Daily Forecast - 23 January 2015

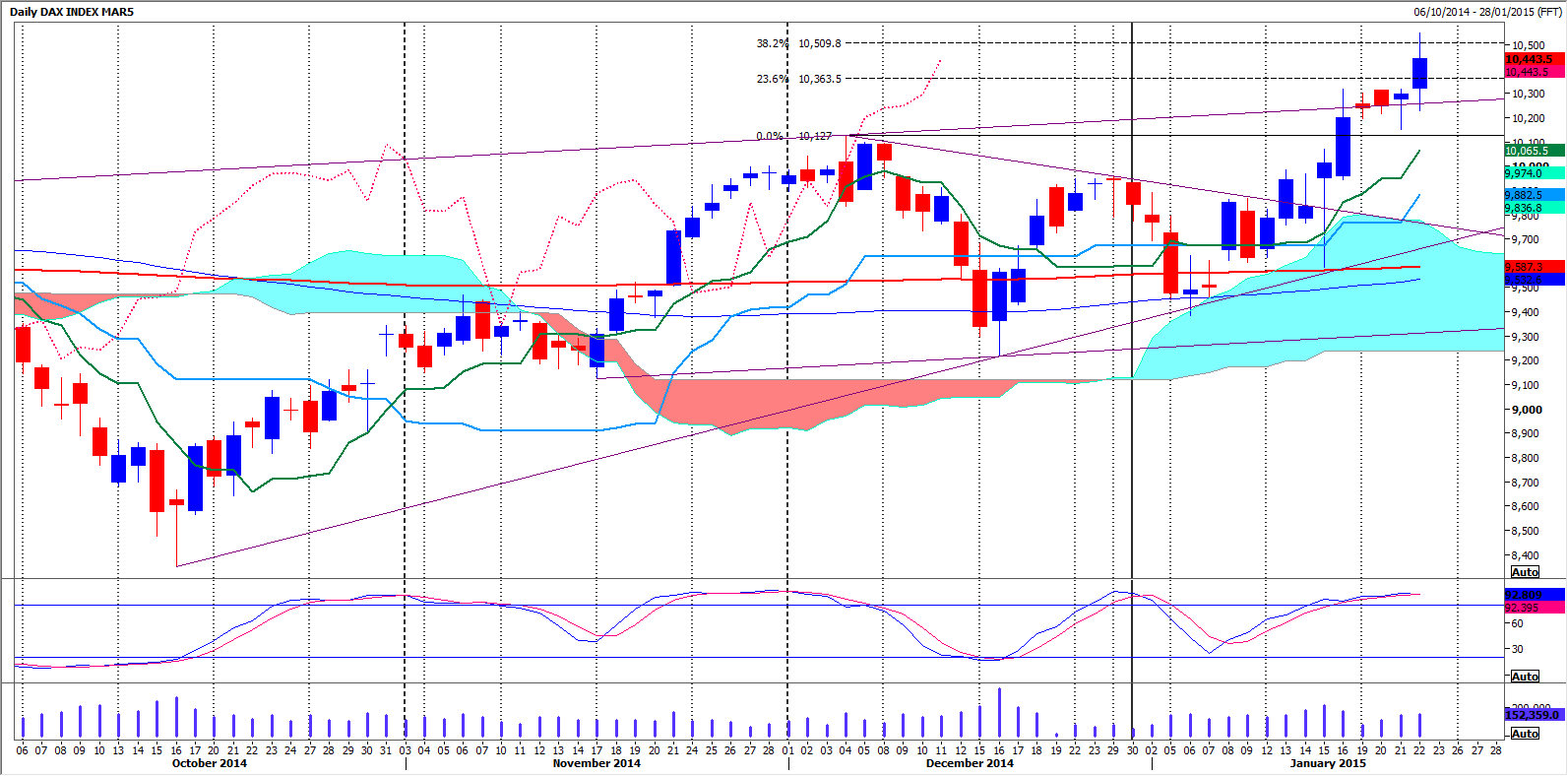

Dax March contract

Dax March is now severely overbought having almost perfectly hit our target of 10,550. There is a risk of profit-taking today down to 10,495 and perhaps far as 10,465/10,450. A good chance of a bounce from here but be aware that a break lower could target strong support at 10,415/10,405. Try longs here with a stop below 10,380. Just be aware that a break lower could then target 10,355/350 but if we fall as far as 10,330/320, use this as an excellent buying opportunity with a stop below 10,290.

