Daily Forecast - 10 February 2015

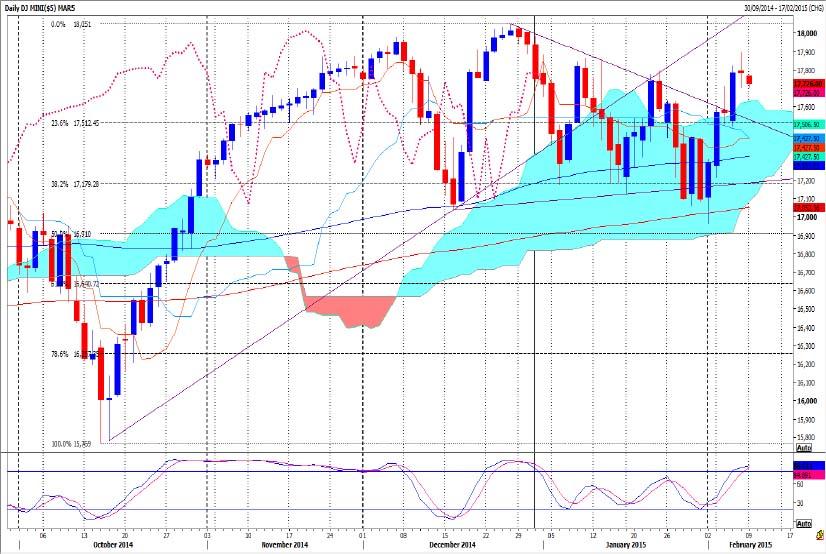

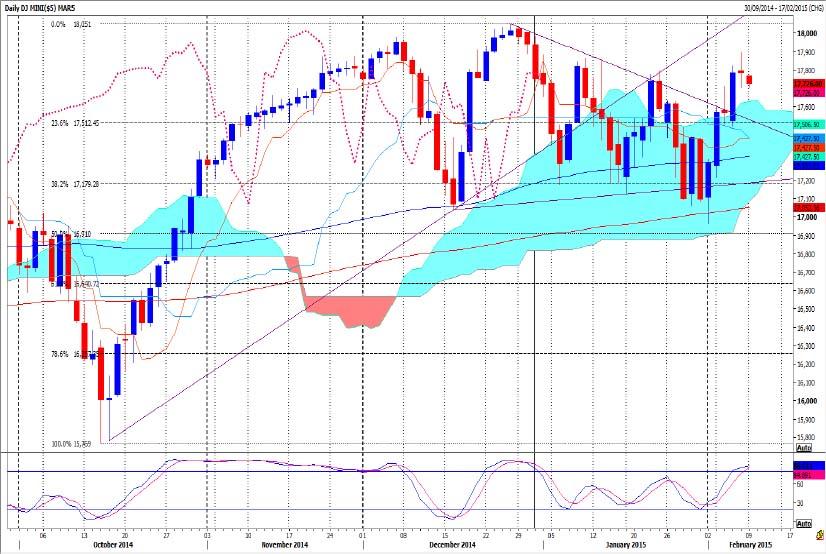

Emini Dow Jones March contract

Emini Dow Jones overbought and chances are we will continue lower. First support level at 17,680/670 is key to direction and if this does not hold the downside we are likely to retest yesterday’s low at 17,624 & perhaps see 17,615/600. However we don't meet strong support until the 17,500/17,535 area. There is a good chance of a low for the day here but longs need a stop below 17,500. Be ready to go with a break lower to target the next support level at 17,460/17,430. Try longs here with a stop below 17,400.

Emini Dow Jones overbought and chances are we will continue lower. First support level at 17,680/670 is key to direction and if this does not hold the downside we are likely to retest yesterday’s low at 17,624 & perhaps see 17,615/600. However we don't meet strong support until the 17,500/17,535 area. There is a good chance of a low for the day here but longs need a stop below 17,500. Be ready to go with a break lower to target the next support level at 17,460/17,430. Try longs here with a stop below 17,400.

Mini Russell 2000 March contract

Mini Russell 1199/98 level is key to direction again today. Failure beat this first resistance retests 1194/93 but we could continue lower today to support at 1190/89. A bounce from here is likely but below here targets 1182/81. If we continue lower look for good support at 1174/73. Buy with stops on a move below 1168.

First resistance at 1199/98 to try shorts, with stops above 1205. Be ready to go with a break higher however for a move towards last week’s high at 1213/14. Just be aware that a break higher this week targets the all time high at 1220.

