Polish Zloty (EUR/PLN) – Pressure increasing

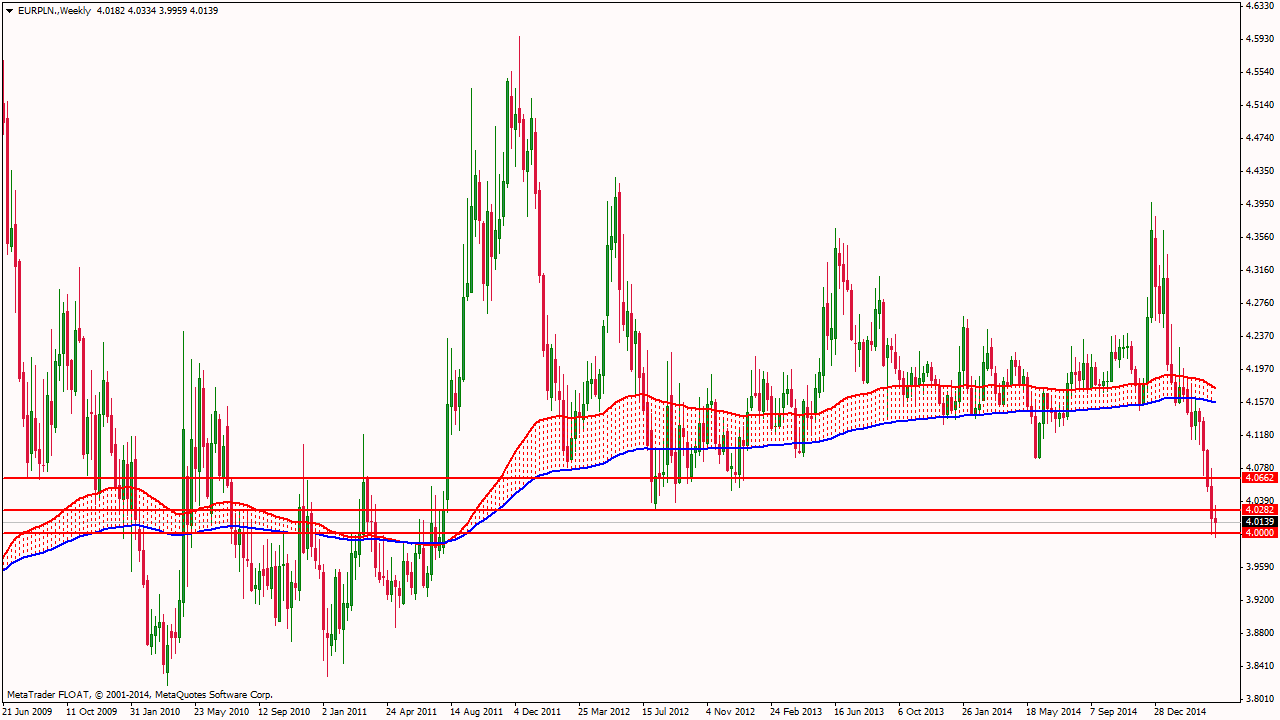

A few weeks ago reports showed the Polish economy advancing 0.7 percent quarter on quarter in the last three months of 2014, better than a preliminary estimate. As I wrote in my last commentary Goldman Sachs has been satisfied with fundamentals and investment banks are still following Easter Europe. It seems Polish jobless rate was unchanged at 12% in February 2015. The number of unemployed persons was unchanged at 1.918 million in February. When compared to the same month of the previous year, the number dropped by 14.9 percent. Next week we will be able to take a look at industrial and retail sectors. We see a modest growth in the former field, as analysts are expecting more from the industrial production data (5 percent). On the other hand we saw some decrease in retail sales on the last publication. Actually it seems EM currencies will close a modest and labile week thanks to the Euro bulls. ECB QE remains in progress until sustained adjustment of inflation is seen. Despite that major currencies (Euro as well) started massive corrections against the greenback.From the technical perspective the Polish Zloty also could find support at 4.0000. It would be hard to break through this line and make the local currency stronger. Small pull back may start in the near future, and our target is 4.07 for the next week if EURPLN could conquer the 4.02 resistance.

