Good Morning Traders,

As of this writing 5:45 AM EST, here’s what we see:

US Dollar: Down at 95.130 the US Dollar is down 795 ticks and trading at 95.130.

Energies: May Crude is up at 41.05.

Financials: The June 30 year bond is up 45 ticks and trading at 162.29.

Indices: The Mar S&P 500 emini ES contract is up 7 ticks and trading at 2019.00.

Gold: The April gold contract is trading up at 1265.70. Gold is 359 ticks higher than its close.

Initial Conclusion

This is not a correlated market. The dollar is down- and crude is up+ which is normal but the 30 year bond is trading higher. The Financials should always correlate with the US dollar such that if the dollar is lower then bonds should follow and vice-versa. The indices are up and Crude is trading higher which is not correlated. Gold is trading up which is correlated with the US dollar trading down. I tend to believe that Gold has an inverse relationship with the US Dollar as when the US Dollar is down, Gold tends to rise in value and vice-versa. Think of it as a seesaw, when one is up the other should be down. I point this out to you to make you aware that when we don’t have a correlated market, it means something is wrong. As traders you need to be aware of this and proceed with your eyes wide open.

Asia traded mainly higher with the exception of the Nikkei exchange which traded fractionally lower. As of this writing all of Europe is trading lower except the London exchange which is trading fractionally higher.

Possible Challenges To Traders Today

- Philly Fed Manufacturing Index is out at 8:30 AM EST. This is major

- Unemployment Claims is out at 8:30 AM EST. This is major.

- Current Account is out at 8:30 AM EST. This is major.

- JOLTS Job Openings are out at 10 AM EST. This is major.

- CB Leading Index m/m is out at 10 AM EST. This is not major.

- Natural Gas Storage is out at 10:30 AM EST. This is major.

