Daily Forecast - 06 November 2015

Gold Spot

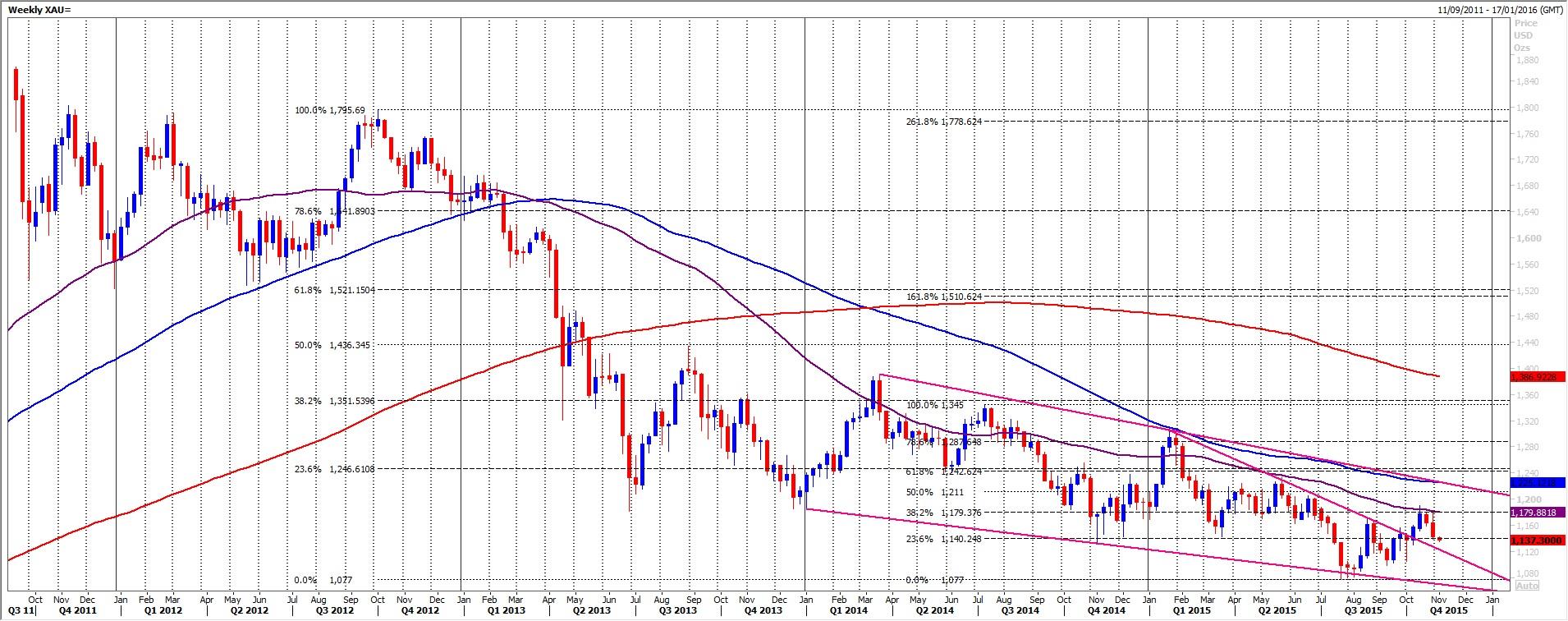

Gold meets first resistance at 1110/1111 today but being oversold we could continue higher to stronger resistance at 1115/16. Watch for a high for the day but shorts need stops above 1120. If we continue higher look for a selling opportunity at 1123/24 with n further gains expected but shorts need stops above 1127.

Failure to beat 1110/11 keeps the pressure on for 1106 then yesterday's low at 1103/02. If we continue lower there is good support at September lows at 1099/98. This could hold the downside in severely oversold conditions but longs need stops below 1096. Be ready to sell a break below to target 1193/92.

S&P December contract

Emini S&P above 2100 could re-target 2106/07 then 2109/10. On a break higher today look for 2113/14 & July highs at 2125/26. If we continue higher this week look for June highs at 2127.50 then the all time high set in May at 2134.

Holding below 2100 targets support at 2087/86 but if we continue lower today look for 2081/80, perhaps as far as good support at 2076/75 for an excellent buying opportunity. Longs need stops below 2070. A break lower is a short term sell signal however targeting 2059/58 & perhaps as far as good support at 2053/52 for the next buying opportunity.

USDJPY Spot

USDJPY key to direction is of course the 100 day moving average at 121.72/75 again today. Bulls will need to clear & close above here & beat Fibonacci resistance at 121.90/95 to be in full control for next week. A sustained break above 122.00 today could trigger sharp moves higher to target 122.33, 122.57 & 122.90/93.

First support at 121.51/46 must hold the downside once again today or we move back in to dull range trading. Further losses target 121.25 then good support for today at 121.10/00 which should hold the downside. Longs need stops below 120.80 to target 120.55 then good support at 120.30/25.

The contents of our reports are intended to be understood by professional users who are fully aware of the inherent risks in Forex, Futures, Options, Stocks and Bonds trading. INFORMATION PROVIDED WITHIN THIS MATERIAL SHOULD NOT BE CONSTRUED AS ADVICE AND IS PROVIDED FOR INFORMATION AND EDUCATION PURPOSES ONLY.

Recommended Content

Editors’ Picks

EUR/USD hovers around 1.0700 ahead of German IFO survey

EUR/USD is consolidating recovery gains at around 1.0700 in the European morning on Wednesday. The pair stays afloat amid strong Eurozone business activity data against cooling US manufacturing and services sectors. Germany's IFO survey is next in focus.

USD/JPY refreshes 34-year high, attacks 155.00 as intervention risks loom

USD/JPY is renewing a multi-decade high, closing in on 155.00. Traders turn cautious on heightened risks of Japan's FX intervention. Broad US Dollar rebound aids the upside in the major. US Durable Goods data are next on tap.

Gold price flat lines above $2,300 mark, looks to US macro data for fresh impetus

Gold price (XAU/USD) struggles to capitalize on the previous day's bounce from over a two-week low – levels just below the $2,300 mark – and oscillates in a narrow range heading into the European session on Wednesday.

Worldcoin looks set for comeback despite Nvidia’s 22% crash Premium

Worldcoin (WLD) price is in a better position than last week's and shows signs of a potential comeback. This development occurs amid the sharp decline in the valuation of the popular GPU manufacturer Nvidia.

Three fundamentals for the week: US GDP, BoJ and the Fed's favorite inflation gauge stand out Premium

While it is hard to predict when geopolitical news erupts, the level of tension is lower – allowing for key data to have its say. This week's US figures are set to shape the Federal Reserve's decision next week – and the Bank of Japan may struggle to halt the Yen's deterioration.