Daily Forecast - 15 December 2014

AUDJPY Spot

AUDJPY key to direction is immediate resistance at 9860/70 again today. It may be worth trying shorts with a stop above 9900 but be ready to go with a break higher using 9870/60 as strong support for a move to resistance at 9950. Watch for a high for the day here but if we manage to continue higher look for a very good selling opportunity at 9995/100.05.

Immediate resistance at 9800 & failure to get back above here keeps the market under pressure. We are then likely to retest support at 9750/45. If we continue lower today, look for an excellent buying opportunity at 9730/9720 with stops below 9705.

Bund March contract

Bund hit all targets to the 154.65/73 area to keep the outlook positive. Prices topped at 154.80 but on a break higher today we target 154.93/97 & perhaps as far as 155.08/11. Any further gains could reach 155.19/23.

Below 154.74 may trigger short term profit taking to 154.56/51 but below here risks a slide to 154.33 then Friday’s low at 154.23. Longs need stops below the gap at 154.17.

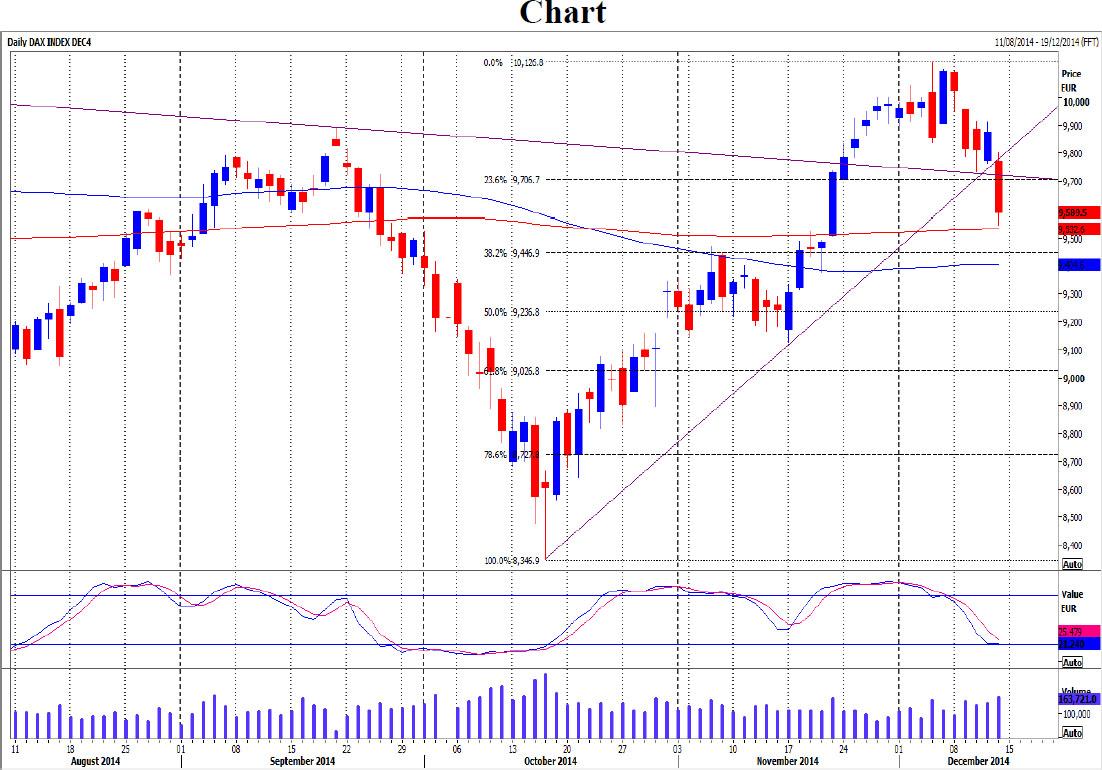

Dax December contract

Dax got to within 15 ticks of our ultimate target on Friday of 200 day moving average support at 9530/9520. Outlook remains negative so if trying longs here we need a stop below a small gap at 9490. Be ready to go with a break lower to target strong Fibonacci support at 9450/45. Try longs with stops below the 100 day moving average support at 9405/00. Just be aware that a break below here is again worryingly negative. Downside pressure should increase & we could see accelerated downside movement to target 9345/35 then important longer term trend line & Fibonacci support at 9315/10. A low for the correction is very possible here so is worth trying longs with stops below 9275.

