Daily Forecast - 23 March 2015

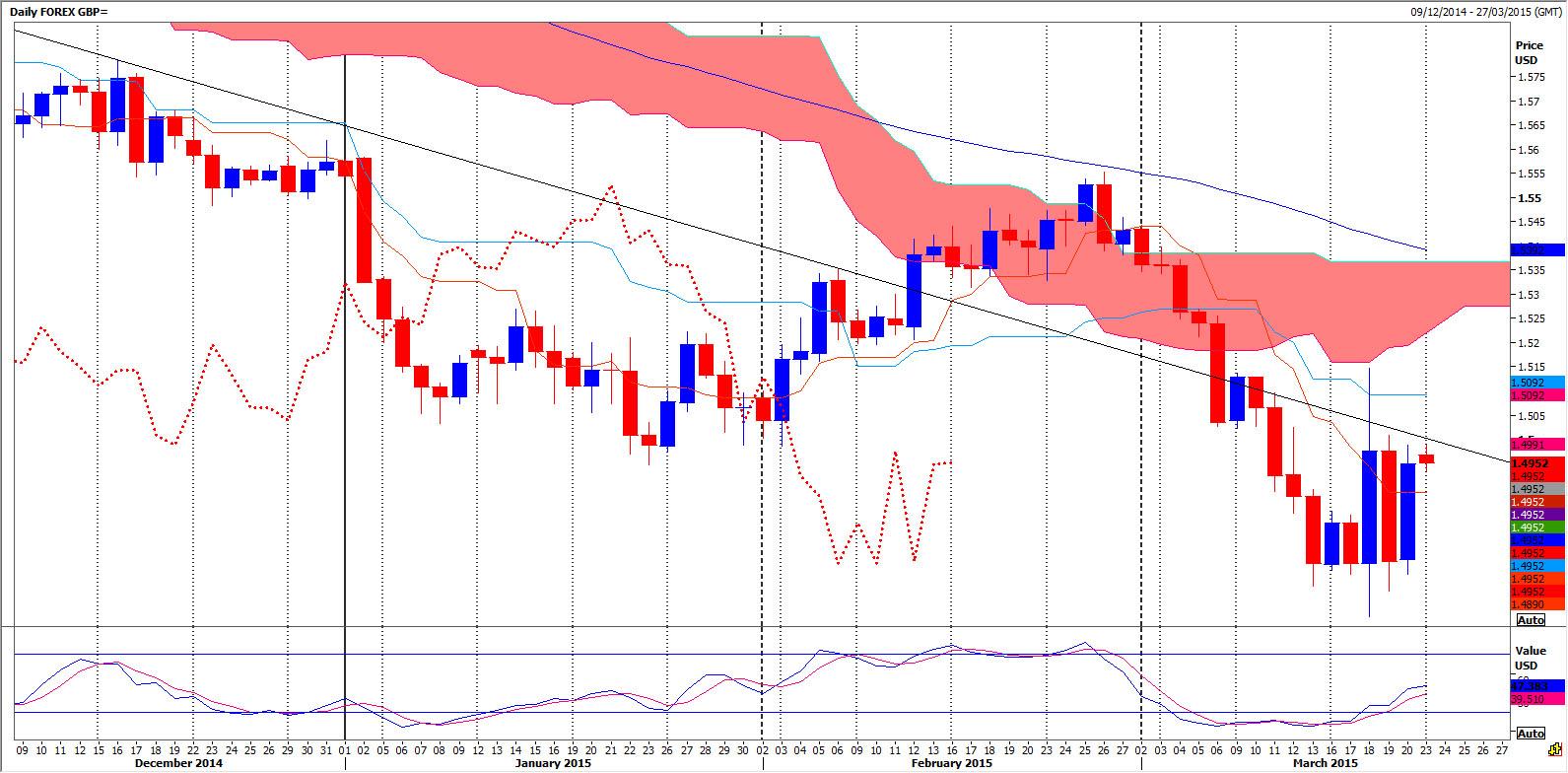

GBPUSD

GBPUSD first resistance at 1.4975/85 for a selling opportunity with a stop above 1.5000. Above here however is more positive for this week. Be ready to go with a break above 1.5000 using 1.4975/85 as support for a move towards 1.5045/50 & perhaps as far as resistance at 1.5090/95.

