Good Morning Traders,

As of this writing 4:30 AM EST, here’s what we see:

US Dollar: Down at 96.575 the US Dollar is down 90 ticks and trading at 96.575.

Energies: April Crude is down at 38.38.

Financials: The June 30 year bond is up 20 ticks and trading at 162.03.

Indices: The Mar S&P 500 emini ES contract is down 36 ticks and trading at 2000.25.

Gold: The April gold contract is trading down at 1233.20. Gold is 119 ticks lower than its close.

Initial Conclusion

This is not a correlated market. The dollar is down- and crude is down- which is not normal but the 30 year bond is trading higher. The Financials should always correlate with the US dollar such that if the dollar is lower then bonds should follow and vice-versa. The indices are down and Crude is trading lower which is not correlated. Gold is trading down which is not correlated with the US dollar trading down. I tend to believe that Gold has an inverse relationship with the US Dollar as when the US Dollar is down, Gold tends to rise in value and vice-versa. Think of it as a seesaw, when one is up the other should be down. I point this out to you to make you aware that when we don’t have a correlated market, it means something is wrong. As traders you need to be aware of this and proceed with your eyes wide open.

All of Asia traded lower with the exception of the Shanghai exchange which traded fractionally higher. As of this writing all of Europe is trading lower.

Possible Challenges To Traders Today

- Core Retail Sales m/m is out at 8:30 AM EST. This is major

- Retail Sales is out at 8:30 AM EST. This is major.

- PPI m/m is out at 8:30 AM EST. This is major.

- Core PPI is out at 8:30 AM EST. This is major.

- Empire State Manufacturing Index is out at 8:30 AM EST. This is major.

- Business Inventories m/m is out at 10 AM EST. This is not major.

- NAHB Housing Market Index is out at 10 AM EST. This is major.

- TIC Long-Term Purchases is out at 4 PM EST.

Currencies

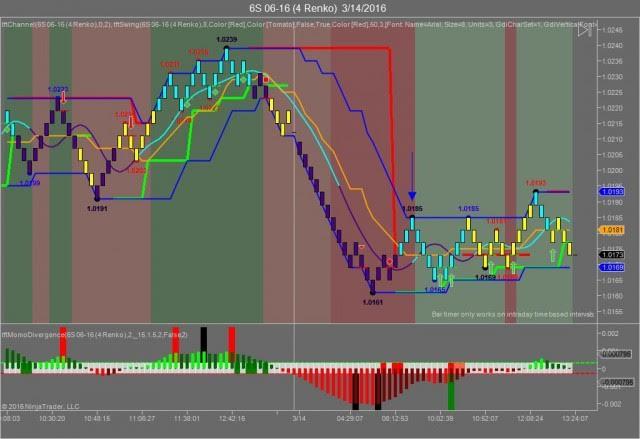

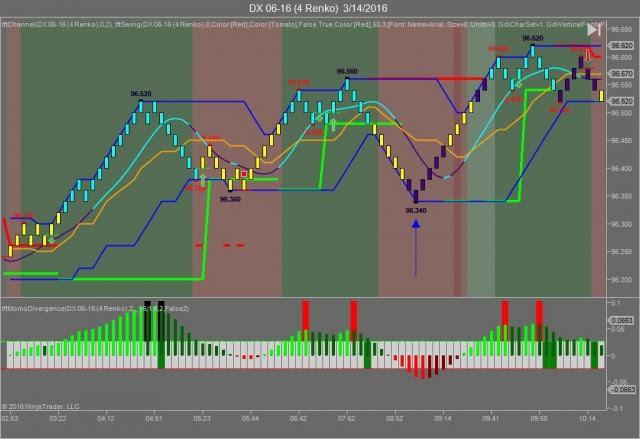

Yesterday the Swiss Franc made it’s move at around 9 AM EST with no real economic news to speak of. The USD hit a low at around that time and the Swiss Franc hit a high. If you look at the charts below the USD gave a signal at around 9 AM EST, while the Swiss Franc also gave a signal at just about the same time. Look at the charts below and you’ll see a pattern for both assets. The USD hit a low at around 9 AM EST and the Swiss Franc hit a high. These charts represent the latest version of Trend Following Trades and I’ve changed the timeframe to a Renko chart to display better. This represented a shorting opportunity on the Swiss Franc, as a trader you could have netted about 20 ticks per contract on this trade. We added a Donchian Channel to the charts to show the signals more clearly. Remember each tick on the Swiss Franc is equal to $12.50 versus the $10.00 that we usually see for currencies.

