Good Morning Traders,

As of this writing 4:40 AM EST, here’s what we see:

US Dollar: Down at 99.465 the US Dollar is down 187 ticks and trading at 99.465.

Energies: March Crude is down at 33.16.

Financials: The Mar 30 year bond is up 7 ticks and trading at 161.08.

Indices: The Mar S&P 500 emini ES contract is down 29 ticks and trading at 1922.75.

Gold: The Feb gold contract is trading down at 1121.00. Gold is 46 ticks lower than its close.

Initial Conclusion

This is not a correlated market. The dollar is down- and crude is down- which is not normal but the 30 year bond is trading higher. The Financials should always correlate with the US dollar such that if the dollar is lower then bonds should follow and vice-versa. The indices are down and Crude is trading lower which is not correlated. Gold is trading down which is not correlated with the US dollar trading down. I tend to believe that Gold has an inverse relationship with the US Dollar as when the US Dollar is down, Gold tends to rise in value and vice-versa. Think of it as a seesaw, when one is up the other should be down. I point this out to you to make you aware that when we don’t have a correlated market, it means something is wrong. As traders you need to be aware of this and proceed with your eyes wide open.

All of Asia traded traded mixed with half the exchanges higher and the other half lower. As this writing all of Europe is trading mixed as well.

Possible Challenges To Traders Today

- Core PCE Price Index m/m is out at 8:30 AM EST. This is major.

- Personal Spending m/m is out at 8:30 AM EST. This is major.

- Personal Income m/m is out at 8:30 AM EST. This is major.

- Final Manufacturing PMI is out at 9:45 AM EST. This is not major.

- ISM Manufacturing PMI is out at 10 AM EST. This is major.

- Construction Spending m/m is out at 10 AM EST. This is major.

- ISM Manufacturing Prices is out at 10 AM EST. This is not major.

- FOMC Member Fischer Speaks at 1 PM EST. This is major.