Failure to beat resistance at 1.4975/85 should trigger a move lower towards 1.4921/16 but if this does not hold the downside we risk at 1.4860/50. This could hold the downside but longs need a stop below 1.4830. Just be aware that a break targets 1.4795 before Friday's low at 1.4725/20.

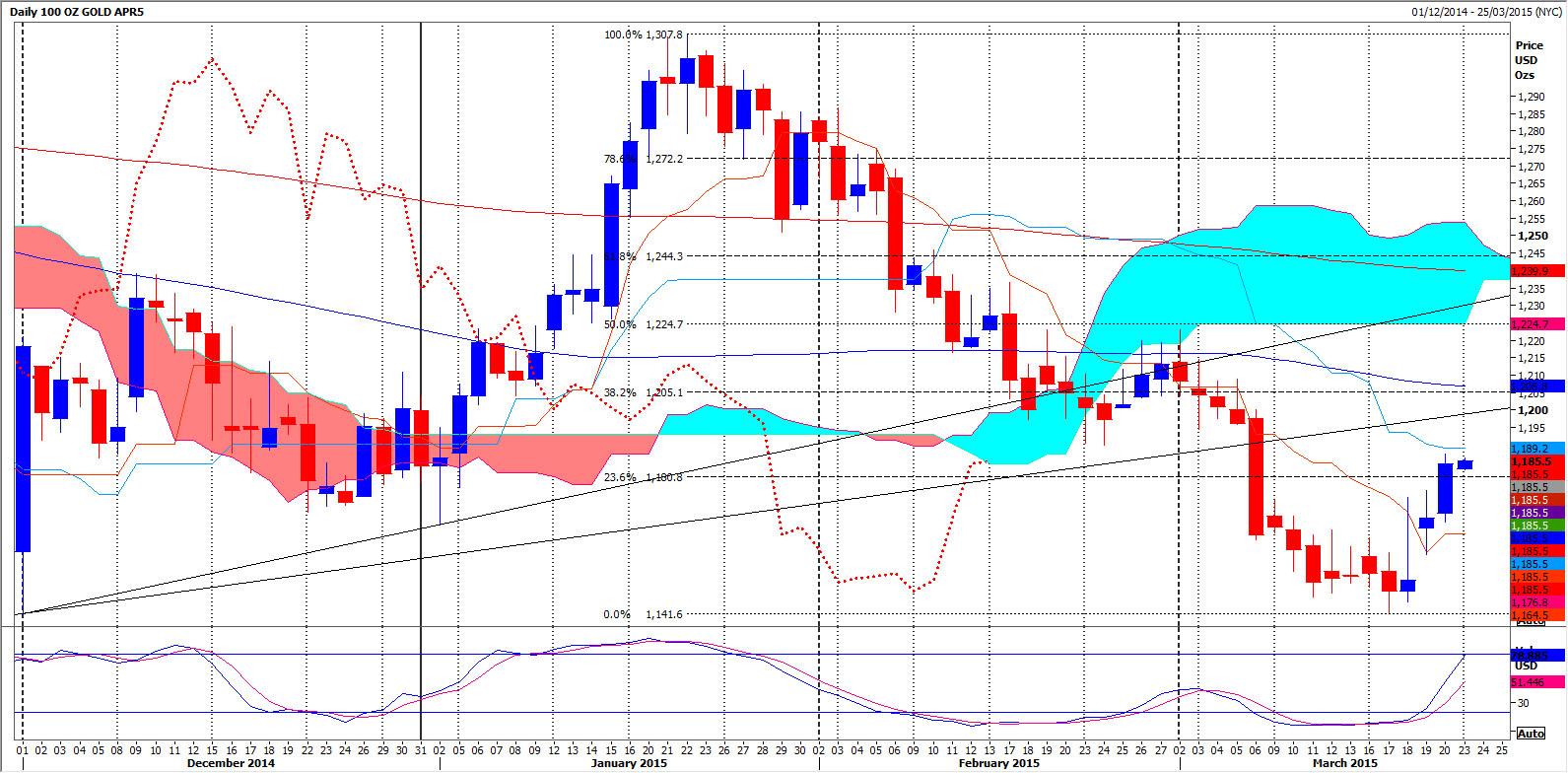

Gold April Contract

Gold must now hold above 1181/1183 for a move up to the next target of 1193/1195 today. We should struggle here with 4 month trend line strong resistance just above at 1199. A high for the day is expected if we reach this far. Just be aware however that any further gains this week run into very strong resistance at 1204/1205 for a selling opportunity.

