Polish Zloty (EUR/PLN) – is the run to yearly highs possible?

The geopolitical situation is the main factor affecting movements on financial markets during the last couple of weeks. Sure, we got the upcoming Fed meeting on which most expect an interest rate hike (I do not, although the publication series of decent macro data from the U.S economy continues). Also, the ECB might extend the QE program. In the short term though, we are all affected on what is going on in Turkey and Syria. As the situation is tense, emerging market currencies are under pressure. The Polish Zloty has been steadily depreciating since the beginning of the week. Markets have calmed down after the elections but we are still waiting for some important decisions (some of them already made proved to be controversial. In a normal world, the currency of a country would depreciate but during the current times we have more important, global, issues on our minds). In the meantime, we saw that the unemployment rate in October declined to 9.6%. Good news but inflation still remains the main problem. No action from the MPC means that we will have to let external factors to decide about the PLN’s movement. Usually, the Zloty recovers ground as the end of the year approaches. This year is different and Christmas time might not be so peaceful.

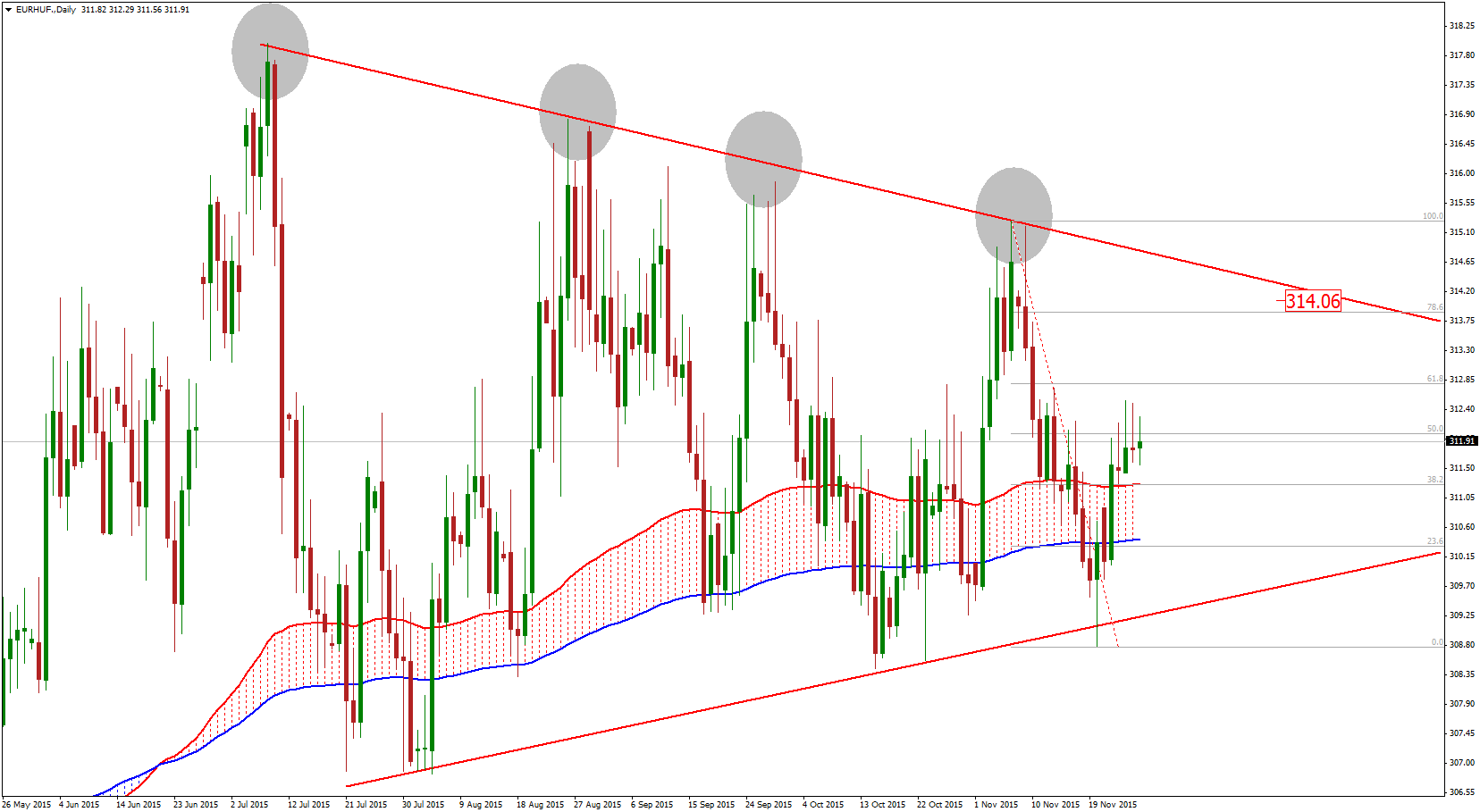

As we see on the daily chart, the EUR/PLN kept climbing from the beginning of the week and is currently trading close to the 4.28 resistance. If broken, the market will head towards the local highs of 4.30. Now, this is the last stop before a really big movement could happen. If 4.30 is broken, we could see the EUR/PLN attacking this year’s highs (from January) at 4.36. Possible? If the political situation in the middle east worsens, then of course. The stochastic oscillator suggests a corrective movement next week. If so, the first stop for the market will be 4.26 with a possible downward movement towards 4.24.

