Polish Zloty (EUR/PLN) – worse data weakens the Zloty

The Zloty market remained stable only for a couple of days. Trading volumes were low as volatility did not encourage trades to take action. Throughout the week though, a bunch of worse than expected macro data has been published which negatively affected the PLN. CPI for May (yearly basis) stood at -0.9%, which was lower than expected. Core CPI has not changed and remained at 0.4%. Average wages increased only by 3.2% which was also a lower number than we were hoping for. It was no surprise then that the retail ales and industrial production readings were also below expectations. Only the PPI reading was slightly better (at -2.2%) than forecasts. No wonder the PLN started to depreciate. Are traders expecting another interest rate cut? I do not think so. The MPC was pretty straightforward in their statements that interest rates will not be lower. Also, it seems the usually known negative correlation with the EUR/USD is broken – the PLN used to gain with an increasing EUR/USD. Still, the outlook for the Zloty is not so bad. Sure, some further depreciation can happen but the economy will pick up at some point. If in light of the worse than expected macro data (for a couple of months already) the PLN has not lost so much, then with increasing confidence in the economy we should see a stronger Zloty.On the daily chart we see the EUR/PLN has been traded close to the 4.15 level for a couple of days and then it shoot up to reach the 4.1750 area. The level that we will be closely watching is 4.1950. If broken, we would expect the market to attack 4.24. On the other hand, if the PLN regains some power, a corrective movement could take it back to 4.15.

_20150619141741.png)

Pic.1 EUR/PLN D1 source: xStation

Hungarian Forint (EUR/HUF) – Waiting for the solution, under pressure

The Greek crisis and the growing possibility of the Grexit determined our local currency's power this past week. There was no important macro data and the exchange rate was defined by the investors’ sentiment and by the pressure on emerging markets. The Forint is relatively vulnerable, although Hungary’s economic numbers are quite satisfying. Demand for Hungary’s 3-year government bond was particularly strong on the last auction. The MPC is also satisfied with the indicators but we still expect an interest rate cut at the MPC meeting on Tuesday (23rd of June) by 10 or 15 basis points (from the current 1,65%). I have observed when the past cuts happened,(since the period they started again) the HUF has not weakened much after the announcement, or it reacted earlier.From the technical perspective, the 61.8% Fibonacci retracement level is still strong at around 315. This Fibo level might be important since it is drawn between the historical low (327.2) and the local peak (295.4) of the HUF. There is a nice uptrend channel on the daily chart. The latest 3 peaks are declining, so it cannot make a new top. This could be attractive for carry traders, looking for a good entry. Maybe the EUR/HUF will fill out the available space in the range, but the 315 level will be a good entry for the shorts. The braver ones can start to speculate soon, we are far from the notable moving averages. Probably, the EUR/HUF will stay at high levels for the next 3-4 months, but we see that the channel will break down soon and the rate may be visiting the 310-308 zone again.

_20150619141911.png)

