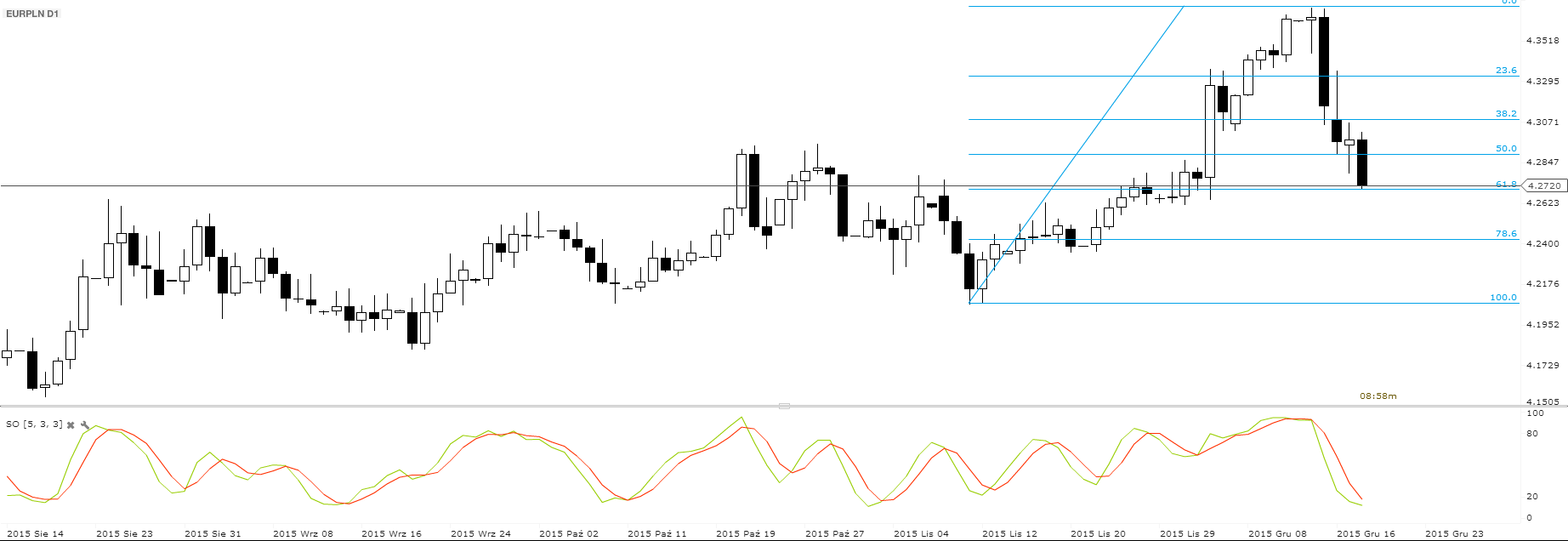

Polish Zloty (EUR/PLN) – back to 4.30

It was the week of the Fed. Interest rates were raised in the U.S by 25 bp for the first time in 9 years. Despite the fact that this move it was widely expected, it cause volatility on the markets. To be honest, I have expected the Fed will wait till new year with increasing the cost money. We got it for Christmas though. This proves that the U.S has recovered and that the economy is back on track. EM currencies reacted and most of them strongly appreciated. The Zloty kept gaining too, despite the mixed macroeconomic data from the economy. The CPI inflation in November stood at -0.6% (yearly basis), which was lower than expected. The Core CPI reading showed 0.2%, also lower than forecasts. Poland is still experiencing deflation, which was confirmed by the PPI reading, which stood at -1,8%. On the other hand, average wages grew in November move than analysts’ expectations – by 4%. Also, industrial production increased by 7.8%. The drop in retail sales by 5.9% should be made up in December. So we see that the MPC has a hard task for 2016. The thing is that most of its members will be exchanged soon and the Committee will meet in January for the last time in its current composition. There are news that the ruling party (rightist Prawo i Sprawiedliwość – Law and Justice) is looking for future members that have a tendency to be more dovish. So are interest rates cuts possible next year? Yes. The government is surprising economists with its shocking ideas so cutting interest rates to lower levels than the current 1.5% is possible. Of course, the MPC is an independent body. Its independence though, depends upon who are its members…The EUR/PLN reached its 2015 highs of 4.37 but was unable to continue higher. A strong corrective movement brought it back to the crucial 4.29 - 4.30 support (which is the 50% retracement level of the last upward impulse), which was broken and took the market down to 4.27. The stochastic oscillator is telling us this is a good time to attack higher levels (the market seems oversold) with targets of 4.30 and 4.33. If the EUR/PLN continues its downward move, the next targets for the market will be 4.24.