Currencies

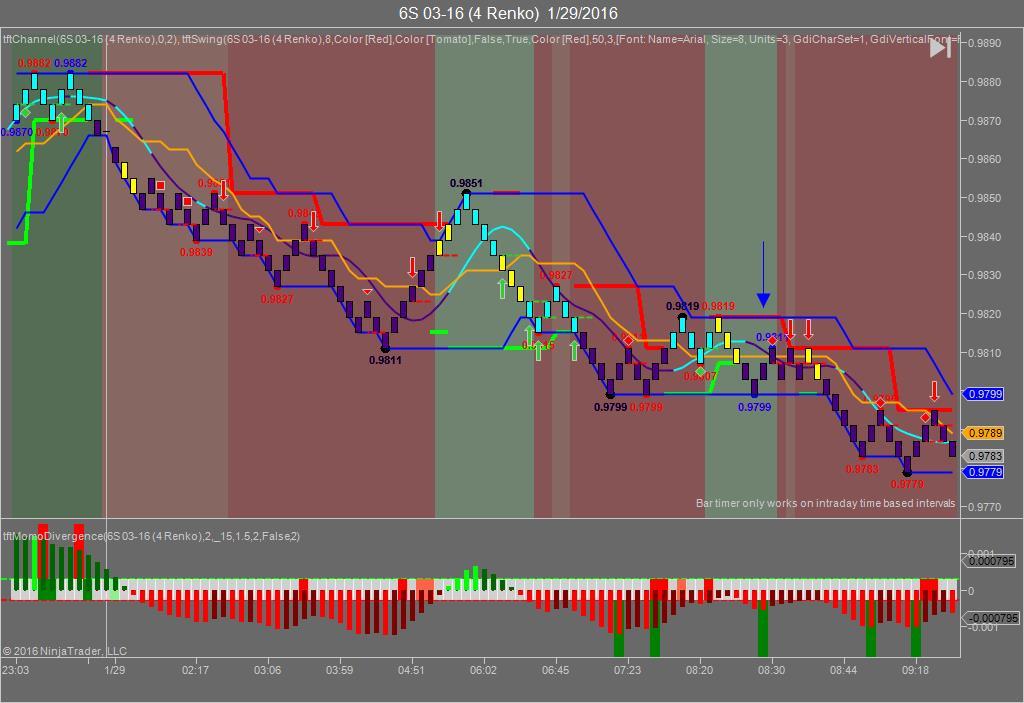

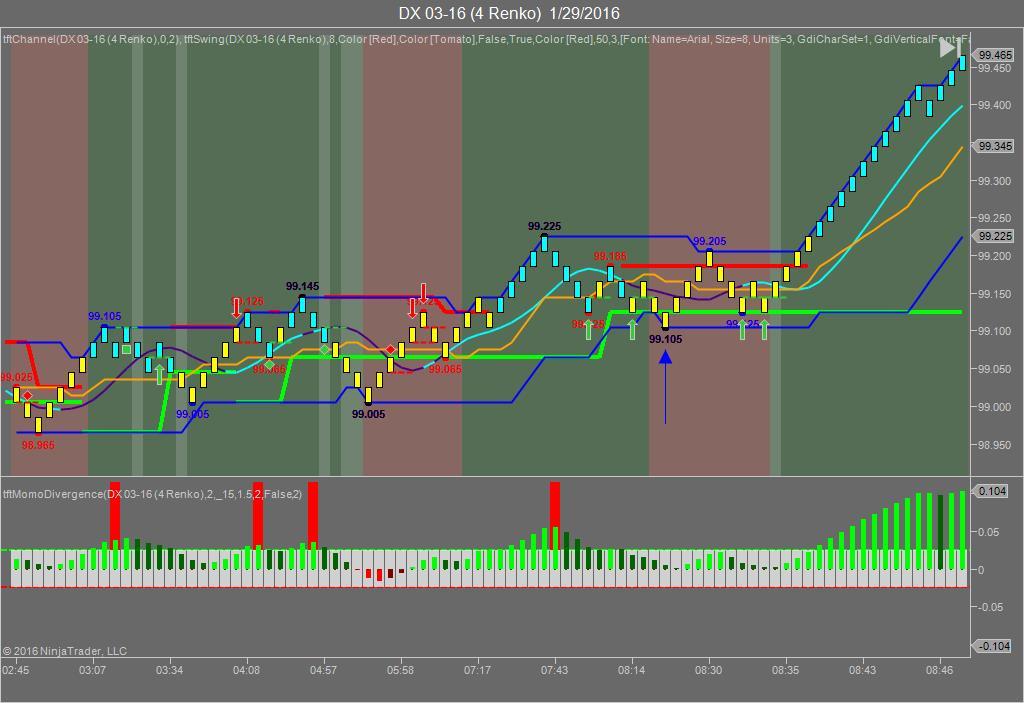

On Friday the Swiss Franc made it’s move at around 8:30 AM EST at around the time that the economic news was reported . The USD hit a low at around that time and the Swiss Franc hit a high. If you look at the charts below the USD gave a signal at around 8:30 AM EST, while the Swiss Franc also gave a signal at just about the same time. Look at the charts below and you’ll see a pattern for both assets. The USD hit a low at around 8:30 AM EST and the Swiss Franc hit a high. These charts represent the latest version of Trend Following Trades and I’ve changed the timeframe to a Renko chart to display better. This represented a shorting opportunity on the Swiss Franc, as a trader you could have netted about 20 plus ticks per contract on this trade. We added a Donchian Channel to the charts to show the signals more clearly. Remember each tick on the Swiss Franc is equal to $12.50 versus the $10.00 that we usually see for currencies.

Charts Courtesy of Trend Following Trades built on a NinjaTrader platform

Bias

Last Friday we gave the markets a neutral bias as we felt the markets could move in any direction. the Dow gained 396 points and the other indices rose as well. Today we aren’t dealing aith a correlated market and our bias is to the downside.

Could this change? Of Course. Remember anything can happen in a volatile market.

Commentary

Last Friday the markets awoke to the news that the Bank of Japan (which is the central bank) will now charge interest on bank deposits held above and beyond the minimum required. This is the equivalent of a negative interest rate as it wants to promote lending and spending. All of Asia traded higher on this news as did all of Europe. The United States needs to take a lesson here as proposed interest rate hikes will only serve to weaken the economy overall and the markets. Let’s face this past January has been the weakest since 2009 and we all know what was happening then. Case-in-point US GDP is only growing at an annual rate of about 3% when it should be more liken to 5-6% annually. Inflation? No where to be seen and the increase in employment? Employment is always a lagging indicator and not a leading one. Want proof? Take a look at the U6 rate and remember that although the economy started to turn around in 2010, it took years for the unemployment rate to drop. I personally think the Fed should take back the rate increase from December but we all know they won’t. As far as additional rate hikes for 2016? Only time will tell…

Trading performance displayed herein is hypothetical. The following Commodity Futures Trading Commission (CFTC) disclaimer should be noted.

Hypothetical performance results have many inherent limitations, some of which are described below. No representation is being made that any account will or is likely to achieve profits or losses similar to those shown.

In fact, there are frequently sharp differences between hypothetical performance results and the actual results subsequently achieved by any particular trading program. One of the limitations of hypothetical performance trading results is that they are generally prepared with the benefit of hindsight.

In addition, hypothetical trading does not involve financial risk, and no hypothetical trading record can completely account for the impact of financial risk in actual trading. For example, the ability to withstand losses or to adhere to a particular trading program in spite of trading losses are material points which can also adversely affect actual trading results.

There are numerous other factors related to the markets in general or to the implementation of any specific trading program which cannot be fully accounted for in the preparation of hypothetical performance results and all of which can adversely affect actual trading results.

Trading in the commodities markets involves substantial risk and YOU CAN LOSE A LOT OF MONEY, and thus is not appropriate for everyone. You should carefully consider your financial condition before trading in these markets, and only risk capital should be used.

In addition, these markets are often liquid, making it difficult to execute orders at desired prices. Also, during periods of extreme volatility, trading in these markets may be halted due to so-called “circuit breakers” put in place by the CME to alleviate such volatility. In the event of a trading halt, it may be difficult or impossible to exit a losing position.

Recommended Content

Editors’ Picks

EUR/USD comes under pressure near 1.0630

Further gains in the Greenback encourage sellers to maintain their control over the risk complex, forcing EUR/USD to retreat further and revisit the 1.0630 region as the US session draws to a close.

GBP/USD retreats toward 1.2450 on modest USD rebound

GBP/USD edges lower in the second half of the day and trades at around 1.2450. Better-than-expected Jobless Claims and Philadelphia Fed Manufacturing Index data from the US provides a support to the USD and forces the pair to stay on the back foot.

Gold is closely monitoring geopolitics

Gold trades in positive territory above $2,380 on Thursday. Although the benchmark 10-year US Treasury bond yield holds steady following upbeat US data, XAU/USD continues to stretch higher on growing fears over a deepening conflict in the Middle East.

Ripple faces significant correction as former SEC litigator says lawsuit could make it to Supreme Court

Ripple (XRP) price hovers below the key $0.50 level on Thursday after failing at another attempt to break and close above the resistance for the fourth day in a row.

Have we seen the extent of the Fed rate repricing?

Markets have been mostly consolidating recent moves into Thursday. We’ve seen some profit taking on Dollar longs and renewed demand for US equities into the dip. Whether or not this holds up is a completely different story.