Good Morning Traders,

As of this writing 4:40 AM EST, here’s what we see:

US Dollar: Up at 94.270, the US Dollar is up 95 ticks and trading at 94.270.

Energies: June Crude is up at 61.13.

Financials: The June 30 year bond is up 2 ticks and trading at 154.12.

Indices: The June S&P 500 emini ES contract is down 24 ticks and trading at 2068.25.

Gold: The June gold contract is trading down at 1181.70. Gold is 86 ticks lower than its close.

Initial Conclusion

This is a correlated market, unfortunately it’s correlated to the downside. The dollar is up+ and oil is up+ which is not normal and the 30 year bond is trading up. The Financials should always correlate with the US dollar such that if the dollar is lower then bonds should follow and vice-versa. The indices are down and Crude is trading up which is correlated. Gold is trading down which is correlated with the US dollar trading up. I tend to believe that Gold has an inverse relationship with the US Dollar as when the US Dollar is down, Gold tends to rise in value and vice-versa. Think of it as a seesaw, when one is up the other should be down. I point this out to you to make you aware that when we don’t have a correlated market, it means something is wrong. As traders you need to be aware of this and proceed with your eyes wide open.

All of Asia traded to the downside. As of this writing all of Europe is currently trading lower.

Possible Challenges To Traders Today

- Challenger Job Cuts are out at 7:30 AM EST. This is major.

- Unemployment Claims are out at 8:30 EST. This is major.

- Natural Gas Storage is out at 10:30 AM EST. This could move the Nat Gas market.

- Consumer Credit m/m is out at 3 PM EST. This is major.

Currencies

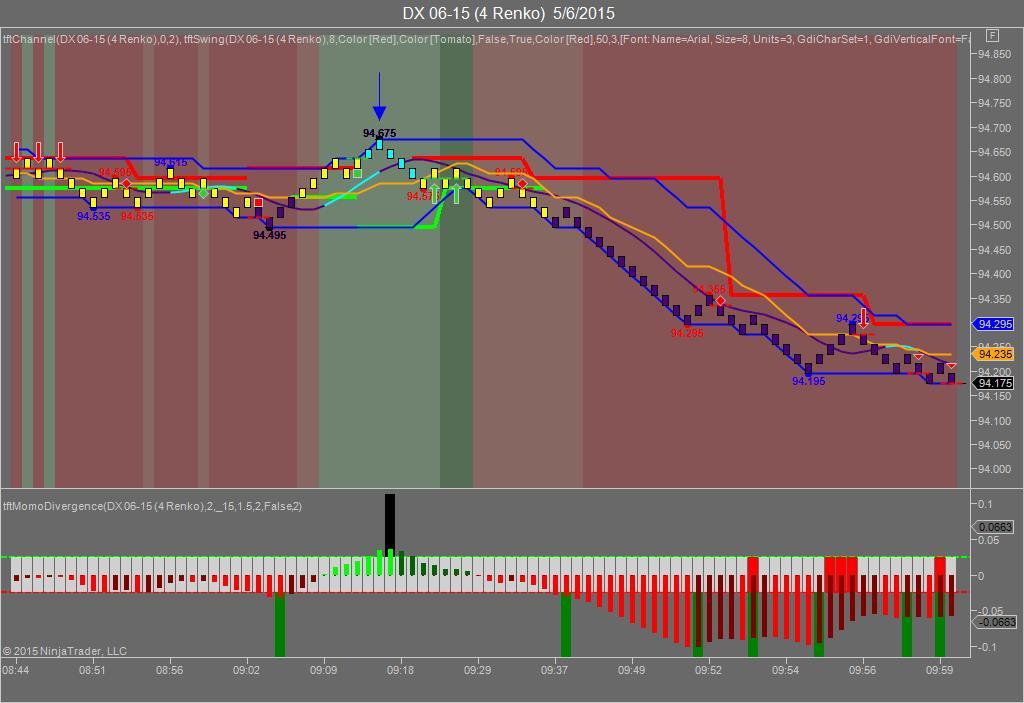

Yesterday the Swiss Franc made it’s move at around 9:15 AM EST just before Janet Yellen started speaking. The USD hit a high at around that time and the Swiss Franc hit a low. If you look at the charts below the USD gave a signal at around 9:15 AM EST, while the Swiss Franc also gave a signal at just about the same time. Look at the charts below and you’ll see a pattern for both assets. The USD hit a high at around 9:15 AM EST and the Swiss Franc hit a low. These charts represent the latest version of Trend Following Trades and I’ve changed the timeframe to a Renko chart to display better. This represented a long opportunity on the Swiss Franc, as a trader you could have netted 20 plus ticks on this trade. We added a Donchian Channel to the charts to show the signals more clearly. Remember each tick on the Swiss Franc is equal to $12.50 versus $10.00 that we usually see for currencies.