Pic.1 EUR/PLN D1 source: xStation

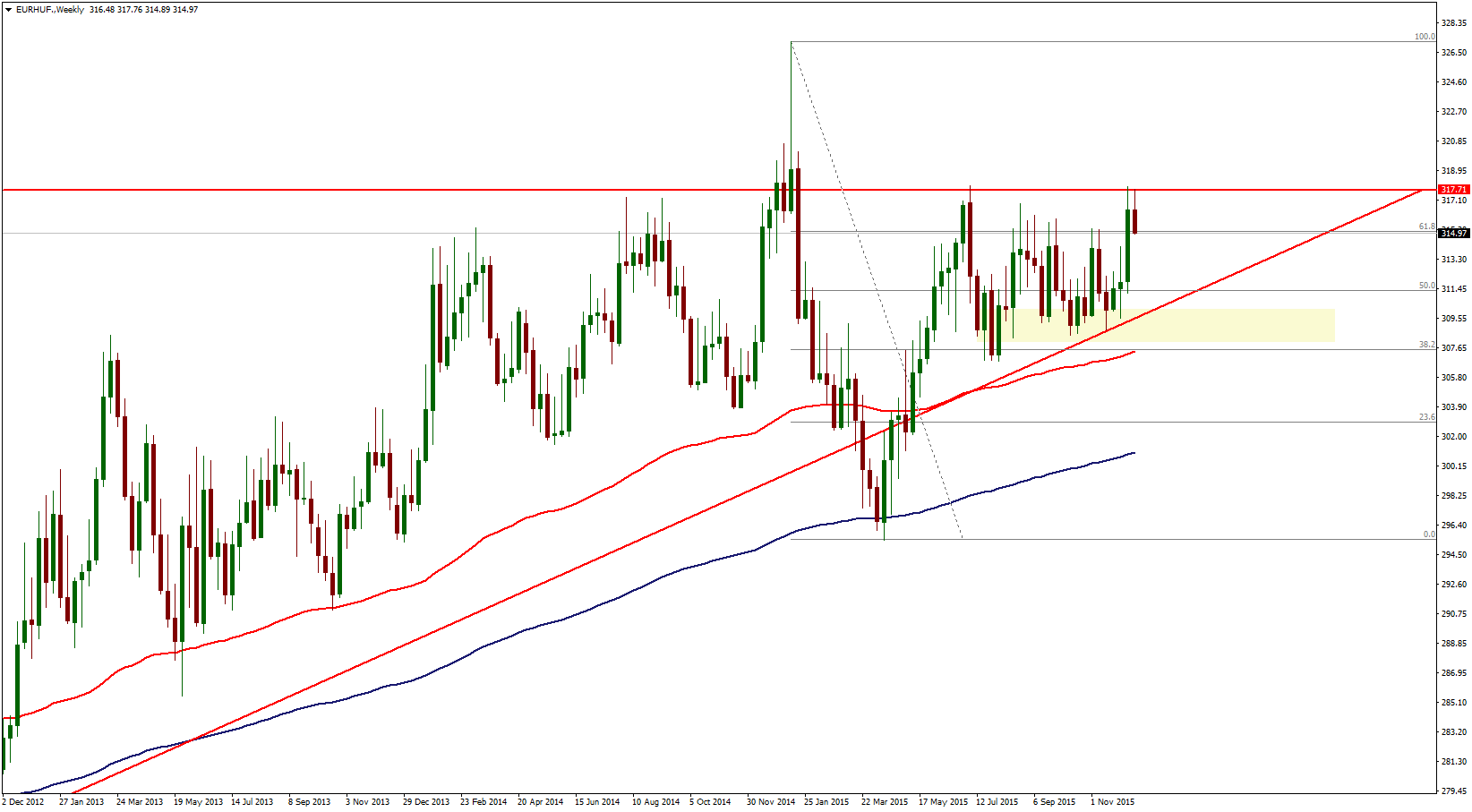

Hungarian Forint (EUR/HUF) – Forint regains its power

The National Bank of Hungary (NBH) is still considering making amendments to its self-financing program. Probably, we will have to wait for the official announcements until early 2016. Anyway, MNB’s Deputy Governor, Márton Nagy, said that the central bank’s goal remains to make sure banks buy government securities instead of "parking" their excess cash, with the primary goal being to spur the sale of long-term bonds. He also highlighted that the NBH would use the instrument of interest rate swap (IRS) more actively in the future. Additionally, the Forint got a positive impulse from macro data publications on Friday. It seems in October 2015, the volume of retail sales increased by 4.1% according to raw data and rose 4.6% adjusted for calendar effects compared to the same period of the previous year. In the January-October period of 2015, sales rose by 3.5% (yearly basis) in food, drinks and tobacco stores, by 7.8% in non-food retail trade and by 7.6% in automotive fuel retailing.Right after the FOMC statement, the EUR/HUF dropped down a little bit to 315. A consolidation pattern visible on the weekly chart what can maintain the Forint power. Using the Fibonacci retracement tool on the latest swing high and low shows that it lines up with the 61.8% Fibonacci level again. This also coincides with the 315 minor psychological mark. In a nutshell, Euro bulls lost an important battle at the 318 resistance again.

