Polish Zloty (EUR/PLN) – same stories affect the PLN

The Polish Zloty has been in a depreciating mood for almost a month. This past week it regained some ground but it is hard to say if this is just a corrective movement or a change of trend. The main topic on the Polish market remains the problem of CHF mortgage holders and the aid the government is expected to provide to them (described by me last week). Now it seems the project might not go through Senate as it might be unconstitutional and the banks’ foreign shareholders might have a strong claim if they decide to go to court against the Polish government. The issue remains if such aid will not create a moral hazard in the future. The other issue are the promises given by the new President, Andrzej Duda. Those promises looked really nice during the presidential campaign (although many economists warned they cannot be realized as the country’s budget will not sustain them) but now the President is pushing them over to the government (opposing party, the Civil Platform). This could mean that Duda has been promising he might not deliver unless the ruling party goes along with him. From the local macro side, CPI inflation in July (yearly basis) stood at -0.7% which was slightly better than expectations. Core CPI was 0.4%, which matched forecasts. Of course, these reading does not change anything in the MPC’s monetary policy. External factors also played a role on the Zloty market. There are talks about the problems in the Chinese economy and this is affecting all emerging markets currencies, including the PLN.As we see on the daily chart, the EUR/PLN continued its upward move from the previous week but was unable to break the 4.21 resistance. The market turned around and the Zloty is being traded at around 4.18 – 4.19 against the Euro. The recent strong upward movements suggest this could be just a corrective movement and that the EUR/PLN will attack the 4.21 resistance again next week. The stochastic oscillator also suggests the market is oversold and that an upward move could be expected. For the record, is the resistance is broken, we should see the market at July’s highs of 4.24. For a continuation of the corrective downward movement, the EUR/PLN needs to break the 4.17 support in order to test 4.14.

