EUR/USD, that had already confirmed the FibStalker’s “W-support pattern” on the daily after Thursday, shows again participation from longs today at the 1.3790 support area.

This area had been tested already once and confirmed. However, anything can happen in the markets and I wanted to see a new confirmation of price on top of this level. I am glad this confirmation came today and I showed it on-line during my FXStreet webinar.

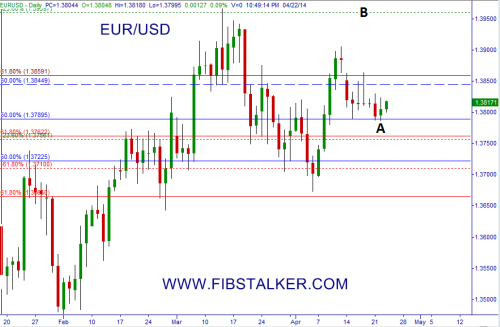

Before I drill into the 4-hour chart, give a peek at the daily chart below:

"EUR/USD holds support at 1.3790" – April 22th 2014

we can clearly see that the support area A is holding price and the 1st target of the corresponding measured move has targets at previous highs, in the B area. We also see the other group of participants which is preparing to short in the area starting at 1.3845. I do not believe these sellers will have success (but my Mr. Market is not interested in my beliefs, and remember that anything can happen) and this would be confirmed is price just climbed above the 1.3860 level.

When we drill down into the 4-hour chart, a couple of very good and useful observations can be made:

"EURUSD confirmed already support on the 4-hour chart" – April 22nd 2014

The Euro has re-confirmed support yesterday morning when price went for the first time above A. The potential action and trading plan would have been to buy a breakout from A with a stop below B (this is not mentioned here after the fact, but a requirement of the FibStalking technique and you can review my previous analysis/videos). When you think of getting involved in the markets, please always mind risk. Notice that very few people would be able to stick to this trade after seeing that long throw-back red bar, just after A was pierced on the upside.

But this is the whole point of “doing things differently”! If you have a trading plan and your risk level is decent (not 5%, but rather 0.5% on each trade, and you can be a superstar!) you can easily stick to the plan and I believe that trader who want to become consistent must learn to do it.

Most people will still be waiting for price to break above the “C” trendline. When/if that happens those who entered in A will have the opportunity to transform their risk into a risk-free trade, while the late comers trading the breakout in C will take all the risks of having price approaching the potential area of resistance at 1.3845-1.3860. In my opinion, trading the breakout at C is inherently wrong and does not align with the current assessment of price structure and requires taking unnecessary risks.

Moreover the trendline really does not have any real market meaning, but just a line that we believe “may” explain prices. The fact that it is watched by lots of retail traders or even more experienced traders does not make it more valid, especially in modern markets that are governed by computerized algorithmics.

On top of that, price dynamics has already provided all the information we need! By breaking above the A level, price behavior in the Euro offered an important piece of information, showing that professional traders and program trading are still willing to support higher prices in this pair. Moreover entering in A offers the possibility for a 1R (unit of risk) in gains before price gets to the next dangerous resistance area (where price can always reverse), so that you can lock half in and raise your stop in the hope of bringing the trade right into that 1.4080 target.

Recommended Content

Editors’ Picks

AUD/USD rises to two-day high ahead of Aussie CPI

The Aussie Dollar recorded back-to-back positive days against the US Dollar and climbed more than 0.59% on Tuesday, as the US April S&P PMIs were weaker than expected. That spurred speculations that the Federal Reserve could put rate cuts back on the table. The AUD/USD trades at 0.6488 as Wednesday’s Asian session begins.

EUR/USD now refocuses on the 200-day SMA

EUR/USD extended its positive momentum and rose above the 1.0700 yardstick, driven by the intense PMI-led retracement in the US Dollar as well as a prevailing risk-friendly environment in the FX universe.

Gold struggles around $2,325 despite broad US Dollar’s weakness

Gold reversed its direction and rose to the $2,320 area, erasing a large portion of its daily losses in the process. The benchmark 10-year US Treasury bond yield stays in the red below 4.6% following the weak US PMI data and supports XAU/USD.

Bitcoin price makes run for previous cycle highs as Morgan Stanley pushes BTC ETF exposure

Bitcoin (BTC) price strength continues to grow, three days after the fourth halving. Optimism continues to abound in the market as Bitcoiners envision a reclamation of previous cycle highs.

Australia CPI Preview: Inflation set to remain above target as hopes of early interest-rate cuts fade

An Australian inflation update takes the spotlight this week ahead of critical United States macroeconomic data. The Australian Bureau of Statistics will release two different inflation gauges on Wednesday.