Please note that the front months are now June, 2016.

Charts Courtesy of Trend Following Trades built on a NinjaTrader platform

Bias

Yesterday we gave the markets an upside bias as the Financials and Gold were both trading lower and this is generally a good sign for an upside day. The Dow gained 16 points, the Nasdaq gained 2 and the S&P fell by 3. The Dow however did close higher as predicted. Today we aren’t dealing with a correlated market and our bias is neutral.

Could this change? Of Course. Remember anything can happen in a volatile market.

Commentary

Yesterday morning it appeared that the market would gravitate higher as crude, the Bonds and Gold were all trading lower and ordinarily this should represent an upside. The Dow flip flopped all session long between positive and negative territory all without any major economic news to speak of. This changes today as we have 8 economic reports out with most of them being major and proven market movers. It could very well be that the markets yesterday was concerned over the upcoming FOMC meeting which is scheduled for tomorrow at 2 PM EST.

Trading performance displayed herein is hypothetical. The following Commodity Futures Trading Commission (CFTC) disclaimer should be noted.

Hypothetical performance results have many inherent limitations, some of which are described below. No representation is being made that any account will or is likely to achieve profits or losses similar to those shown.

In fact, there are frequently sharp differences between hypothetical performance results and the actual results subsequently achieved by any particular trading program. One of the limitations of hypothetical performance trading results is that they are generally prepared with the benefit of hindsight.

In addition, hypothetical trading does not involve financial risk, and no hypothetical trading record can completely account for the impact of financial risk in actual trading. For example, the ability to withstand losses or to adhere to a particular trading program in spite of trading losses are material points which can also adversely affect actual trading results.

There are numerous other factors related to the markets in general or to the implementation of any specific trading program which cannot be fully accounted for in the preparation of hypothetical performance results and all of which can adversely affect actual trading results.

Trading in the commodities markets involves substantial risk and YOU CAN LOSE A LOT OF MONEY, and thus is not appropriate for everyone. You should carefully consider your financial condition before trading in these markets, and only risk capital should be used.

In addition, these markets are often liquid, making it difficult to execute orders at desired prices. Also, during periods of extreme volatility, trading in these markets may be halted due to so-called “circuit breakers” put in place by the CME to alleviate such volatility. In the event of a trading halt, it may be difficult or impossible to exit a losing position.

Recommended Content

Editors’ Picks

AUD/USD hovers around 0.6500 amid light trading, ahead of US GDP

AUD/USD is trading close to 0.6500 in Asian trading on Thursday, lacking a clear directional impetus amid an Anzac Day holiday in Australia. Meanwhile, traders stay cautious due ti risk-aversion and ahead of the key US Q1 GDP release.

USD/JPY finds its highest bids since 1990, near 155.50

USD/JPY keeps breaking into its highest chart territory since June of 1990 early Thursday, testing 155.50 for the first time in 34 years as the Japanese Yen remains vulnerable, despite looming Japanese intervention risks. Focus shifts to Thursday's US GDP report and the BoJ decision on Friday.

Gold price treads water near $2,320, awaits US GDP data

Gold price recovers losses but keeps its range near $2,320 early Thursday. Renewed weakness in the US Dollar and the US Treasury yields allow Gold buyers to breathe a sigh of relief. Gold price stays vulnerable amid Middle East de-escalation, awaiting US Q1 GDP data.

Injective price weakness persists despite over 5.9 million INJ tokens burned

Injective price is trading with a bearish bias, stuck in the lower section of the market range. The bearish outlook abounds despite the network's deflationary efforts to pump the price. Coupled with broader market gloom, INJ token’s doomed days may not be over yet.

Meta Platforms Earnings: META sinks 10% on lower Q2 revenue guidance Premium

This must be "opposites" week. While Doppelganger Tesla rode horrible misses on Tuesday to a double-digit rally, Meta Platforms produced impressive beats above Wall Street consensus after the close on Wednesday, only to watch the share price collapse by nearly 10%.