Polish Zloty (EUR/PLN) – 4.15 might be broken

This past week was all about Janet Yellen and her testimony in front of Congress. I believe we heard nothing new (some might disagree) that could change our view of the Fed’s monetary policy. The discussion among analysts was about the word “patient” that the FOMC used on its December meeting. Some figured, Yellen suggested the central bank will keep using this word regarding the Fed’s stance towards hiking interest rates. I do not see that. A series of strong NFP reports (above +200K) and we can have higher rates in June. How had emerging market currencies behaved after that? Most of them remained strong. In Poland we had only the unemployment rate publication (increase to 12% in January) but the news were rather ignored by traders. The good news came on Friday with the Q4 GDP reading, which showed the Polish economy grew by 3.2% (better than expectations). The main topic on the local market remains deflation and the need for an interest rate cut in March. I really wonder what will happen. The MPC should decrease interest rates and it will be a good decision. On the other hand, we will see if the MPC keeps it logic. When it cut the rate by 50bp in October of last year, it stated it will keep cutting if the economical situation worsens. Most recently, the economic outlook for Poland is better so according to this, it should not change the rates. Still, the reaction of the market should not be big. Despite lower rates expectations, the Zloty had a good week and it approached the 4.15 level against the Euro. Supporting it were news about the stabilizing situation in Ukraine and positive outcome of the Greek talks.From the technical analysis perspective, the crucial level is 4.15. Currently, the market is fighting at this support. If broken, the EUR/PLN will target 4.13. On the other hand the market might want to take a breather and rebound. The stochastic oscillator suggests such move. Then, the target would be 4.19.

_20150227154640.png)

Pic.1 EUR/PLN D1 source: xStation

Hungarian Forint (EUR/HUF) – At 2 months low

Hungary’s national economy rose by 3.40% (quarterly basis) in the fourth quarter of 2014. As an interesting fact, the GDP Annual Growth Rate in Hungary averaged 2.13% from 1996 until 2014, reaching an all time high of 5% in the first quarter of 2000 and a record low of -8% in the second quarter of 2009. Fast GDP growth in Q4 last year was not caused by booming investments. In view of the investment data published yesterday, we have a growing suspicion that it was domestic consumption that jumped, as the contribution of a 1.9% investment growth must have been awfully small to the 3.3% output increase. On the other hand, the Hungarian Forint continued its solid performance this week. The National Bank of Hungary kept the interest rate at 2.1% and gave a green light to the 300 support. However, the biggest question is that how long can Hungary's central bank keep rates on hold?Technical analysis points to more downward movements and targets the support at 300. On the other hand, we feel that some traders will take out profits and close down bigger transactions next week what can cause a little pull back. Furthermore, the 38.2% Fibo level and the 100 WEMA (red) also show a strong support at 302.16. In conclusion, we are looking for a bigger pull back to the 305-306 levels next week.

_20150227154735.png)

Pic.2 EUR/HUF W1 source: Metatrader

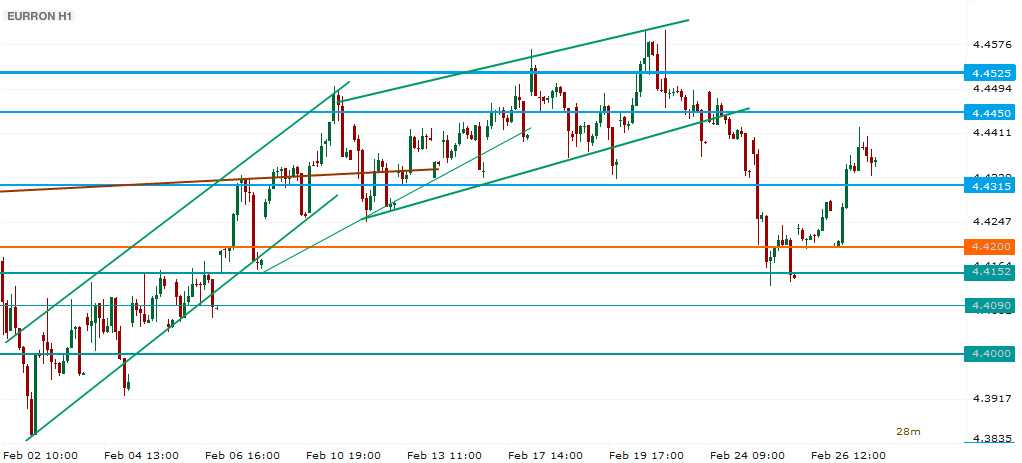

Romanian Leu (EUR/RON) – Greece spoke, RON strengthened.. for a limited time

As the pressure was relieved at least partially in what concerns Greece, the Leu responded favorably. We are also approaching March, when floods of ECB liquidity start, wth demand for Romania’s Treasuries, and possibly other assets such as stocks as well encouraged by the hunt for yield. On the local front, the fiscal relaxation measures are a little bit audacious (possibly leading to a RON 16 bn. shortfall in first year alone) and may not be counterbalanced by the increased revenue from higher consumption and voluntary declaration of previously under-surface income. The EU also started the macro imbalance procedure, with many seeing that as a possible deterring factor of fiscal relaxation. We do not share that opinion. The macro data is encouraging, with a more than 6% rise in building permits in January m/y and higher temperature in retail, constructions and industrial sector. However gains did not hold, and we see EUR/RON fluctuating above 4.4200 in the week ahead, as risk starts to be re-priced.Technical analysis perspective had become a bit uncertain, after a rejection from 4.4150 that was lower than estimated, we now see room to settle in the 4.4200 – 4.4450 area. The resistance at 4.4450 is likely to be tested while the closest one above is at 4.4525. There is a more powerful level to watch at 4.4750, but in the week ahead “normal” behaviour may limit the upside towards 4.4600.

Pic.3 EUR/RON W1 source: xStation

Recommended Content

Editors’ Picks

EUR/USD clings to daily gains above 1.0650

EUR/USD gained traction and turned positive on the day above 1.0650. The improvement seen in risk mood following the earlier flight to safety weighs on the US Dollar ahead of the weekend and helps the pair push higher.

GBP/USD recovers toward 1.2450 after UK Retail Sales data

GBP/USD reversed its direction and advanced to the 1.2450 area after touching a fresh multi-month low below 1.2400 in the Asian session. The positive shift seen in risk mood on easing fears over a deepening Iran-Israel conflict supports the pair.

Gold holds steady at around $2,380 following earlier spike

Gold stabilized near $2,380 after spiking above $2,400 with the immediate reaction to reports of Israel striking Iran. Meanwhile, the pullback seen in the US Treasury bond yields helps XAU/USD hold its ground.

Bitcoin Weekly Forecast: BTC post-halving rally could be partially priced in Premium

Bitcoin price shows no signs of directional bias while it holds above $60,000. The fourth BTC halving is partially priced in, according to Deutsche Bank’s research.

Week ahead – US GDP and BoJ decision on top of next week’s agenda

US GDP, core PCE and PMIs the next tests for the Dollar. Investors await BoJ for guidance about next rate hike. EU and UK PMIs, as well as Australian CPIs also on tap.