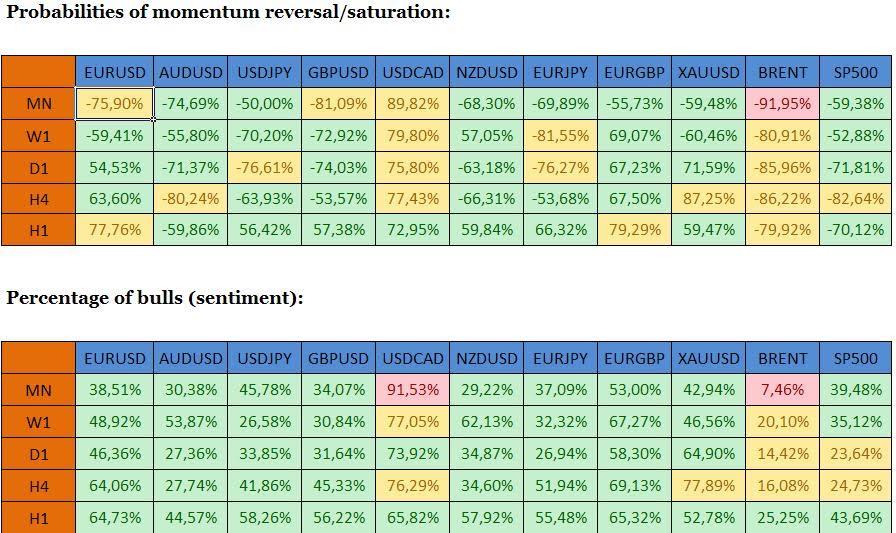

BETA - Propareos levels (areas where probabilities of price action reversal or saturation reach 90%; valid till 09:00 GMT):

EURUSD: 1.0855-1.0870 on the upside, 1.0635-1.0650 on the downside.

AUDUSD: 0.7270 -0.7285 on the upside, 0.69300-0.6945 on the downside.

USDJPY: 119.80-119.95 on the upside, 117.30 -117.45 on the downside.

GBPUSD: 1.4750 -1.4765 on the upside, 1.4545-1.4560 on the downside.

USDCAD: 1.4200-1.4215 on the upside, 1.3820-1.3835 on the downside.

NZDUSD: 0.6775-0.6790 on the upside, 0.6520 - 0.6535 on the downside.

EURJPY: 128.80 -128.95 on the upside, 125.40-125.55 on the downside.

EURGBP: 0.7435-0.7450 on the upside, 0.7260-0.7275 on the downside.

XAUUSD: 1100.00-1110.00 on the upside, 1050.00-1060.00 on the downside.

BRENT: 39.00-40.00 on the upside, 34.00 -35.00 on the downside.

SP500: 2055.00-2065.00 on the upside, 1930.00-1940.00 on the downside.

Warning! Propareos levels do not take into account fundamental developments. Their validity is reduced on days when the NFP is released and when Central Banks change their interest rate.

Recommended Content

Editors’ Picks

EUR/USD rises toward 1.0700 after Germany and EU PMI data

EUR/USD gains traction and rises toward 1.0700 in the European session on Monday. HCOB Composite PMI data from Germany and the Eurozone came in better than expected, providing a boost to the Euro. Focus shifts US PMI readings.

GBP/USD holds above 1.2350 after UK PMIs

GBP/USD clings to modest daily gains above 1.2350 in the European session on Tuesday. The data from the UK showed that the private sector continued to grow at an accelerating pace in April, helping Pound Sterling gather strength.

Gold price flirts with $2,300 amid receding safe-haven demand, reduced Fed rate cut bets

Gold price (XAU/USD) remains under heavy selling pressure for the second straight day on Tuesday and languishes near its lowest level in over two weeks, around the $2,300 mark heading into the European session.

Here’s why Ondo price hit new ATH amid bearish market outlook Premium

Ondo price shows no signs of slowing down after setting up an all-time high (ATH) at $1.05 on March 31. This development is likely to be followed by a correction and ATH but not necessarily in that order.

US S&P Global PMIs Preview: Economic expansion set to keep momentum in April

S&P Global Manufacturing PMI and Services PMI are both expected to come in at 52 in April’s flash estimate, highlighting an ongoing expansion in the private sector’s economic activity.