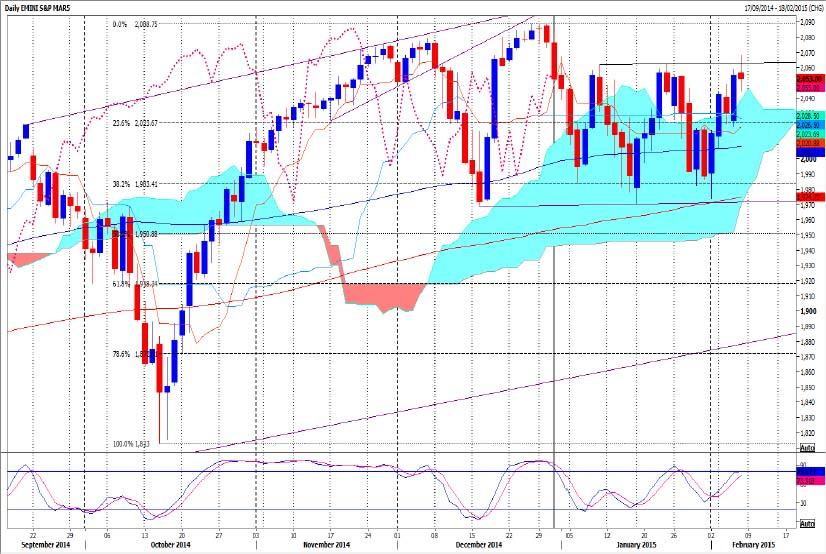

S&P March contract

Emini S&P failure to beat quite strong resistance at 2045/44 sees a retest of support at 2038/37. We could continue lower today however to test good support at 2031/30. A low for the day is possible here, but longs need stops below 2025 for the next target of 2021/20. It should be worth trying longs here with stops below 2016. However a break lower sees 2020/21 act as resistance for a move towards the next support at 2010/2008. Try longs with stops below 2004.

First resistance at 2044/45 is the main challenge to a recovery. Above here is more positive & targets resistance at 2052/2053. We should struggle here & a high for the day possible but shorts need stops above 2057 for a test of resistance at 2063. Try shorts with stops above 2068. An unexpected break higher is very positive however & we should then target 2073, 2076 & the all time high at 2086/2088.75.

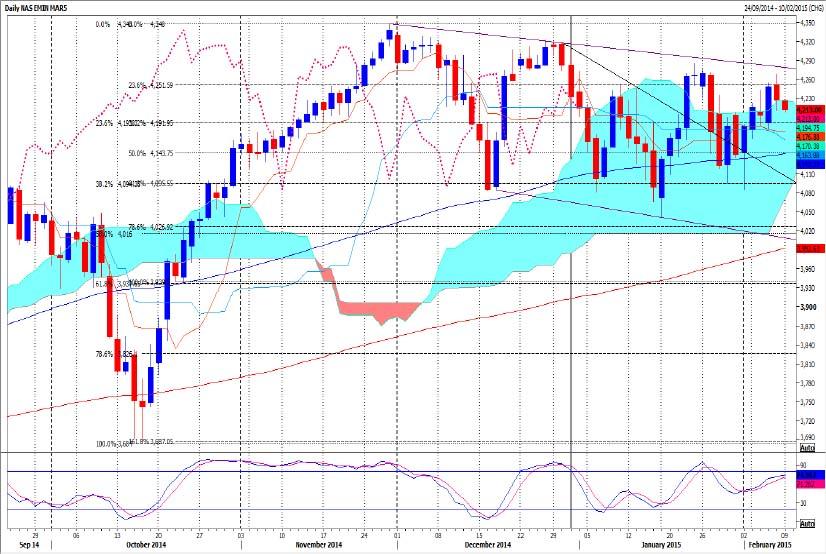

E Mini Nasdaq March contract

E-Mini Nasdaq outlook is not particularly positive so watch our first support level at 4199/4198. Longs need stops below 4190 to target 4185 then support at 4177/4176 but if trying longs we need stops below 4166. If this does not hold the downside however look for a test of better support at 4156/4155. This is an excellent buying opportunity and it is worth trying longs with a stop below 4140.

First resistance at 4225/4230 but above here is more positive for today at least and targets 4243 then 4252. If we continue higher look for a retest of last week's high at 4268 but only just above here we run into 2.5 month trendline resistance at 4276/79. A good chance of a high for today and it is worth trying shorts with a stop above 4290.

The contents of our reports are intended to be understood by professional users who are fully aware of the inherent risks in Forex, Futures, Options, Stocks and Bonds trading. INFORMATION PROVIDED WITHIN THIS MATERIAL SHOULD NOT BE CONSTRUED AS ADVICE AND IS PROVIDED FOR INFORMATION AND EDUCATION PURPOSES ONLY.

Recommended Content

Editors’ Picks

AUD/USD bounces to 0.6450, shrugs off mixed Australian jobs data

AUD/USD is rebounding to test 0.6450 amid renewed US Dollar weakness in the Asian session on Thursday. The pair reverses mixed Australian employment data-led minor losses, as risk sentiment recovers.

USD/JPY drops to test 154.00 on Japan's intervention warnings

USD/JPY extends losses to test 154.00 in Asian trading on Thursday. The pair is undermined by the latest US Dollar pullback, Japan's FX intervention risks and a softer risk tone. Focus shifts to more Fedspeak and US data.

Gold price finds buyers again near $2,355 as USD licks its wounds

Gold price is attempting a tepid bounce in the Asian session, having found fresh demand near $2,355 once again. Gold price capitalizes on a softer risk tone and an extended weakness in the US Treasury bond yields, despite the recent hawkish Fed commentary.

Manta Network price braces for volatility as $44 million worth of MANTA is due to flood markets

Manta Network price was not spared from the broader market crash instigated by a weakness in the Bitcoin market. While analysts call a bottoming out in the BTC price, the Web3 modular ecosystem token could suffer further impact.

Investors hunkering down

Amidst a relentless cautionary deluge of commentary from global financial leaders gathered at the International Monetary Fund and World Bank Spring meetings in Washington, investors appear to be taking a hiatus after witnessing significant market movements in recent weeks.