Pic.1 EUR/PLN D1 source: xStation

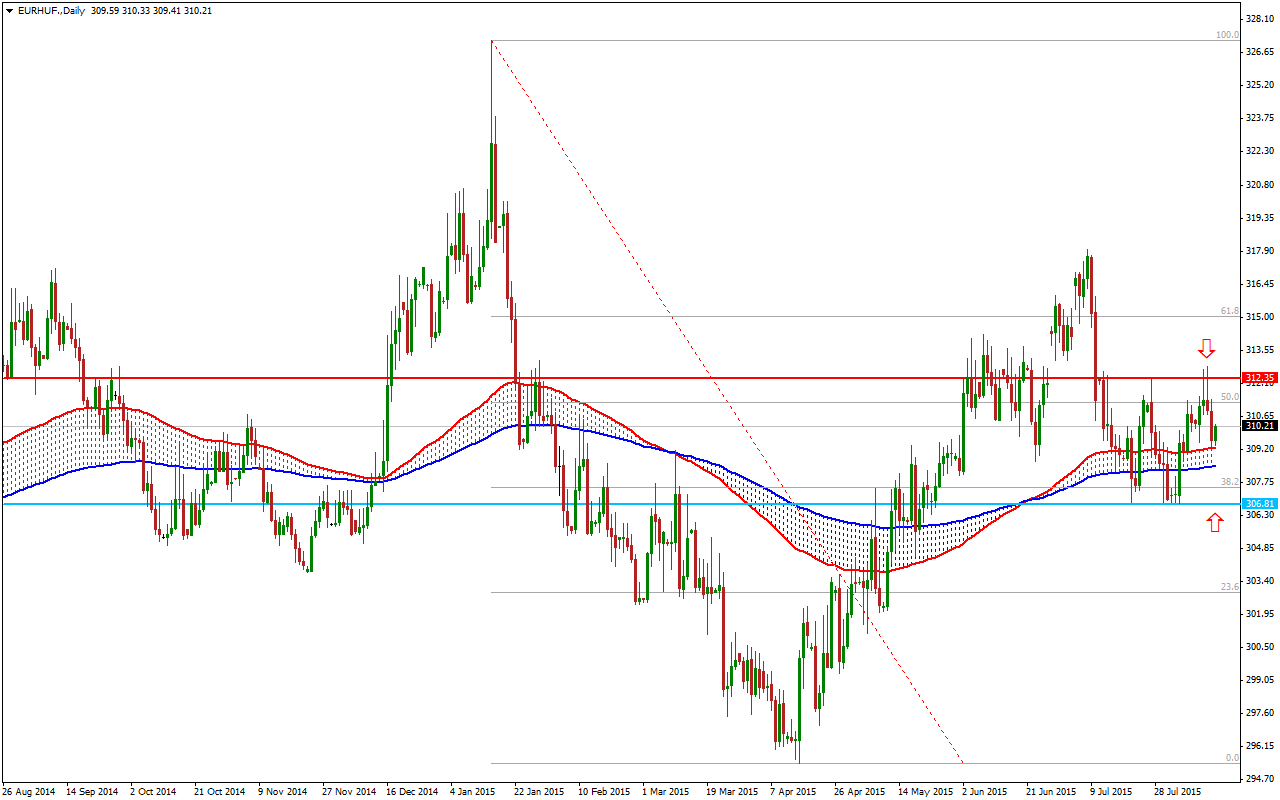

Hungarian Forint (EUR/HUF) – Still between the lines

The Central Statistical Office (KSH) is expected to report on Tuesday that inflation dropped to 0.5% (yearly basis) in July from 0.6% in June. July’s price index could have been dragged lower primarily by the fall in the price of gasoline. What this means is that the National Bank of Hungary is still far from the 2% inflation target. János Lázár, minister at the helm of the Prime Minister’s Office, said on Thursday, he will propose a meeting of the Hungarian government next Tuesday to invite tenders in the 2014-2020 programming period for cc. HUF 12 trillion worth of European Union funds by June 30th 2017. Now, the plan is to bring forward all tenders by June 30th 2017, which will redraw the entire map of Hungary’s macroeconomic scene in the following years. Looking at today's GDP data, we also see a small slowdown in the economic growth. Hungary’s gross domestic product was 2.7% in Q2, which is lower than the Q1 3,5% number. Probably, there is some connection between János Lázár's announcement and the slowdown.From rom the technical point of view, Forint buyers activated their funds few days ago at the 312 levels and pulled back the EUR/HUF into the rectangle again. As we mentioned last week, the EUR/HUF will probably stay in the 307 - 312 range for a longer time especially with an agreement between the Eurogroup and the Greek parliament.

Pic.2 EUR/HUF D1 source: Metatrader

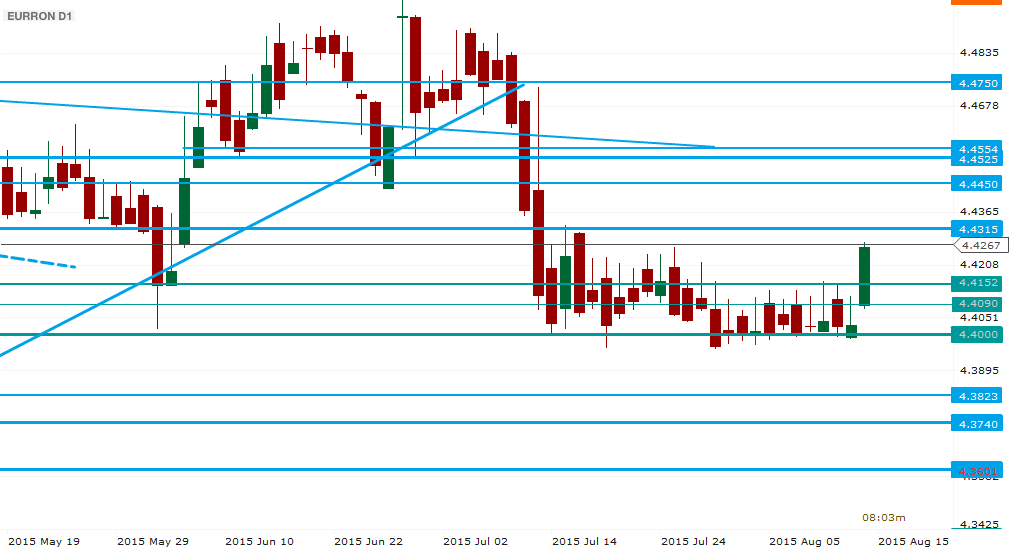

Romanian Leu (EUR/RON) – A miss by one GDP report does that to a currency

The week has been full of decent and/or good macro data (+2.5% m/m jump in core retail, better construction intensity and a slightly lower CPI, due to one-off tax cuts for the food sector), and the RON stayed close to 4.4000, but one GDP report on Friday was particularly bad. Well, not in itself, as a 3.7% q/y GDP growth is not to be moaned about, but the estimates were sky-high, some in the very high 4.5 to 5%, so some (speculative) funds were up for a ”disappointment” trade. The report may imply that the fiscal space is not as large as to provide room for the massive tax cuts and wage rises the government has in mind, and therefore justify a push for EUR/RON, or maybe the Leu backpedal may be due to some re-surfaced worries about the political determination to provide Greece funding, especially in Germany. This, if confirmed, would define an interesting ”bellwether” status for the RON. We view the market largely settling above 4.42 but below 4.45 in the week ahead.Technical perspective provides a clear breakout above the previous range. Now everyone is wondering whether this means a new range, or a strong uptrend. We tend to lean towards the former: a resistance level at 4.4315 may hold, and the defense of 4.4150 would define the new range. However, if we break 4.4315 the momentum may be strong enough to set a classic trend, with the usual 38.2% retracements possibly occurring near 4.4450 level.

Pic.3 EUR/RON D1 source: xStation

Recommended Content

Editors’ Picks

GBP/USD stays weak near 1.2400 after UK Retail Sales data

GBP/USD stays vulnerable near 1.2400 early Friday, sitting at five-month troughs. The UK Retail Sales data came in mixed and added to the weakness in the pair. Risk-aversion on the Middle East escalation keeps the pair on the back foot.

EUR/USD extends its downside below 1.0650 on hawkish Fed remarks

The EUR/USD extends its downside around 1.0640 after retreating from weekly peaks of 1.0690 on Friday. The hawkish comments from Federal Reserve officials provide some support to the US Dollar.

Gold: Middle East war fears spark fresh XAU/USD rally, will it sustain?

Gold price is trading close to $2,400 early Friday, reversing from a fresh five-day high reached at $2,418 earlier in the Asian session. Despite the pullback, Gold price remains on track to book the fifth weekly gain in a row.

Bitcoin Price Outlook: All eyes on BTC as CNN calls halving the ‘World Cup for Bitcoin’

Bitcoin price remains the focus of traders and investors ahead of the halving, which is an important event expected to kick off the next bull market. Amid conflicting forecasts from analysts, an international media site has lauded the halving and what it means for the industry.

Israel vs. Iran: Fear of escalation grips risk markets

Recent reports of an Israeli aerial bombardment targeting a key nuclear facility in central Isfahan have sparked a significant shift out of risk assets and into safe-haven investments.