If we do manage to hold important 200 day moving average support at 9530/9520, w e should recover back up to 9620/25. Above here is more positive and we could even reach as far as 9690/9700. There is a good chance of a high for the day here and it is worth trying shorts with a stop above 9745. However on a break higher be ready to jump into longs using 9700/9690 as good support for a move to 9785/90. A break above Friday’s high at 9801 would then turn the outlook much more positive for the rest of the week.

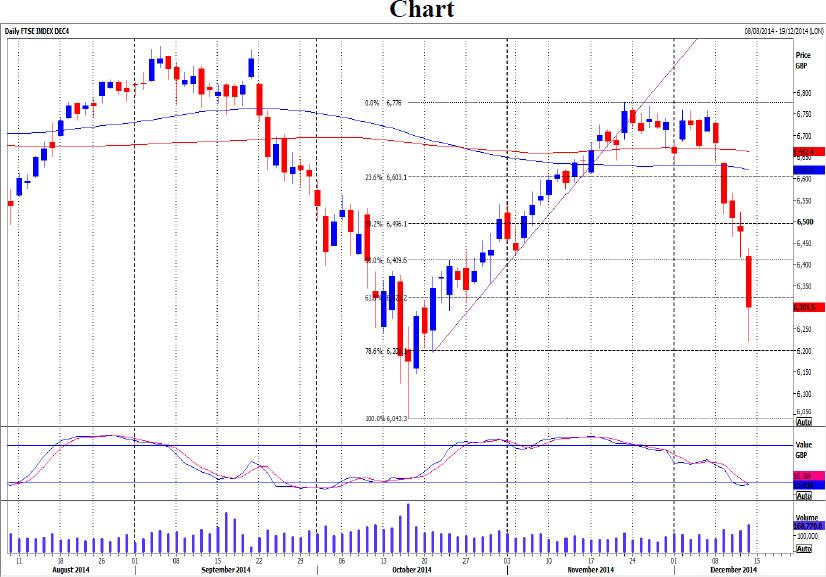

Ftse December contract

FTSE outlook remains negative after last week’s loss of over 500 points. A break below immediate support at 6200/6195 adds pressure to target 6150/45 with any further losses to test 200 month moving average support at 6125/20. A low for the day possible but longs need stops below 6100. Be ready to go with a break lower to target 6083/82 then 6065/60.

Our first resistance level is at 6260/65 then 6290/93. Above here look for a selling opportunity at 6310/15 with a good chance of a high for the day but our shorts need a stop above 6330. On a break higher we should target 6345/50 and any shorts here will need a stop above 6360.

The contents of our reports are intended to be understood by professional users who are fully aware of the inherent risks in Forex, Futures, Options, Stocks and Bonds trading. INFORMATION PROVIDED WITHIN THIS MATERIAL SHOULD NOT BE CONSTRUED AS ADVICE AND IS PROVIDED FOR INFORMATION AND EDUCATION PURPOSES ONLY.

Recommended Content

Editors’ Picks

EUR/USD extends gains above 1.0700, focus on key US data

EUR/USD meets fresh demand and rises toward 1.0750 in the European session on Thursday. Renewed US Dollar weakness offsets the risk-off market environment, supporting the pair ahead of the key US GDP and PCE inflation data.

USD/JPY keeps pushing higher, eyes 156.00 ahead of US GDP data

USD/JPY keeps breaking into its highest chart territory since June of 1990 early Thursday, recapturing 155.50 for the first time in 34 years as the Japanese Yen remains vulnerable, despite looming intervention risks. The focus shifts to Thursday's US GDP report and the BoJ decision on Friday.

Gold closes below key $2,318 support, US GDP holds the key

Gold price is breathing a sigh of relief early Thursday after testing offers near $2,315 once again. Broad risk-aversion seems to be helping Gold find a floor, as traders refrain from placing any fresh directional bets on the bright metal ahead of the preliminary reading of the US first-quarter GDP due later on Thursday.

Injective price weakness persists despite over 5.9 million INJ tokens burned

Injective price is trading with a bearish bias, stuck in the lower section of the market range. The bearish outlook abounds despite the network's deflationary efforts to pump the price.

US Q1 GDP Preview: Economic growth set to remain firm in, albeit easing from Q4

The United States Gross Domestic Product is seen expanding at an annualized rate of 2.5% in Q1. The current resilience of the US economy bolsters the case for a soft landing.