Pic.1 EUR/PLN D1 source: xStation

Hungarian Forint (EUR/HUF) – Base rate may be cut further

The National Bank of Hungary has stressed many times that it has no exchange rate target and does not plan to weaken the Forint. "We need an exchange rate level, which ensures that a 3% inflation can be achieved in a sustainable way on the monetary policy horizon," MNB’s Managing Director Barnabás Virág said on Wednesday. More and more analysts expect a slowdown in GDP growth to extend into 2016 despite authorities' efforts to stimulate growth. Now, the average expectations envision a 2.3% growth for 2016. For 2017 they forecast acceleration to 2.7% on the back of improved absorption of EU funds. According to the downside risk, the NBH may cut the interest rate to 1% or lower in the future which is bad news for the Hungarian currency. What is more to that, Fitch Ratings has left Hungary's BB+ long-term sovereign debt rating unchanged last Friday. They are expecting a 2.9% economic growth in Hungary this year while the budget deficit is expected to remain stable at 2.3% of GDP. That seems not enough for an upgrade. The country's next chance to move from the junk bond category to investment grade will be in 2016. To put it in a nutshell, from the fundamental perspective the local currency has lower chances to appreciate in the upcoming weeks.

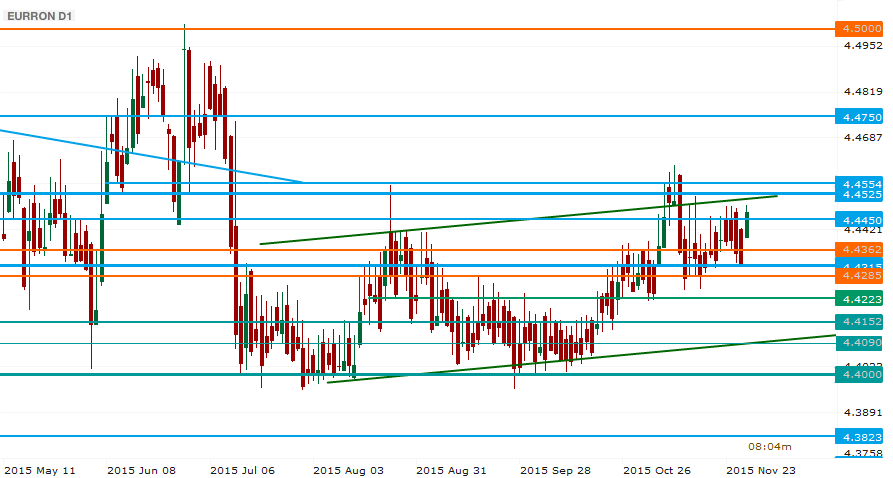

From the technical point of view, we can be sure the EUR/HUF will stay in the triangle and would like to touch the top of it at the 314 resistance. Now, only the 61.8% Fibonacci level stood in the way of the Euro bulls but above the 100 and 200 daily moving averages further upward movement could be guaranteed.

Pic.2 EUR/HUF D1 source: Metatrader

Romanian Leu (EUR/RON) – One law vs. many yield hunters

As the people who thought rates in Europe could not go any lower are proven wrong, and the ECB prepares a push of the “unconventional” frontier of its policies, the yield on Romanian bonds, low as it may be, becomes attractive to funds in the search for yield. The feeling that December can be a good month for the local currency, given the flows that occur close to Christmas from returning workers also goes for RON normally in the 2nd half of the month. This time the week ends on a softer tone for Leu as traders press their ear onto the ground to anticipate what next week’s roar could look like, but also because of the law that passed through Parliament allowing debtors to return their property to the bank and thus force the bank to cease and desist all foreclosure proceedings, regardless of the market value of the real estate piece relative to credit balance. The initiative is being criticized by bankers who view it as switching the market risk onto the banks, and believe it will lead to a jump in credit costs to reflect those risks. There seems to be, even without the law we discussed already, a tendency for EURRON to go higher, and it may be reasonable for the pair to reach above 4.45 next week, given the domestic and global volatility.