Currencies

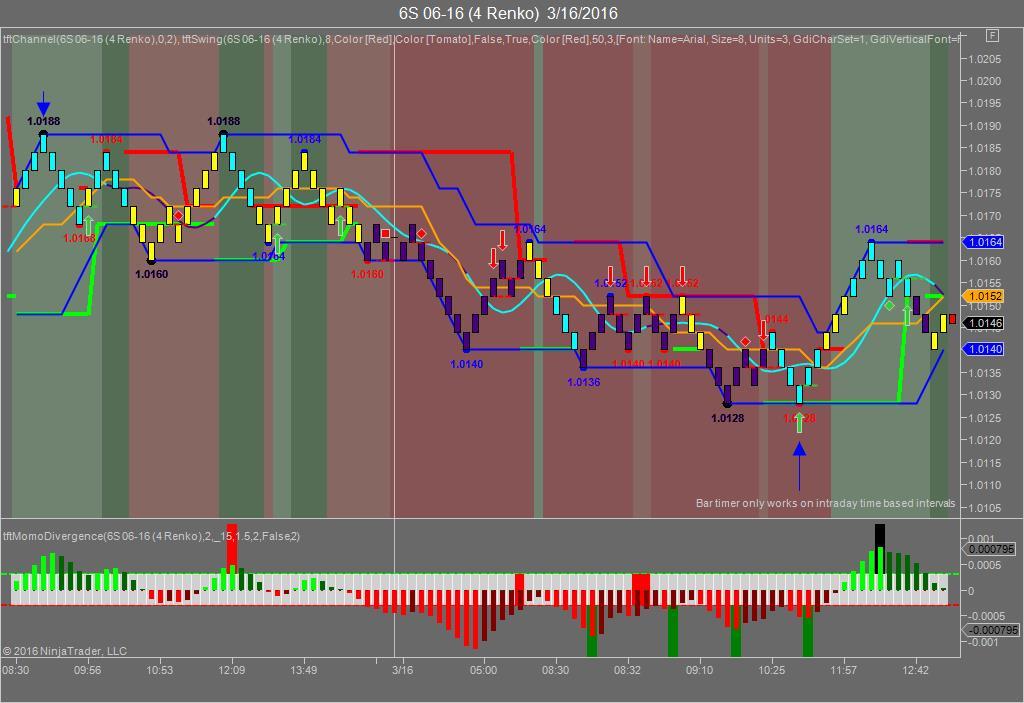

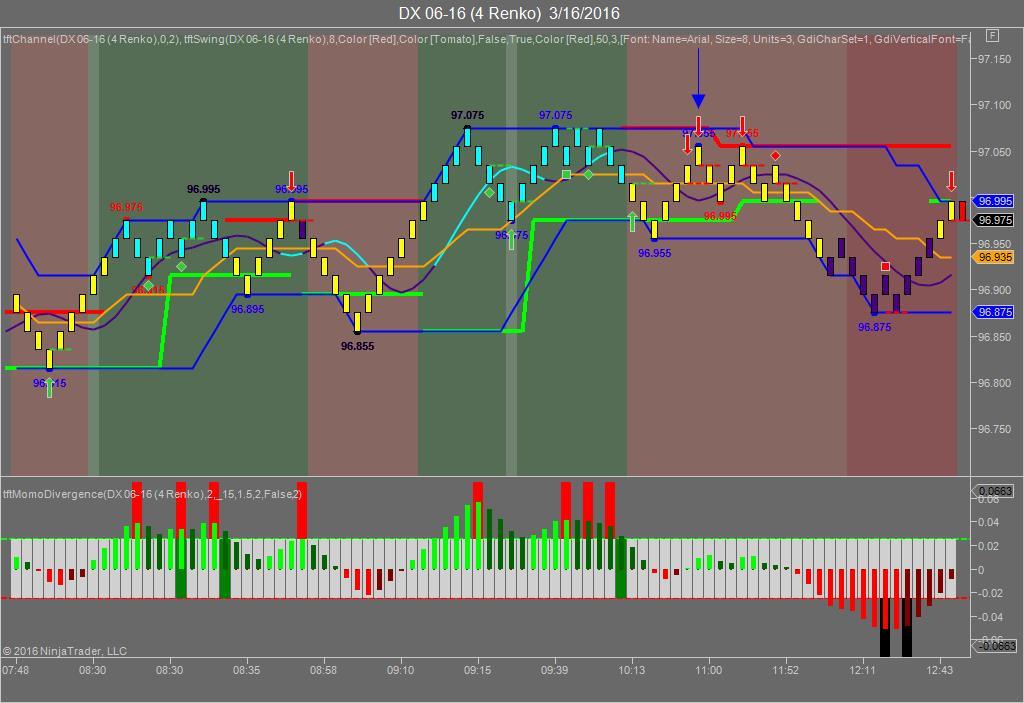

Yesterday the Swiss Franc made it’s move at around 10:50 AM EST after the economic news was reported. The USD hit a high at around that time and the Swiss Franc hit a low. If you look at the charts below the USD gave a signal at around 10:50 AM EST, while the Swiss Franc also gave a signal at just about the same time. Look at the charts below and you’ll see a pattern for both assets. The USD hit a high at around 10:50 AM EST and the Swiss Franc hit a low. These charts represent the latest version of Trend Following Trades and I’ve changed the timeframe to a Renko chart to display better. This represented a long opportunity on the Swiss Franc, as a trader you could have netted 20 ticks plus per contract on this trade. We added a Donchian Channel to the charts to show the signals more clearly. Remember each tick on the Swiss Franc is equal to $12.50 versus the $10.00 that we usually see for currencies.

Please note that the front months are now June, 2016.

Charts Courtesy of Trend Following Trades built on a Ninja Trader platform

Bias

Yesterday we gave the markets a neutral bias as it was FOMC Day and we always maintain a neutral bias on that day. Why? Because the markets have never shown any sense of normalcy on that day. The Dow gained 74 points and the other indices gained ground as well. Today we aren’t dealing with a correlated market and we’ll maintain a neutral bias.

Could this change? Of Course. Remember anything can happen in a volatile market.

Commentary

Yesterday we gave the markets a neutral bias as it was FOMC Day. For those of you who are new subscribers, a neutral bias means the markets could go in any direction. Yesterday teh markets were all over the place with no real direction or trend. That all changed at 2 PM EST when the Fed made their announcement. The Federal Reserve has decided to keep the FFR unchanged and furthermore has cut their 2016 forecast down from 4 rate hikes to two. This was in our opinion quite wise as they could have thrown this economy into a recession otherwise. The markets rewarded this decision by closing higher.

Trading performance displayed herein is hypothetical. The following Commodity Futures Trading Commission (CFTC) disclaimer should be noted.

Hypothetical performance results have many inherent limitations, some of which are described below. No representation is being made that any account will or is likely to achieve profits or losses similar to those shown.

In fact, there are frequently sharp differences between hypothetical performance results and the actual results subsequently achieved by any particular trading program. One of the limitations of hypothetical performance trading results is that they are generally prepared with the benefit of hindsight.

In addition, hypothetical trading does not involve financial risk, and no hypothetical trading record can completely account for the impact of financial risk in actual trading. For example, the ability to withstand losses or to adhere to a particular trading program in spite of trading losses are material points which can also adversely affect actual trading results.

There are numerous other factors related to the markets in general or to the implementation of any specific trading program which cannot be fully accounted for in the preparation of hypothetical performance results and all of which can adversely affect actual trading results.

Trading in the commodities markets involves substantial risk and YOU CAN LOSE A LOT OF MONEY, and thus is not appropriate for everyone. You should carefully consider your financial condition before trading in these markets, and only risk capital should be used.

In addition, these markets are often liquid, making it difficult to execute orders at desired prices. Also, during periods of extreme volatility, trading in these markets may be halted due to so-called “circuit breakers” put in place by the CME to alleviate such volatility. In the event of a trading halt, it may be difficult or impossible to exit a losing position.

Recommended Content

Editors’ Picks

EUR/USD fluctuates near 1.0700 after US data

EUR/USD stays in a consolidation phase at around 1.0700 in the American session on Wednesday. The data from the US showed a strong increase in Durable Goods Orders, supporting the USD and making it difficult for the pair to gain traction.

USD/JPY refreshes 34-year high, attacks 155.00 as intervention risks loom

USD/JPY is renewing a multi-decade high, closing in on 155.00. Traders turn cautious on heightened risks of Japan's FX intervention. Broad US Dollar rebound aids the upside in the major. US Durable Goods data are next on tap.

Gold stays in consolidation above $2,300

Gold finds it difficult to stage a rebound midweek following Monday's sharp decline but manages to hold above $2,300. The benchmark 10-year US Treasury bond yield stays in the green above 4.6% after US data, not allowing the pair to turn north.

Worldcoin looks set for comeback despite Nvidia’s 22% crash Premium

Worldcoin price is in a better position than last week's and shows signs of a potential comeback. This development occurs amid the sharp decline in the valuation of the popular GPU manufacturer Nvidia.

Three fundamentals for the week: US GDP, BoJ and the Fed's favorite inflation gauge stand out Premium

While it is hard to predict when geopolitical news erupts, the level of tension is lower – allowing for key data to have its say. This week's US figures are set to shape the Federal Reserve's decision next week – and the Bank of Japan may struggle to halt the Yen's deterioration.