Good support at 1183/1181 to try longs with a stop below 1177. A break below 1175 then adds pressure risking a test of strong support at 1168/1167 for a buying opportunity with a stop below 1164.

USDJPY Spot

USDJPY has good support at 119.70/65 and this is the key to direction today. Holding on here triggers a recovery to 120.15/20. If this does not hold a move higher for a test of strong resistance at 120.55/60. Try shorts with stops above 120.80. Be ready to go with a break higher however using 120.60/55 as support for a move towards resistance at 121.10/15. Try shorts with stops above 121.30.

Failure to hold above good support at 119.70/65 risks a retest of support at last week's low & March lows at 119.38/35. A break below here is obviously significant & risks a slide to 119.10/05 then 118.95/90.

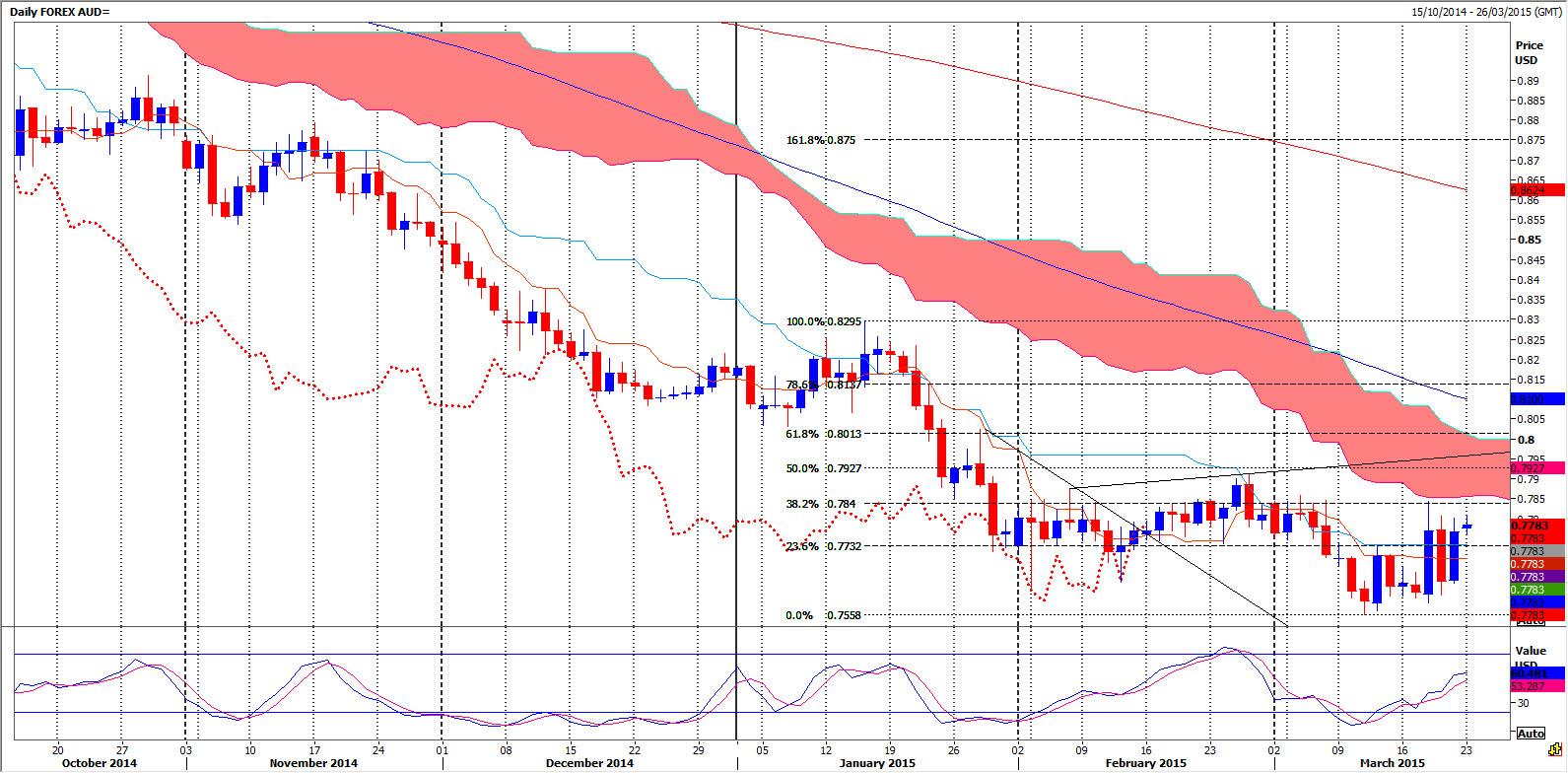

AUDUSD

AUDUSD first resistance at the 2 day highs of 7802/7807 but above here meets strong resistance at 7840/7850. This is the main challenge for bulls this week & shorts need stops above 7865. Be ready to go with a break higher using 7850/7840 as support for further gains to target 7875 then 7900/7910.

First support at 7755/7750 then 7732/7726. If trying longs here we need a stop below 7710. A break below 7700 then adds pressure to target 7665/7660 and perhaps as far as Friday's low at 7638. If we continue lower look for Thursday's low & support at 7608/02 but failure here tests last week's low at 7588.