Courtesy of Trend Following Trades built on a NinjaTrader platform

Bias

Yesterday we said our bias was to the upside but that was before Janet Yellen started speaking. The Dow dropped 86 points and the other indices dropped as well. Today we are dealing with a correlated market, unfortunately it’s correlated to the downside and hence our bias is to the downside.

Could this change? Of Course. Remember anything can happen in a volatile market.

Commentary

Yesterday we said our bias was to the upside as the markets were correlated in that direction. Usually whenever Yellen speaks the markets tend to gravitate higher. Yesterday was an exception to that rule as the markets dropped on Yellen’s comments that the market valuations were too high. Well duh; we could have been saying that for the last 5 years. I always thought Google selling for more than $100.00 a share was too high but that never stopped Google or Apple for selling north of triple digit territory. Anyone could look at these markets with a view of the glass half empty or conversely half fill. The ADP Job numbers came out yesterday that showed teh US economy creating 169,000 versus 199,000 expected.

Trading performance displayed herein is hypothetical. The following Commodity Futures Trading Commission (CFTC) disclaimer should be noted.

Hypothetical performance results have many inherent limitations, some of which are described below. No representation is being made that any account will or is likely to achieve profits or losses similar to those shown.

In fact, there are frequently sharp differences between hypothetical performance results and the actual results subsequently achieved by any particular trading program. One of the limitations of hypothetical performance trading results is that they are generally prepared with the benefit of hindsight.

In addition, hypothetical trading does not involve financial risk, and no hypothetical trading record can completely account for the impact of financial risk in actual trading. For example, the ability to withstand losses or to adhere to a particular trading program in spite of trading losses are material points which can also adversely affect actual trading results.

There are numerous other factors related to the markets in general or to the implementation of any specific trading program which cannot be fully accounted for in the preparation of hypothetical performance results and all of which can adversely affect actual trading results.

Trading in the commodities markets involves substantial risk and YOU CAN LOSE A LOT OF MONEY, and thus is not appropriate for everyone. You should carefully consider your financial condition before trading in these markets, and only risk capital should be used.

In addition, these markets are often liquid, making it difficult to execute orders at desired prices. Also, during periods of extreme volatility, trading in these markets may be halted due to so-called “circuit breakers” put in place by the CME to alleviate such volatility. In the event of a trading halt, it may be difficult or impossible to exit a losing position.

Recommended Content

Editors’ Picks

EUR/USD clings to modest gains above 1.0650 ahead of US data

EUR/USD trades modestly higher on the day above 1.0650 in the early American session on Tuesday. The upbeat PMI reports from the Eurozone and Germany support the Euro as market focus shift to US PMI data.

GBP/USD extends rebound, tests 1.2400

GBP/USD preserves its recovery momentum and trades near 1.2400 in the second half of the day on Tuesday. The data from the UK showed that the private sector continued to grow at an accelerating pace in April, helping Pound Sterling gather strength against its rivals.

Gold flirts with $2,300 amid receding safe-haven demand

Gold (XAU/USD) remains under heavy selling pressure for the second straight day on Tuesday and languishes near its lowest level in over two weeks, around the $2,300 mark in the European session. Eyes on US PMI data.

Here’s why Ondo price hit new ATH amid bearish market outlook Premium

Ondo price shows no signs of slowing down after setting up an all-time high (ATH) at $1.05 on March 31. This development is likely to be followed by a correction and ATH but not necessarily in that order.

US S&P Global PMIs Preview: Economic expansion set to keep momentum in April

S&P Global Manufacturing PMI and Services PMI are both expected to come in at 52 in April’s flash estimate, highlighting an ongoing expansion in the private sector’s economic activity.