Immediate resistance at the new all-time high of 10,548.5 of course but above here we could test 2 year trendline resistance at 10,600/10,625. We should struggle here and a high for the day is certainly possible. Try shorts with a stop above 10,660. However just be aware that a break higher could see prices race towards 10,740/750.

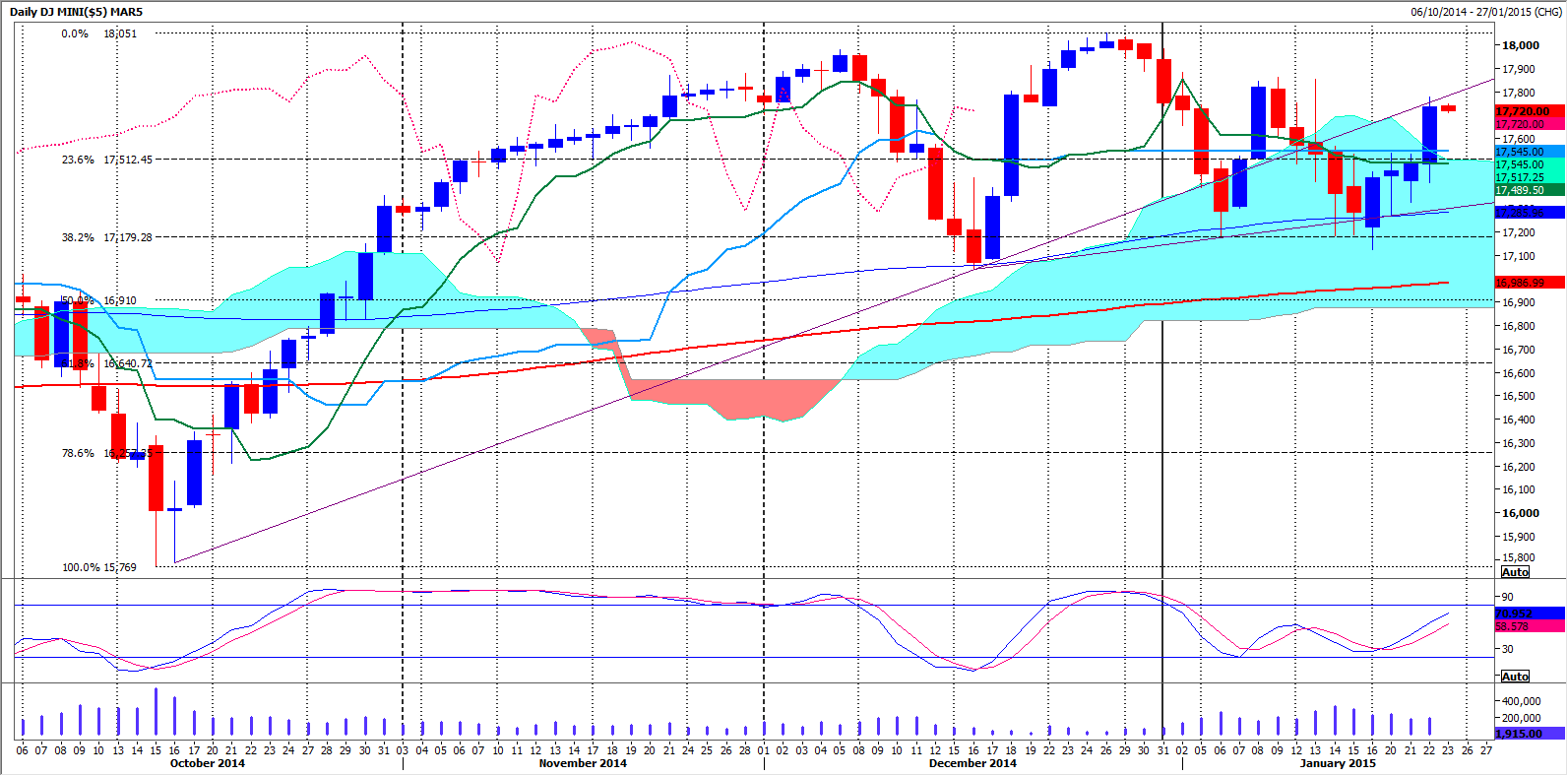

Emini Dow Jones March contract

Emini Dow Jones March has now tested three month trendline resistance at 17,770/780 and this will be key to direction today. There is a good chance we will turn lower and below 17,690 should add pressure to target 17,670 then good support at 17,635/625. Try longs here with a stop below 17,580. A break lower however sees 17,625 act as resistance to trigger a move down to 17,560. If we continue lower look for good support at 17,540/530. Try longs here with a stop below 17,475.

It could worth trying shorts at 17,770/780 with a stop above 17,810. Be ready to go with a break higher to continue the fourday rally and target 17,845/865. We will be quite overbought in the short-term at this stage, but if trying shorts, we need a stop above 17,885. A break higher is then likely to target 17,910, 17,940 and perhaps even make it as far as 17,980/985. Just be aware that above here meets the all-time high at 18,036/18,051.

