Daily Forecast - 20 January 2016

EURGBP Spot

EURGBP clearly in a powerful bull trend as we target 7736/39. Further gains target 7757/60 then 7780/82. If we continue higher look for resistance at 7795.

Support at 7715/13 but below 7695 risks a slide to 7660. The downside is likely to be limited in the negative trend but further losses offer an excellent buying opportunity at 7635/30.

EURUSD Spot

EURUSD first resistance at 1.0940/44 but a break above the 2 day high today could retest last week's high at 1.0984. Further gains target an excellent selling opportunity at 1.1020/25. There is a good chance of a high for the day & even for the week but shorts need stops above 1.1060.

Holding below 1.0920 targets 1.0900/1.0895 then support at 1.0880/76. A good chance of a low for the day and this did just hold yesterday, but longs need stops below 1.0850. Further losses target 1.0835/31 then support at 1.0815. Try longs with stops below 1.0795. Further losses however could target 1.0765/62. If we continue lower look for support at 1.0740/35 to hold the downside.

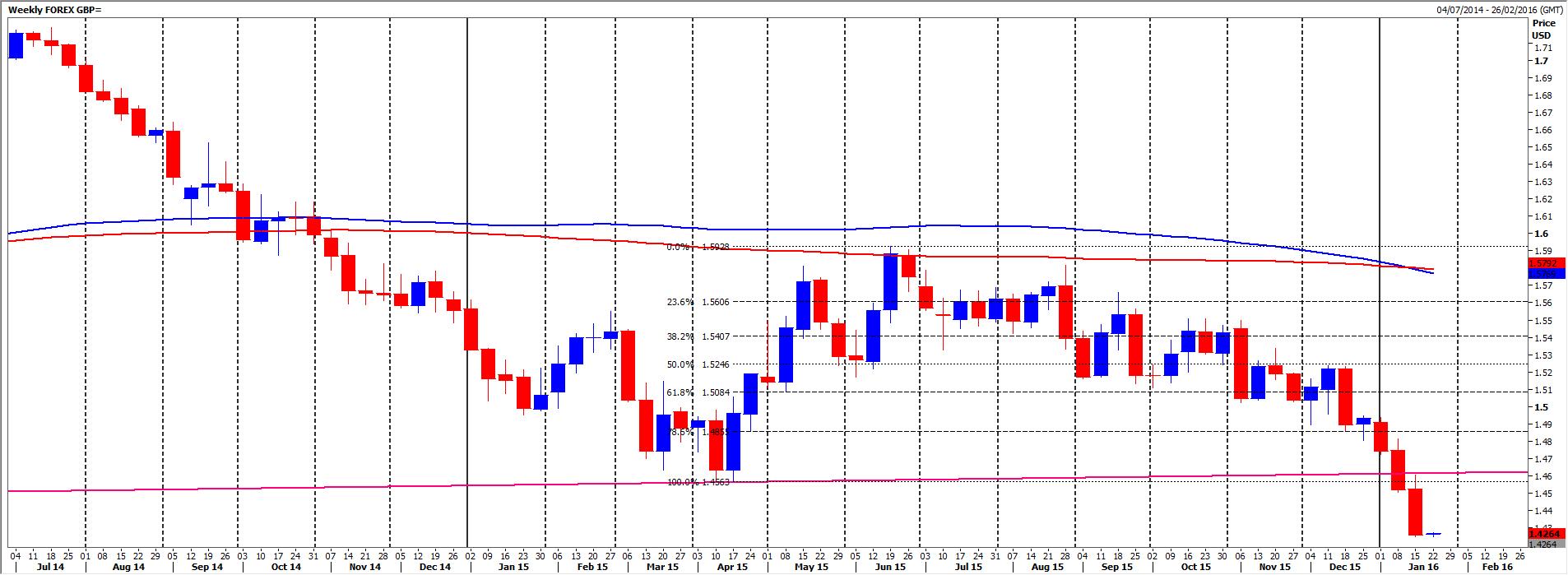

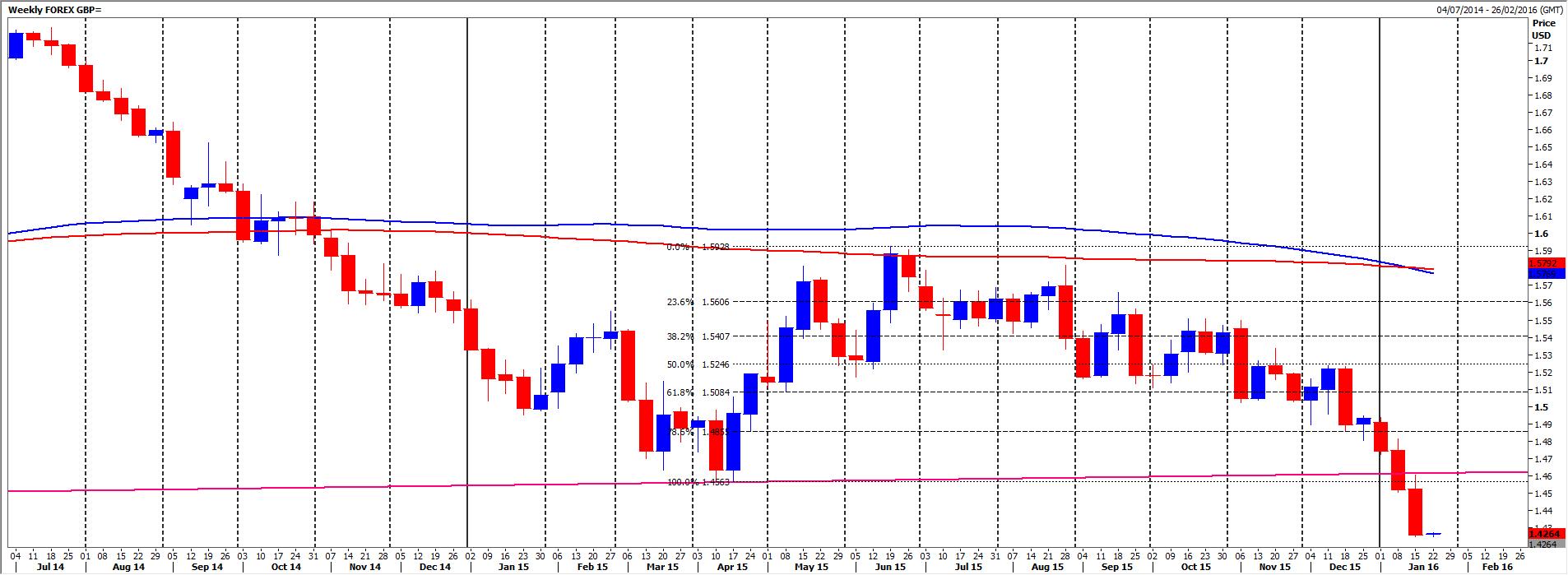

GBPUSD spot

GBPUSD recovery could target 1.4183/80, perhaps as far as 2010 year lows at 1.4230/35. This could hold a rally but further gains meet a selling opportunity at 1.4285/90. Shorts need stops above 1.4320.

Needless to say this is a bear trend so failure to beat 1.4183/80 re-targets 1.4134/30 & perhaps as far as 1.4108. Further losses target 1.4090 & 1.4050/45.

USDJPY Spot

USDJPY has dipped back to 117.21/25 & this held perfectly for a bounce to first resistance at 117.65/70. Again gains are expected to be limited but if we continue higher look for another selling opportunity at 118.10/15. Try shorts with stops above 118.30. An unexpected break higher however targets 118.45/49.

First support at 117.21/25 but below targets 117.00/95 then 116.70/67. August lows at 116.46 are important today of course. A break below here however is obviously negative therefore & could target January 2015 lows at 115.82. This is now the most important support of the week. A break below here however targets 1 year lows at 115.56.

AUDUSD Spot