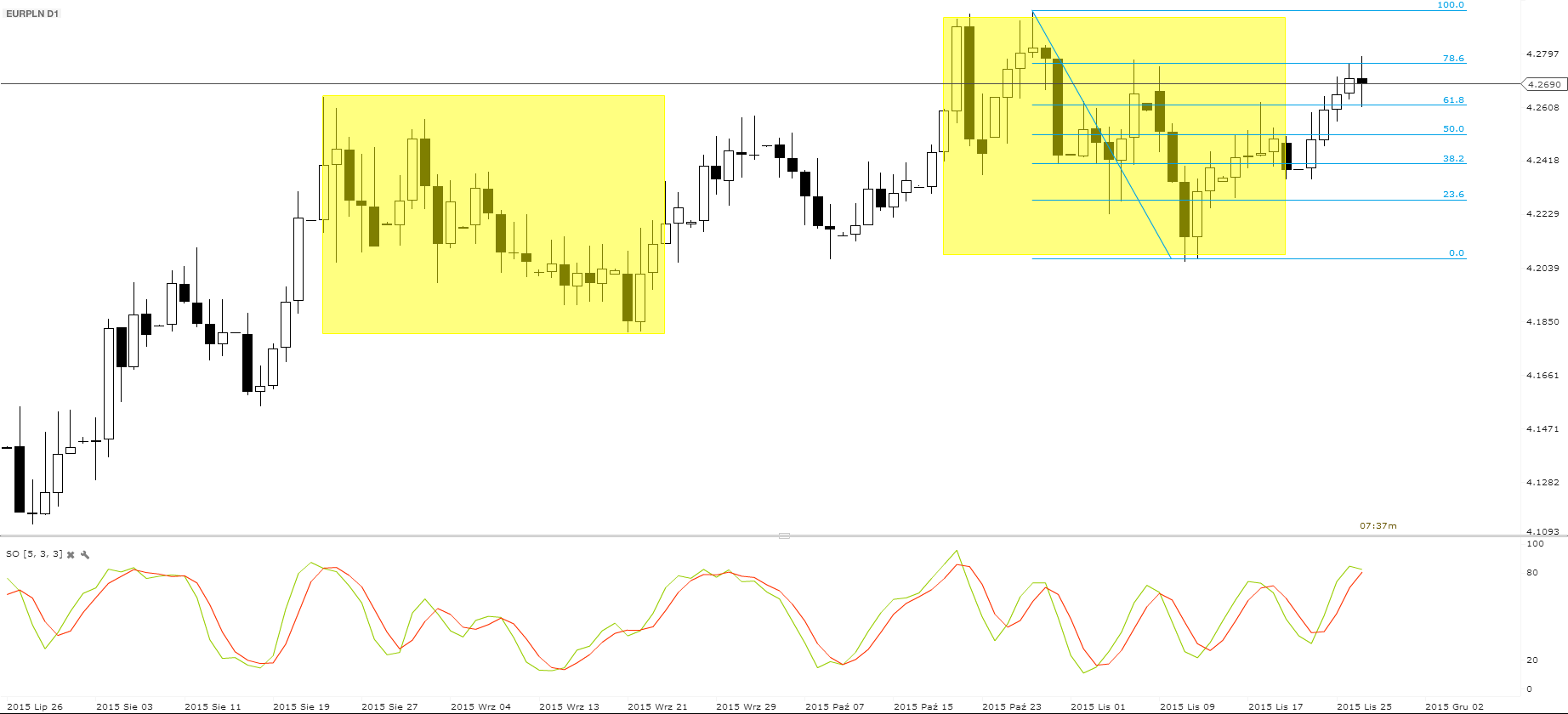

Technical overview offers a warmed-up trend channel that may be soon tested on the upper bound. As the momentum unfolds towards 4.4525, we see only a close above 4.4600 as offering enough of a buffer to see the clear intent towards 4.4750. Local support is placed at 4.4285 and then at 4.4150.

Pic.3 EUR/RON D1 source: xStation

X-Trade Brokers Dom Maklerski S.A. does not take responsibility for investment decisions made under the influence of the information published on this website. None of the published information can be treated as a recommendation, disposition, promise, or guarantee that the investor will achieve a profit or will minimize risk using the information published on this website. Transactions including investment instruments, especially derivatives using leverage, are in its nature speculative and can provide both profits and losses that can exceed the initial deposit engaged by the investor.

Recommended Content

Editors’ Picks

AUD/USD remained bid above 0.6500

AUD/USD extended further its bullish performance, advancing for the fourth session in a row on Thursday, although a sustainable breakout of the key 200-day SMA at 0.6526 still remain elusive.

EUR/USD faces a minor resistance near at 1.0750

EUR/USD quickly left behind Wednesday’s small downtick and resumed its uptrend north of 1.0700 the figure, always on the back of the persistent sell-off in the US Dollar ahead of key PCE data on Friday.

Gold holds around $2,330 after dismal US data

Gold fell below $2,320 in the early American session as US yields shot higher after the data showed a significant increase in the US GDP price deflator in Q1. With safe-haven flows dominating the markets, however, XAU/USD reversed its direction and rose above $2,340.

Bitcoin price continues to get rejected from $65K resistance as SEC delays decision on spot BTC ETF options

Bitcoin (BTC) price has markets in disarray, provoking a broader market crash as it slumped to the $62,000 range on Thursday. Meanwhile, reverberations from spot BTC exchange-traded funds (ETFs) continue to influence the market.

US economy: slower growth with stronger inflation

The dollar strengthened, and stocks fell after statistical data from the US. The focus was on the preliminary estimate of GDP for the first quarter. Annualised quarterly growth came in at just 1.6%, down from the 2.5% and 3.4% previously forecast.