Daily Forecast - 3 March 2015

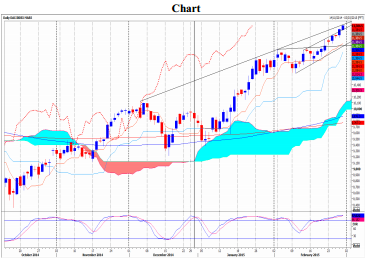

DAX

Dax first resistance at 11,456/60 of course but this should cause problems again today. I never recommend shorts in a Bull trend, but there is just a possibility that we can't beat this level today. If trying shorts use a stop above 11,475 and look for the next target of 11,489/95. If we continue higher look for 11,515 then 11,535/40. Any further gains this week could reach 11,570.

First support at 11,380/375 but below here risks a slide to good support at 11,330/320. Try longs with a stop below 11,290. On a break lower look for a buying opportunity at 11,255/45.

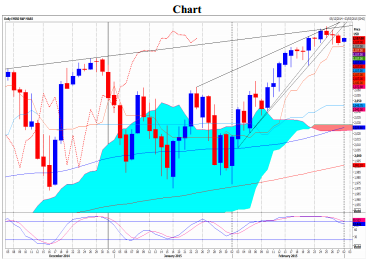

S&P

Emini S&P all time highs & trend line resistance at 2115/17 is obviously key to direction. On a break higher look for the next target of 5 & 19 week trend line resistance at 2127/2130 as a selling opportunity. Try shorts with stops above 2135. A break & close above 2135 would clear all important resistance & opens the door to 2141/42 then 2148/50.

Below 2110/2109 adds a little pressure today & re-targets support at 2104/2003. Any longs need stops below 2099. A break lower risks a slide to to support at 2095/94. A good chance of a bounce from here but if we continue lower look for a buying opportunity at 2089/88 this week. Longs need stops below 2083.

The contents of our reports are intended to be understood by professional users who are fully aware of the inherent risks in Forex, Futures, Options, Stocks and Bonds trading. INFORMATION PROVIDED WITHIN THIS MATERIAL SHOULD NOT BE CONSTRUED AS ADVICE AND IS PROVIDED FOR INFORMATION AND EDUCATION PURPOSES ONLY.

Recommended Content

Editors’ Picks

EUR/USD clings to daily gains above 1.0650

EUR/USD gained traction and turned positive on the day above 1.0650. The improvement seen in risk mood following the earlier flight to safety weighs on the US Dollar ahead of the weekend and helps the pair push higher.

GBP/USD recovers toward 1.2450 after UK Retail Sales data

GBP/USD reversed its direction and advanced to the 1.2450 area after touching a fresh multi-month low below 1.2400 in the Asian session. The positive shift seen in risk mood on easing fears over a deepening Iran-Israel conflict supports the pair.

Gold holds steady at around $2,380 following earlier spike

Gold stabilized near $2,380 after spiking above $2,400 with the immediate reaction to reports of Israel striking Iran. Meanwhile, the pullback seen in the US Treasury bond yields helps XAU/USD hold its ground.

Bitcoin Weekly Forecast: BTC post-halving rally could be partially priced in Premium

Bitcoin price shows no signs of directional bias while it holds above $60,000. The fourth BTC halving is partially priced in, according to Deutsche Bank’s research.

Week ahead – US GDP and BoJ decision on top of next week’s agenda

US GDP, core PCE and PMIs the next tests for the Dollar. Investors await BoJ for guidance about next rate hike. EU and UK PMIs, as well as Australian CPIs also on tap.