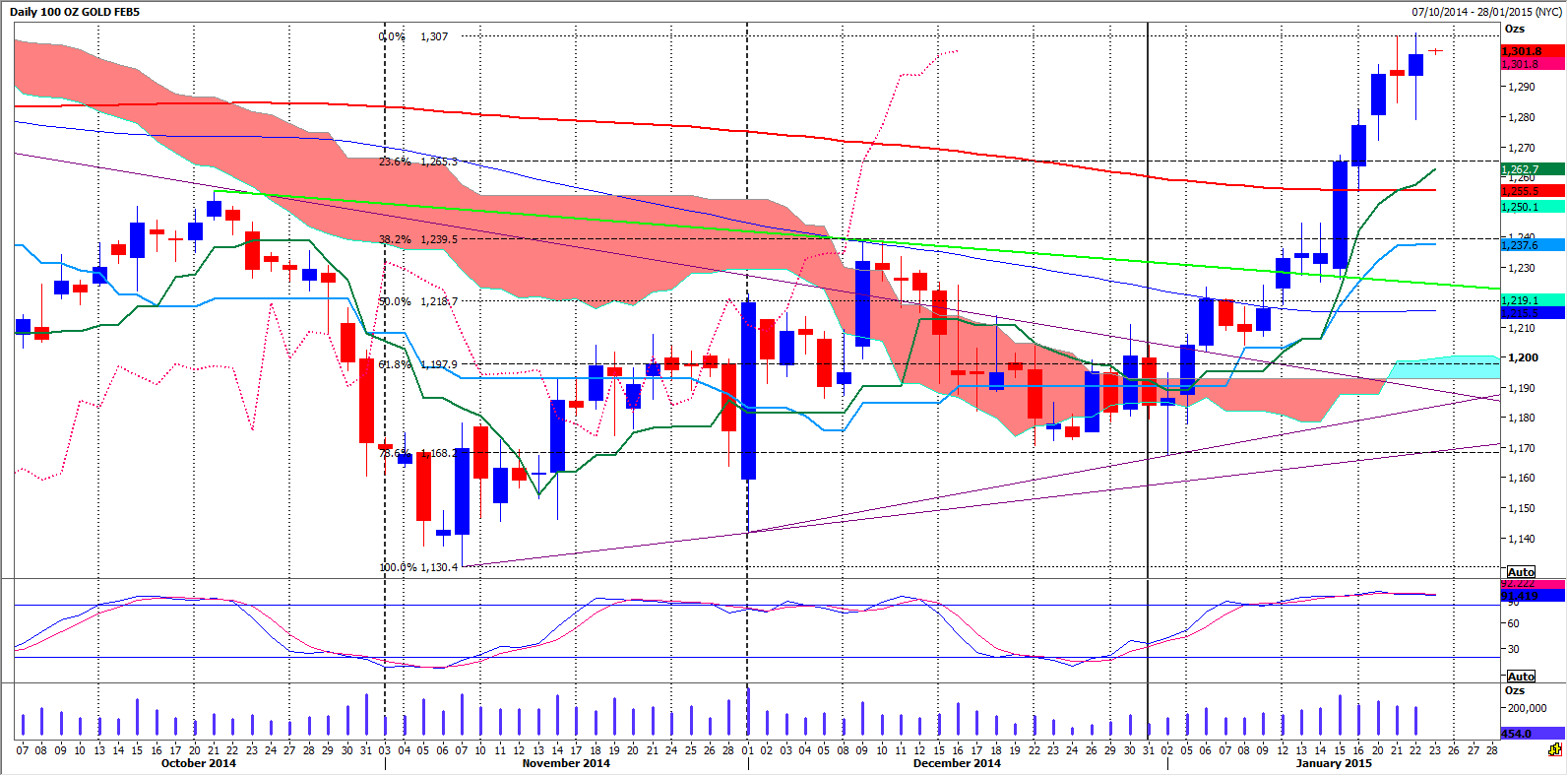

Gold February Contract

Gold February remains worryingly overbought now & the 100 week moving average at 1308 could still mark a high as stated all week. Profit taking possible again today to relive overbought conditions. Immediate support at 1297 but below here could re-target trend line support at 1286/1285. If we continue lower look for a test of yesterday's low at 1179 then very good support at 1275/1274. This could hold the downside today but be aware there is stronger support at 1266/1265. It should be worth buying into longs here with a stop below 1260. A break lower meets support from the 200 day moving average at 1256/1254. Try longs here with a stop below 1248.

Strong resistance at 1307/1308. Again, it should be worth trying shorts with a stop above 1311. However be ready to go with a positive break higher using 1308/1307 as support, for a move up to 1313 then 1319 and perhaps as far as 1322/1324.

The contents of our reports are intended to be understood by professional users who are fully aware of the inherent risks in Forex, Futures, Options, Stocks and Bonds trading. INFORMATION PROVIDED WITHIN THIS MATERIAL SHOULD NOT BE CONSTRUED AS ADVICE AND IS PROVIDED FOR INFORMATION AND EDUCATION PURPOSES ONLY.

Recommended Content

Editors’ Picks

AUD/USD remained bid above 0.6500

AUD/USD extended further its bullish performance, advancing for the fourth session in a row on Thursday, although a sustainable breakout of the key 200-day SMA at 0.6526 still remain elusive.

EUR/USD faces a minor resistance near at 1.0750

EUR/USD quickly left behind Wednesday’s small downtick and resumed its uptrend north of 1.0700 the figure, always on the back of the persistent sell-off in the US Dollar ahead of key PCE data on Friday.

Gold holds around $2,330 after dismal US data

Gold fell below $2,320 in the early American session as US yields shot higher after the data showed a significant increase in the US GDP price deflator in Q1. With safe-haven flows dominating the markets, however, XAU/USD reversed its direction and rose above $2,340.

Bitcoin price continues to get rejected from $65K resistance as SEC delays decision on spot BTC ETF options

Bitcoin (BTC) price has markets in disarray, provoking a broader market crash as it slumped to the $62,000 range on Thursday. Meanwhile, reverberations from spot BTC exchange-traded funds (ETFs) continue to influence the market.

US economy: slower growth with stronger inflation

The dollar strengthened, and stocks fell after statistical data from the US. The focus was on the preliminary estimate of GDP for the first quarter. Annualised quarterly growth came in at just 1.6%, down from the 2.5% and 3.4% previously forecast.