Good Morning Traders,

As of this writing 5:40 AM EST, here’s what we see:

US Dollar: Up at 81.505, the US Dollar is up 90 ticks and is trading at 81.405.

Energies: September Crude is up at 101.18.

Financials: The Sept 30 year bond is down 8 ticks and trading at 138.22.

Indices: The Sept S&P 500 emini ES contract is up 16 ticks and trading at 1967.00.

Gold: The August gold contract is trading down at 1297.04 and is down 9 ticks from its close. Initial Conclusion

This is not correlated market. The dollar is up+ and oil is up+ which is not normal but the 30 year bond is trading lower. The Financials should always correlate with the US dollar such that if the dollar is lower then bonds should follow and vice-versa. The indices are up and the US dollar is trading up which is not correlated. Gold is trading lower which is correlated with the US dollar trading up. I tend to believe that Gold has an inverse relationship with the US Dollar as when the US Dollar is down, Gold tends to rise in value and vice-versa. Think of it as a seesaw, when one is up the other should be down. I point this out to you to make you aware that when we don’t have a correlated market, it means something is wrong. As traders you need to be aware of this and proceed with your eyes wide open.

Asia traded mixed with half the exchanges trading lower and the other half higher. As of this writing Europe is trading mixed with half the exchanges higher and the other lower. Possible Challenges To Traders Today

ADP Non-Farm Employment Change is out at 8:15 AM EST. This is major. Advance GDP q/q is out at 8:30 AM EST. This is major. Advance GDP Price Index q/q is out at 8:30 AM EST. This is major. Crude Oil Inventories is out at 10:30 AM EST. This could move the crude markets. FOMC Statement is out at 2 PM EST. This is major. Federal Funds Rate is out at 2 PM EST. This is major.