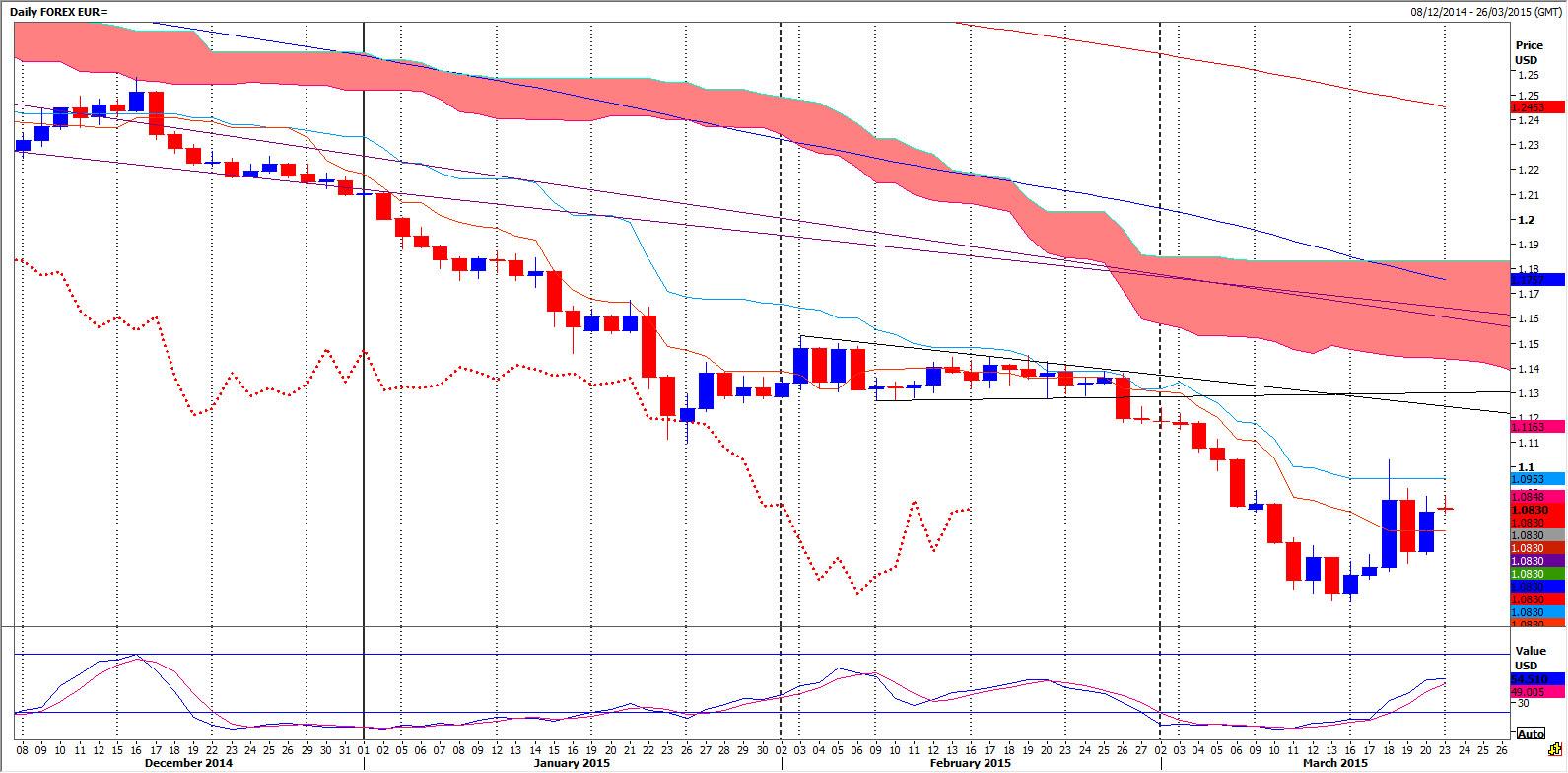

EURUSD Spot

EURUSD holding below 1.0840 is more negative for today and targets 1.0795/91 then support at 1.0760/55. We could try longs here with a stop below 1.0735 but be ready to go with a break lower using 1.0755 as resistance for a move towards 1.0700/0695. If this does not hold the downside look for support at 1.0655/0645. Try longs with a stop below 1.0620. Just be aware that a break lower then targets 1.0580 then 1.0555/50.

Only above 1.0850 is positive for today and retests Friday's high at 1.0880/82. If we continue higher look for Thursday's high at 1.0914 then strong resistance at 1.0945/55. It should be worth trying shorts here with a stop above 1.0980. A break higher however could target last week's high at 1.1031.

The contents of our reports are intended to be understood by professional users who are fully aware of the inherent risks in Forex, Futures, Options, Stocks and Bonds trading. INFORMATION PROVIDED WITHIN THIS MATERIAL SHOULD NOT BE CONSTRUED AS ADVICE AND IS PROVIDED FOR INFORMATION AND EDUCATION PURPOSES ONLY.

Recommended Content

Editors’ Picks

EUR/USD stays below 1.0700 after US data

EUR/USD stays in a consolidation phase below 1.0700 in the early American session on Wednesday. The data from the US showed a strong increase in Durable Goods Orders, supporting the USD and making it difficult for the pair to gain traction.

USD/JPY refreshes 34-year high, attacks 155.00 as intervention risks loom

USD/JPY is renewing a multi-decade high, closing in on 155.00. Traders turn cautious on heightened risks of Japan's FX intervention. Broad US Dollar rebound aids the upside in the major. US Durable Goods data are next on tap.

Gold trades on the back foot, manages to hold above $2,300

Gold struggles to stage a rebound midweek following Monday's sharp decline but manages to hold above $2,300. The benchmark 10-year US Treasury bond yield stays in the green above 4.6% after US data, not allowing the pair to reverse its direction.

Worldcoin looks set for comeback despite Nvidia’s 22% crash Premium

Worldcoin price is in a better position than last week's and shows signs of a potential comeback. This development occurs amid the sharp decline in the valuation of the popular GPU manufacturer Nvidia.

Three fundamentals for the week: US GDP, BoJ and the Fed's favorite inflation gauge stand out Premium

While it is hard to predict when geopolitical news erupts, the level of tension is lower – allowing for key data to have its say. This week's US figures are set to shape the Federal Reserve's decision next week – and the Bank of Japan may struggle to halt the Yen's deterioration.