AUDUSD closing in on 6885/81 but the outlook remains negative so we could continue lower to 6855/50. Further losses retest last week's low at 6829/24. This is not a particularly important support so be ready to sell a break below here to target 6801/00, 6765/60 & 6735/30.

If we hold 6881/85 look for a bounce to resistance at 6915/20. Gains are expected to be limited but look for a selling opportunity again at 6945/50 if we reach this far. Shorts need stops above 6980. An unexpected break higher however targets an excellent selling opportunity at 7015/20.

The contents of our reports are intended to be understood by professional users who are fully aware of the inherent risks in Forex, Futures, Options, Stocks and Bonds trading. INFORMATION PROVIDED WITHIN THIS MATERIAL SHOULD NOT BE CONSTRUED AS ADVICE AND IS PROVIDED FOR INFORMATION AND EDUCATION PURPOSES ONLY.

Recommended Content

Editors’ Picks

GBP/USD stays weak near 1.2400 after UK Retail Sales data

GBP/USD stays vulnerable near 1.2400 early Friday, sitting at five-month troughs. The UK Retail Sales data came in mixed and added to the weakness in the pair. Risk-aversion on the Middle East escalation keeps the pair on the back foot.

EUR/USD extends its downside below 1.0650 on hawkish Fed remarks

The EUR/USD extends its downside around 1.0640 after retreating from weekly peaks of 1.0690 on Friday. The hawkish comments from Federal Reserve officials provide some support to the US Dollar.

Gold: Middle East war fears spark fresh XAU/USD rally, will it sustain?

Gold price is trading close to $2,400 early Friday, reversing from a fresh five-day high reached at $2,418 earlier in the Asian session. Despite the pullback, Gold price remains on track to book the fifth weekly gain in a row.

Bitcoin Price Outlook: All eyes on BTC as CNN calls halving the ‘World Cup for Bitcoin’

Bitcoin price remains the focus of traders and investors ahead of the halving, which is an important event expected to kick off the next bull market. Amid conflicting forecasts from analysts, an international media site has lauded the halving and what it means for the industry.

Israel vs. Iran: Fear of escalation grips risk markets

Recent reports of an Israeli aerial bombardment targeting a key nuclear facility in central Isfahan have sparked a significant shift out of risk assets and into safe-haven investments.