Pic.1 EUR/PLN H4 Chart

Hungarian Forint (EUR/HUF) – 10 more basis points?

TThe most important day of the week is Tuesday, when MPC members will hold an interest rate decision meeting at 12:00. The last time they met, the National Bank of Hungary resumed the easing cycle and lowered the base rate by 15 basis points to a new record low of 1.95%. Despite the cut, HUF bears were not as strong as expected previously. The EURHUF 300 level was strong enough until the end of this week. We saw some EUR strength in the past few days; this was the main reason that the rate has broken the resistance. The weakness of the Euro definitely plays a role in bringing the HUF rate to a good level (from the domestic point of view). Forward-looking tourists bought a lot of Euros at these levels; it was quite good to change HUF to EUR now compared to the previous years. One might say it was a profit taking. Now we're above 300, but there is no general pressure on regional currencies. HUF dropped sharply till 302.40, but at these levels the quotation encountered important technical levels which may stop the movement. It turned back again towards 300, but as we approach the next Eurogroup meeting on Friday, which is vitally important for Greece, the uncertainty may increase, causing difficulties for the HUF too.We expect another cut on Tuesday, at least 10 basis points. We can say that such resolution is totally justifiable by the price trends. From the technical perspective we should focus on 302.40 and 300. If we face a growing stress on the market and the MPC will lower the rate again, we can reach the zone of 304.5 – 306.5 again.

Pic.2 EUR/HUF D1 source: Metatrader

Romanian Leu (EUR/RON) – More Post-orthodox Easter calm

It has been a slow oscillation week for the Romanian Leu, as the market pondered whether there is any cause for concern given the Greece situation (almost one fifth of banking market is owned by Greek names) and the losses from CHF-denominated loans, more so that the franc restarted appreciating versus the RON. Some of the losses will be absorbed by the banking sector, and while there is optimism regarding the balance sheet quality, this may not be guaranteed for the foreseeable future. On the macro front, employment data for all of 2014 was provided, with an unemployment rate of 6.8%. The market has more of a wait-and-see attitude, and in the meantime, signs of faster economic growth this year and the Euro-printing press suggest 4.4000 is not a level impossible to get penetrated.In technical overview, the break below 4.4000 does not seem to invalidate the 4.40 - 4.4315 range, only for now. We see a slight downtrend lean that could push usbelow 4.4000 and to a re-test of 4.3820 or even 4.3740. For the upside, a close above 4.4315 would open the possibility of a move towards 4.4450.

Pic.3 EUR/RON D1 source: xStation

Recommended Content

Editors’ Picks

AUD/USD posts gain, yet dive below 0.6500 amid Aussie CPI, ahead of US GDP

The Aussie Dollar finished Wednesday’s session with decent gains of 0.15% against the US Dollar, yet it retreated from weekly highs of 0.6529, which it hit after a hotter-than-expected inflation report. As the Asian session begins, the AUD/USD trades around 0.6495.

USD/JPY finds its highest bids since 1990, approaches 156.00

USD/JPY broke into its highest chart territory since June of 1990 on Wednesday, peaking near 155.40 for the first time in 34 years as the Japanese Yen continues to tumble across the broad FX market.

Gold stays firm amid higher US yields as traders await US GDP data

Gold recovers from recent losses, buoyed by market interest despite a stronger US Dollar and higher US Treasury yields. De-escalation of Middle East tensions contributed to increased market stability, denting the appetite for Gold buying.

Ethereum suffers slight pullback, Hong Kong spot ETH ETFs to begin trading on April 30

Ethereum suffered a brief decline on Wednesday afternoon despite increased accumulation from whales. This follows Ethereum restaking protocol Renzo restaked ETH crashing from its 1:1 peg with ETH and increased activities surrounding spot Ethereum ETFs.

Dow Jones Industrial Average hesitates on Wednesday as markets wait for key US data

The DJIA stumbled on Wednesday, falling from recent highs near 38,550.00 as investors ease off of Tuesday’s risk appetite. The index recovered as US data continues to vex financial markets that remain overwhelmingly focused on rate cuts from the US Fed.