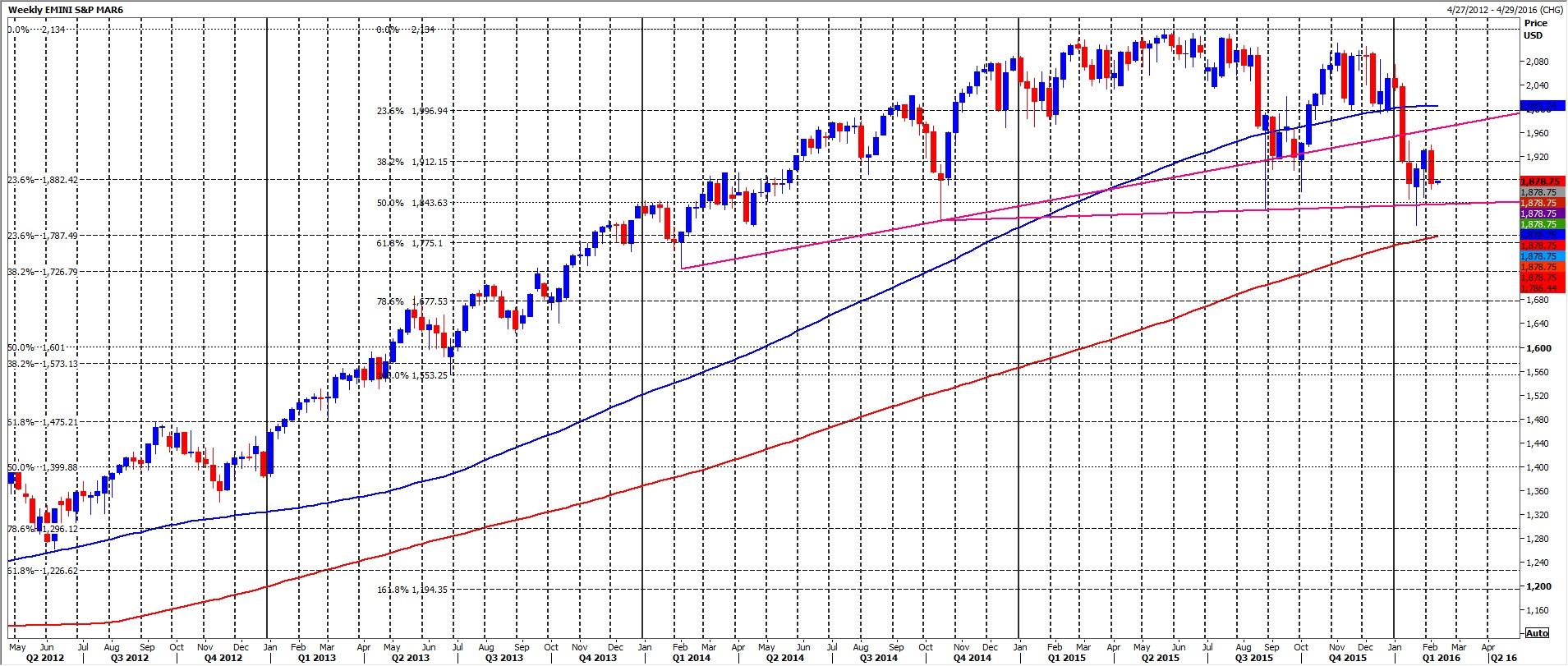

S&P March contract

Emini S&P first resistance at 1921/22 but above here targets 1927/28 then 1933/34. Resistance at 1938/40 is important because it is the 2 week & February high, as well as a 50% recovery of the steep sell off from late December. So this is the main challenge for bulls today. Shorts need stops above 1946 however as a break higher targets 1952 & 1956.

Failure to beat 1922 re-targets 1918/17 then 1912/11. If we continue lower look for the best support of the day at 1905/04. Longs need stops below 1899. A break lower targets minor support at 1892/91, perhaps as far as strong support at 1885/84 which could hold the downside at this stage.

The contents of our reports are intended to be understood by professional users who are fully aware of the inherent risks in Forex, Futures, Options, Stocks and Bonds trading. INFORMATION PROVIDED WITHIN THIS MATERIAL SHOULD NOT BE CONSTRUED AS ADVICE AND IS PROVIDED FOR INFORMATION AND EDUCATION PURPOSES ONLY.

Recommended Content

Editors’ Picks

EUR/USD climbs to 10-day highs above 1.0700

EUR/USD gained traction and rose to its highest level in over a week above 1.0700 in the American session on Tuesday. The renewed US Dollar weakness following the disappointing PMI data helps the pair stretch higher.

GBP/USD extends recovery beyond 1.2400 on broad USD weakness

GBP/USD gathered bullish momentum and extended its daily rebound toward 1.2450 in the second half of the day. The US Dollar came under heavy selling pressure after weaker-than-forecast PMI data and fueled the pair's rally.

Gold rebounds to $2,320 as US yields turn south

Gold reversed its direction and rose to the $2,320 area, erasing a large portion of its daily losses in the process. The benchmark 10-year US Treasury bond yield stays in the red below 4.6% following the weak US PMI data and supports XAU/USD.

Here’s why Ondo price hit new ATH amid bearish market outlook Premium

Ondo price shows no signs of slowing down after setting up an all-time high (ATH) at $1.05 on March 31. This development is likely to be followed by a correction and ATH but not necessarily in that order.

Germany’s economic come back

Germany is the sick man of Europe no more. Thanks to its service sector, it now appears that it will exit recession, and the economic future could be bright. The PMI data for April surprised on the upside for Germany, led by the service sector.