Pic.2 EUR/HUF D1 source: xStation

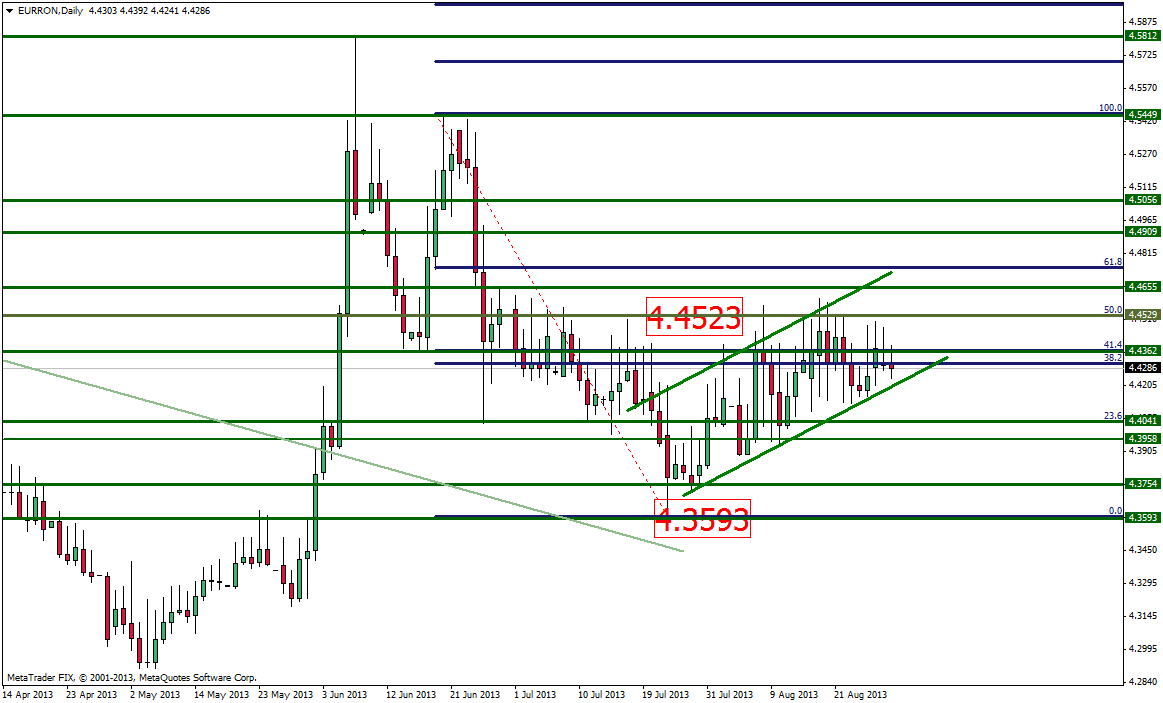

Romanian Leu (EUR/RON) – Do we sense the NBR gentle hand?

There have been several attempts to bring EUR/RON above 4.50 this week, and somehow there was a shyness to breach it. Or maybe was it that the National Bank did not view this as the right moment to do that? The RON was under pressure as Greece seems to trade its membership to the Eurozone for the chance to say “no” to further austerity (although it is quite unlikely to avoid a lump of that in the short term) and the PM of Romania is asked to resign following charges. There is also the issue of the conversion of the proceeds of a municipal bond, yet that should go away as soon as next Monday. The confidence channel may bring the RON to a further slide in case Athens really quits the EZ, since there is a slight banking connection, and risk perception may spike. That would possibly bring EURRON closer to 4.60 in the short-term, as NBR would step aside. However the Euro glory would be brief, as the fundamentals for RON have been improving vastly and the economy is on pace to grow around 4% this year. With such trends, China and Romania GDP deltas would intersect in the years ahead. Retail data has shown 2.7% s.a. growth in April this year vs. last. We view next week’s action as binary: a play within the 4.45 – 4.50 band if no clear news of default and this is our first selection, and a 4.50 to 4.60 range in the alternate scenario.Technical analysis defines a clear uptrend channel growing from a breakout of a previous descending slope, and a slight consolidation within. There is a good cohesion of the trend and the upside seems to favor even a break of 4.50, however the strength of the resistance is not to be understated (more so that the NBR may be following it). Next resistance is 4.5212 and 4.5350, and none seems too far. Support is at 4.4750 (close) and 4.46 (previous trendline).

Pic.3 EUR/RON D1 source: xStation

Recommended Content

Editors’ Picks

EUR/USD regains traction, recovers above 1.0700

EUR/USD regained its traction and turned positive on the day above 1.0700 in the American session. The US Dollar struggles to preserve its strength after the data from the US showed that the economy grew at a softer pace than expected in Q1.

GBP/USD returns to 1.2500 area in volatile session

GBP/USD reversed its direction and recovered to 1.2500 after falling to the 1.2450 area earlier in the day. Although markets remain risk-averse, the US Dollar struggles to find demand following the disappointing GDP data.

Gold climbs above $2,340 following earlier drop

Gold fell below $2,320 in the early American session as US yields shot higher after the data showed a significant increase in the US GDP price deflator in Q1. With safe-haven flows dominating the markets, however, XAU/USD reversed its direction and rose above $2,340.

XRP extends its decline, crypto experts comment on Ripple stablecoin and benefits for XRP Ledger

Ripple extends decline to $0.52 on Thursday, wipes out weekly gains. Crypto expert asks Ripple CTO how the stablecoin will benefit the XRP Ledger and native token XRP.

After the US close, it’s the Tokyo CPI

After the US close, it’s the Tokyo CPI, a reliable indicator of the national number and then the BoJ policy announcement. Tokyo CPI ex food and energy in Japan was a rise to 2.90% in March from 2.50%.