Pic.2 EUR/HUF W1 source: Metatrader

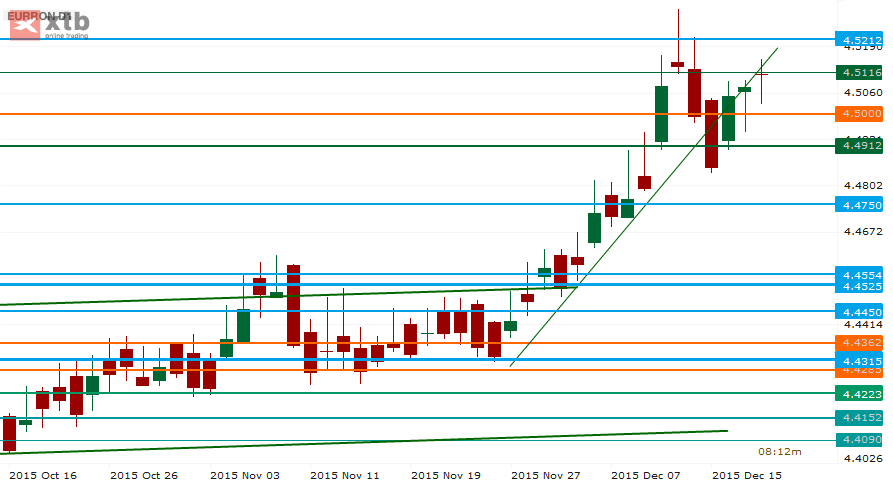

Romanian Leu (EUR/RON) – EUR not letting go

The seasonal pattern favors the RON at this time of the year.. but not this time. A short move below 4.49 did not lead to any serious follow-up. The President has asked the bank law that may bring about significant losses to the system be reconsidered. The budget however is based on a GDP growth of 4.1% and estimates (hopes, one would say) that the deficit will be below the promised 3% even in European (ESA) methodology. The total effect of higher wages and lower taxes is about 20 bn. RON, or 4.44 bn. EUR, aprox. 2.5% of GDP. With 1 year T-bills sold for a yield of less than 1%, a record low, at the latest auction, there may be not enough yield to compensate for the risks ahead. This may be an ominous sign not just for RON but for global risk sentiment and especially the capital markets in 2016.In the short-run we see however some FX flowing into the country before Christmas, meaning a push below 4.50 could happen.

Technical analysis provides now a more confusing picture. The previous spike ended with a shooting star, and the market reversed in due course. The traders have then re-tested the previous trendline, and the market is still mostly playing below that trendline. EUR/RON is now in the midst of a drawing initiative for a new range, between 4.4832 and 4.5212, and this is likely to be the playground for next week. If need be, a RON appreciation below 4.4832 may take us to 4.4750. Resistance is to be found at 4.5212, the local high at 4.5294 and 4.5350.

Pic.3 EUR/RON D1 source: xStation

Note: All information on this page is subject to change. The use of this website constitutes acceptance of our user agreement. Please read our privacy policy and legal disclaimer. Opinions expressed at FXstreet.com are those of the individual authors and do not necessarily represent the opinion of FXstreet.com or its management. Risk Disclosure: Trading foreign exchange on margin carries a high level of risk, and may not be suitable for all investors. The high degree of leverage can work against you as well as for you. Before deciding to invest in foreign exchange you should carefully consider your investment objectives, level of experience, and risk appetite. The possibility exists that you could sustain a loss of some or all of your initial investment and therefore you should not invest money that you cannot afford to lose. You should be aware of all the risks associated with foreign exchange trading, and seek advice from an independent financial advisor if you have any doubts.

Recommended Content

Editors’ Picks

EUR/USD hovers around 1.0700 after German IFO data

EUR/USD stays in a consolidation phase at around 1.0700 in the European session on Wednesday. Upbeat IFO sentiment data from Germany helps the Euro hold its ground as market focus shifts to US Durable Goods Orders data.

USD/JPY refreshes 34-year high, attacks 155.00 as intervention risks loom

USD/JPY is renewing a multi-decade high, closing in on 155.00. Traders turn cautious on heightened risks of Japan's FX intervention. Broad US Dollar rebound aids the upside in the major. US Durable Goods data are next on tap.

Gold price trades with mild negative bias, manages to hold above $2,300 ahead of US data

Gold price (XAU/USD) edges lower during the early European session on Wednesday, albeit manages to hold its neck above the $2,300 mark and over a two-week low touched the previous day.

Worldcoin looks set for comeback despite Nvidia’s 22% crash Premium

Worldcoin price is in a better position than last week's and shows signs of a potential comeback. This development occurs amid the sharp decline in the valuation of the popular GPU manufacturer Nvidia.

Three fundamentals for the week: US GDP, BoJ and the Fed's favorite inflation gauge stand out Premium

While it is hard to predict when geopolitical news erupts, the level of tension is lower – allowing for key data to have its say. This week's US figures are set to shape the Federal Reserve's decision next week – and the Bank of Japan may struggle to halt the Yen's deterioration.