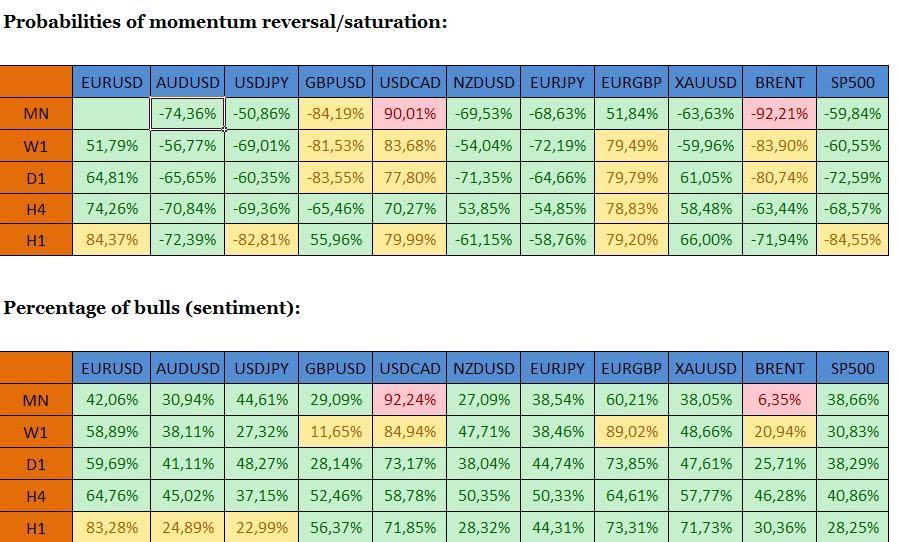

BETA - Propareos levels (areas where probabilities of price action reversal or saturation reach 90%; valid till 09:00 GMT):

EURUSD: 1.0980-1.0995 on the upside, 1.0810-1.0825 on the downside.

AUDUSD: 0.6965 -0.6980 on the upside, 0.6750-0.6765 on the downside.

USDJPY: 118.10-118.25 on the upside, 115.50 -115.65 on the downside.

GBPUSD: 1.4415 -1.4430 on the upside, 1.4035-1.4050 on the downside.

USDCAD: 1.4765-1.4780 on the upside, 1.4220-1.4235 on the downside.

NZDUSD: 0.6575-0.6590 on the upside, 0.6280 - 0.6295 on the downside.

EURJPY: 128.75 -128.90 on the upside, 127.00-127.15 on the downside.

EURGBP: 0.7805-0.78200 on the upside, 0.7440-0.7455 on the downside.

XAUUSD: 1115.00-1125.00 on the upside, 1065.00-1075.00 on the downside.

BRENT: 30.00-31.00 on the upside, 25.50 -26.50 on the downside.

SP500: 1945.00-1955.00 on the upside, 1820.00-1830.00 on the downside.

Warning! Propareos levels do not take into account fundamental developments. Their validity is reduced on days when the NFP is released and when Central Banks change their interest rate.

Recommended Content

Editors’ Picks

AUD/USD could extend the recovery to 0.6500 and above

The enhanced risk appetite and the weakening of the Greenback enabled AUD/USD to build on the promising start to the week and trade closer to the key barrier at 0.6500 the figure ahead of key inflation figures in Australia.

EUR/USD now refocuses on the 200-day SMA

EUR/USD extended its positive momentum and rose above the 1.0700 yardstick, driven by the intense PMI-led retracement in the US Dollar as well as a prevailing risk-friendly environment in the FX universe.

Gold struggles around $2,325 despite broad US Dollar’s weakness

Gold reversed its direction and rose to the $2,320 area, erasing a large portion of its daily losses in the process. The benchmark 10-year US Treasury bond yield stays in the red below 4.6% following the weak US PMI data and supports XAU/USD.

Bitcoin price makes run for previous cycle highs as Morgan Stanley pushes BTC ETF exposure

Bitcoin (BTC) price strength continues to grow, three days after the fourth halving. Optimism continues to abound in the market as Bitcoiners envision a reclamation of previous cycle highs.

US versus the Eurozone: Inflation divergence causes monetary desynchronization

Historically there is a very close correlation between changes in US Treasury yields and German Bund yields. This is relevant at the current juncture, considering that the recent hawkish twist in the tone of the Federal Reserve might continue to push US long-term interest rates higher and put upward pressure on bond yields in the Eurozone.