Currencies

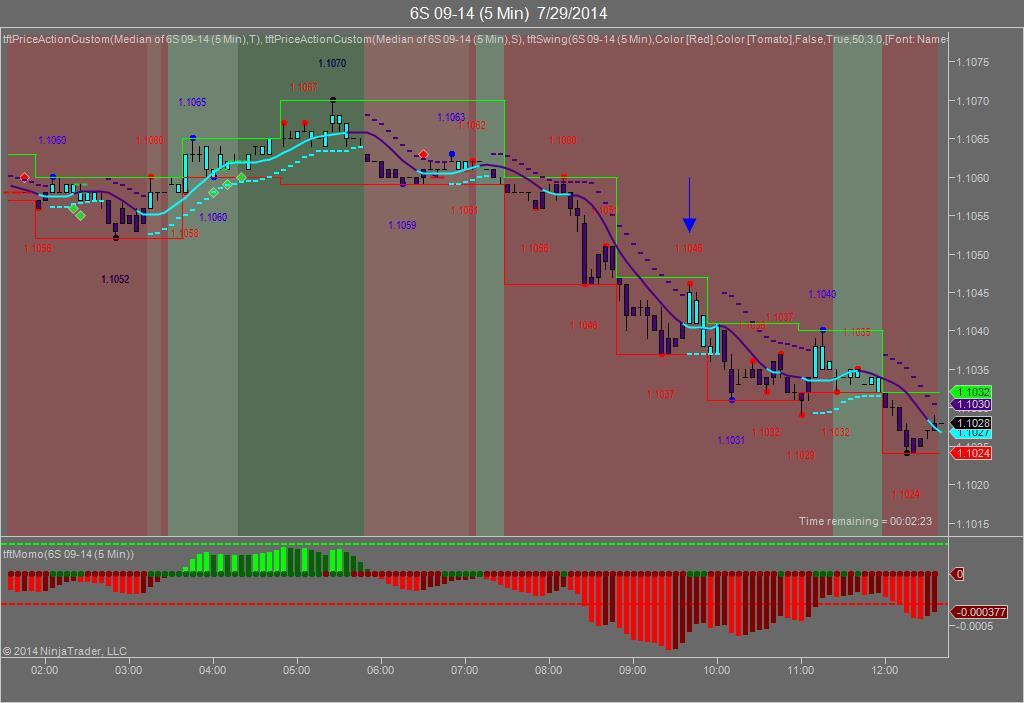

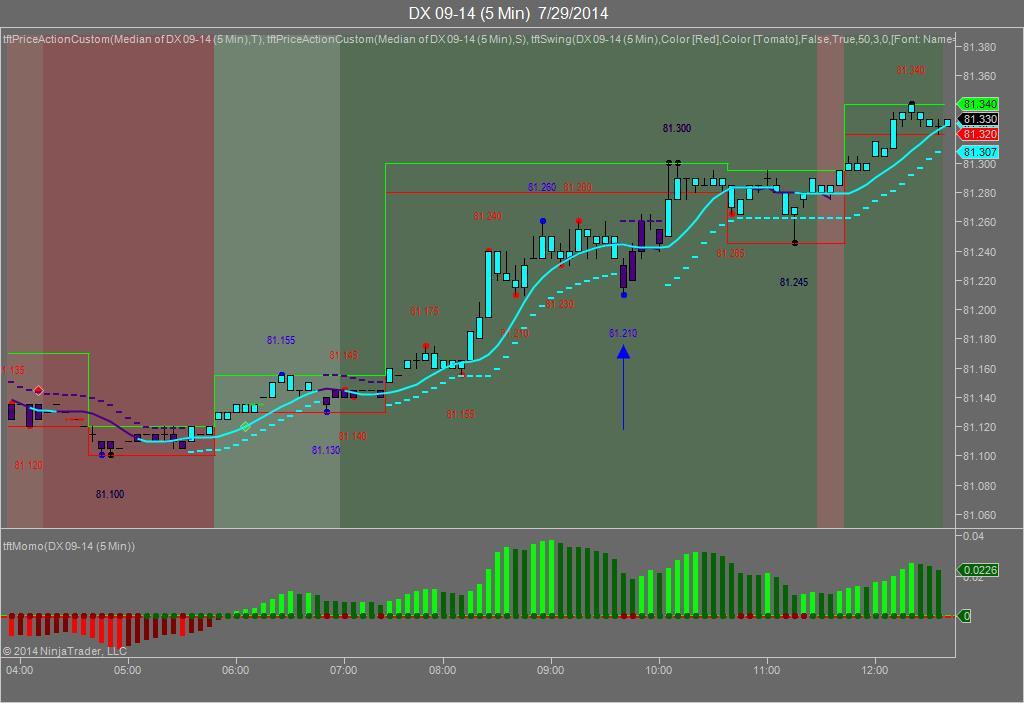

Yesterday the Swiss Franc made it’s move at 9:40 AM EST just prior to the CB Conference Board numbers. The USD hit a low at around that time and the Swiss Franc hit a high. If you look at the charts below the USD gave a signal at 9:40 AM EST, while the Swiss Franc also gave a signal at just about the same time. Look at the charts below and you’ll see a pattern for both assets. The USD hit a low at 9:40 AM EST and the Swiss Franc hit a high. I’ve changed the charts to reflect a 5 minute time frame and added a Darvas Box to make it more clear. This represented a shorting opportunity on the Swiss Franc, as a trader you could have netted 12-15 ticks on this trade. Not much to speak of but yesterday was an unusual day. Remember each tick on the Swiss Franc is equal to $12.50 versus $10.00 that we usually see for currencies.

Charts Courtesy of Trend Following Trades built on a NinjaTrader platform

Bias

Yesterday we said our bias was neutral as the markets didn’t give much direction yesterday morning. The Dow dropped 71 points and the other indices lost ground as well.. Today is FOMC Day and as such our bias is neutral. A neutral bias means the markets could go in any direction.

Could this change? Of Course. Remember anything can happen in a volatile market.

Commentary

Yesterday at first glance it appeared as though the markets might head higher as the futures originally were pointed that way but we didn’t see follow thru which is very key when determining Market Correlation. We kept the bias neutral specifically for that reason. The opening bell came and the markets when up, then down, then up and finally down. It was in effect a roller coaster ride. This is usual on a day that we call for a neutral bias. Today our bias is neutral because it is FOMC Day and on this day the markets have never shown any sense of normalcy. The other day that we always call for a neutral bias is Jobs Friday, for the same reason. Does this mean that we think the Fed will raise rates? No, we don’t but traders being the humans that they are will use any excuse to go long or short for no apparent reason at all. The analysts will be glued to the language used when the announcement is made and any deviation from that language will be used to drive the markets long or short. Something to be mindful of if trading today…

We knew yesterday that the markets would go in any direction, not because of the economic reports but because our rules of market correlation told us so.

Trading performance displayed herein is hypothetical. The following Commodity Futures Trading Commission (CFTC) disclaimer should be noted.

Hypothetical performance results have many inherent limitations, some of which are described below. No representation is being made that any account will or is likely to achieve profits or losses similar to those shown.

In fact, there are frequently sharp differences between hypothetical performance results and the actual results subsequently achieved by any particular trading program. One of the limitations of hypothetical performance trading results is that they are generally prepared with the benefit of hindsight.

In addition, hypothetical trading does not involve financial risk, and no hypothetical trading record can completely account for the impact of financial risk in actual trading. For example, the ability to withstand losses or to adhere to a particular trading program in spite of trading losses are material points which can also adversely affect actual trading results.

There are numerous other factors related to the markets in general or to the implementation of any specific trading program which cannot be fully accounted for in the preparation of hypothetical performance results and all of which can adversely affect actual trading results.

Trading in the commodities markets involves substantial risk and YOU CAN LOSE A LOT OF MONEY, and thus is not appropriate for everyone. You should carefully consider your financial condition before trading in these markets, and only risk capital should be used.

In addition, these markets are often liquid, making it difficult to execute orders at desired prices. Also, during periods of extreme volatility, trading in these markets may be halted due to so-called “circuit breakers” put in place by the CME to alleviate such volatility. In the event of a trading halt, it may be difficult or impossible to exit a losing position.

Recommended Content

Editors’ Picks

AUD/USD remained bid above 0.6500

AUD/USD extended further its bullish performance, advancing for the fourth session in a row on Thursday, although a sustainable breakout of the key 200-day SMA at 0.6526 still remain elusive.

EUR/USD faces a minor resistance near at 1.0750

EUR/USD quickly left behind Wednesday’s small downtick and resumed its uptrend north of 1.0700 the figure, always on the back of the persistent sell-off in the US Dollar ahead of key PCE data on Friday.

Gold holds around $2,330 after dismal US data

Gold fell below $2,320 in the early American session as US yields shot higher after the data showed a significant increase in the US GDP price deflator in Q1. With safe-haven flows dominating the markets, however, XAU/USD reversed its direction and rose above $2,340.

Bitcoin price continues to get rejected from $65K resistance as SEC delays decision on spot BTC ETF options

Bitcoin (BTC) price has markets in disarray, provoking a broader market crash as it slumped to the $62,000 range on Thursday. Meanwhile, reverberations from spot BTC exchange-traded funds (ETFs) continue to influence the market.

US economy: slower growth with stronger inflation

The dollar strengthened, and stocks fell after statistical data from the US. The focus was on the preliminary estimate of GDP for the first quarter. Annualised quarterly growth came in at just 1.6%, down from the 2.5% and 3.4% previously forecast.