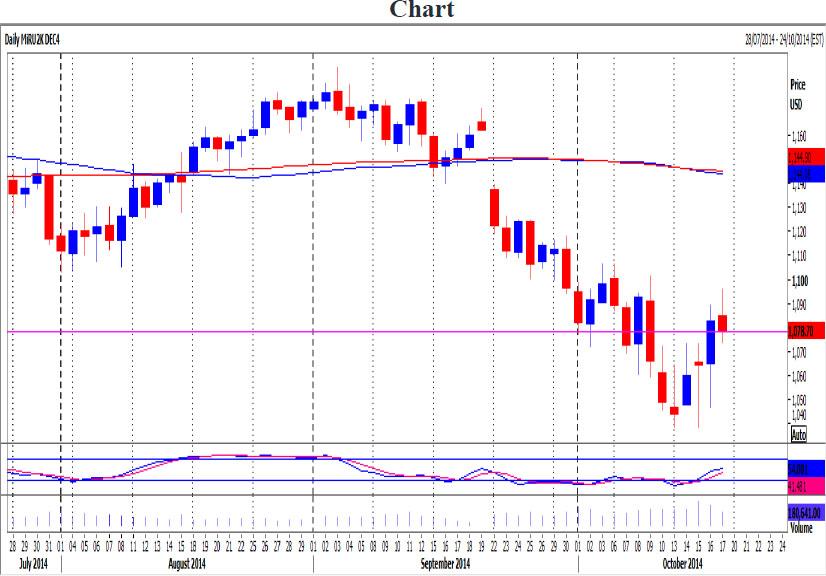

Daily Forecast - 24 October 2014

Mini Russell 2000 December contract

Mini Russell unexpectedly beat 1113/15 but shorts from this level were not stopped above 1120. An unexpected break higher today however targets 1124/25 & possibly 1130/31. Exit longs & try shorts expecting a high for the bounce in the bear trend.

Sooner rather than later we expect the bear trend to resume. Downside pressure today targets 1110/09 then good support at 1101/00. Failure here however then targets 1095 & 1089/88. A good chance of a low for the day if we fall this far but be aware a break lower targets 1081/79.

E Mini Nasdaq December contract

E-Mini Nasdaq unexpected break higher beat 4010/12 to reach 4024 but we have backed off sharply. We are overbought now & could hit profit taking. If we hold below 3985/83 this should trigger a move towards 3959/58 & perhaps as far as key support at 3945/43. A good chance of a low for the day but longs need stops below 3939. Be ready to go with a break lower to target 3911/10 then 3905. Any further losses meet good support at 3895/94 & a bounce from here likely at this stage.

Holding above 3985 is more positive & may allow a retest of yesterday's high at 4022/24. A break higher meets strong resistance at 4033. Try shorts with stops above 4040. A break higher again then targets 4047/48.

Emini Dow Jones December contract

Emini Dow Jones held support at 16420/410 & unexpectedly beat 16560/570 to hit our next target of 16690/16700. Prices topped exactly here & being severely overbought now we should turn lower. Already we have hit support at 16515/510 but below here targets 16480. If this does not hold the downside look for a move towards 16380. Good support from here down to 16350 but any longs need stops below 16320. A break lower could then target 16245.

Immediate resistance at 16600 but above here we could retest 16690/16700 for a selling opportunity with stops above 16750. A break higher however could target 16780/85 then 16860.

EURUSD

EURUSD became severely oversold short term & bottomed at 1.2612. A short term bounce halted below resistance at 1.2688/93 however. Immediate resistance at 1.2686/92 again today but be aware a break higher targets 1.2730/40 for a selling opportunity with stops above 1.2760.

Outlook remains negative in the bear trend. A break below immediate support at 1.2620/12 keeps the market under pressure to target 1.2605/00 then 1.2585/80. If this does not hold the downside in the bear market, look for 1.2550/45 then a retest of October lows at 1.2500.

The contents of our reports are intended to be understood by professional users who are fully aware of the inherent risks in Forex, Futures, Options, Stocks and Bonds trading. INFORMATION PROVIDED WITHIN THIS MATERIAL SHOULD NOT BE CONSTRUED AS ADVICE AND IS PROVIDED FOR INFORMATION AND EDUCATION PURPOSES ONLY.

Recommended Content

Editors’ Picks

EUR/USD regains traction, recovers above 1.0700

EUR/USD regained its traction and turned positive on the day above 1.0700 in the American session. The US Dollar struggles to preserve its strength after the data from the US showed that the economy grew at a softer pace than expected in Q1.

GBP/USD returns to 1.2500 area in volatile session

GBP/USD reversed its direction and recovered to 1.2500 after falling to the 1.2450 area earlier in the day. Although markets remain risk-averse, the US Dollar struggles to find demand following the disappointing GDP data.

Gold holds around $2,330 after dismal US data

Gold fell below $2,320 in the early American session as US yields shot higher after the data showed a significant increase in the US GDP price deflator in Q1. With safe-haven flows dominating the markets, however, XAU/USD reversed its direction and rose above $2,340.

XRP extends its decline, crypto experts comment on Ripple stablecoin and benefits for XRP Ledger

Ripple extends decline to $0.52 on Thursday, wipes out weekly gains. Crypto expert asks Ripple CTO how the stablecoin will benefit the XRP Ledger and native token XRP.

After the US close, it’s the Tokyo CPI

After the US close, it’s the Tokyo CPI, a reliable indicator of the national number and then the BoJ policy announcement. Tokyo CPI ex food and energy in Japan was a rise to 2.90% in March from 2.50%.