Polish Zloty (EUR/PLN) – getting stronger

Despite the global turmoil, the Polish Zloty kept gaining since the beginning of the week. It was a surprising turn of events since even Marek Belka, central bank governor, warned about a stronger Zloty. In an interview given to the Reuters agency, Belka stated that in the current macroeconomic situation, the strengthening of the PLN could negatively affect the Polish economy. He also confirmed there is still space for the MPC to cut interest rates. Since Poland is experiencing deflation and the Zloty is getting stronger, the market expects such move on the next monetary policy meeting (next Tuesday. Having such expectations, it is hard to expect the EUR/PLN could dive even further and try to reach the next support at 4.15. It will be very interesting to see if Belka regained authority. On the last meeting, the MPC kept interest rates unchanged and it seems it was the first time the Governor lost a voting in two years. It is possible, he lost his authority after the tape recording were released a couple of months ago by the “Wprost” magazine, in which Belka tries to push certain changes in the law that would give more power to the central bank (cursing a lot in the meantime). Still, this past week the PLN was the biggest gainer among 24 emerging market currencies.

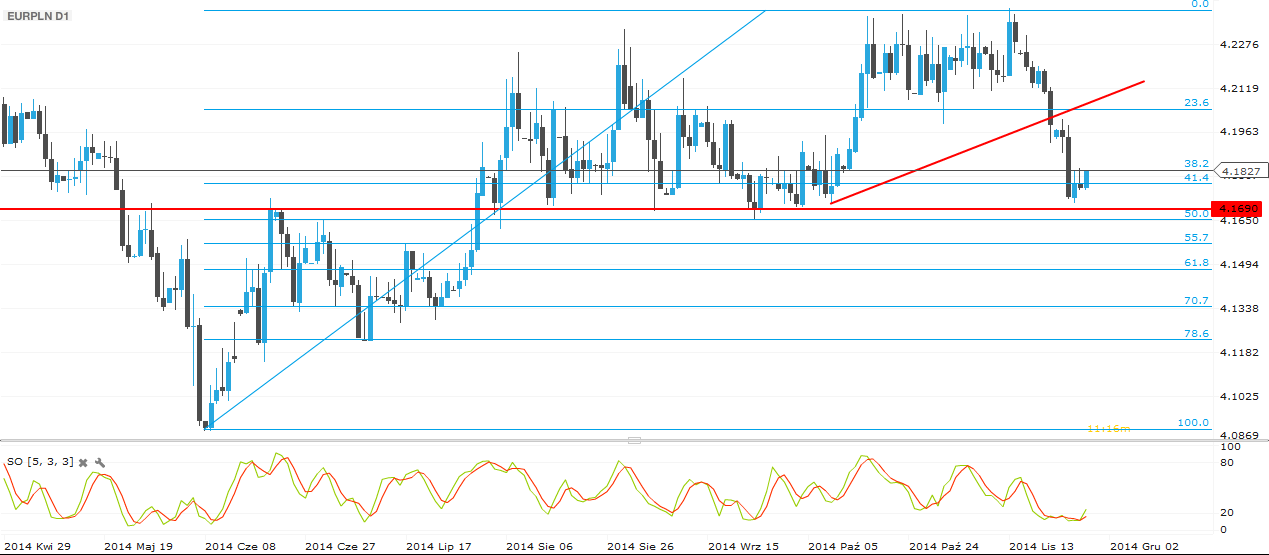

From the technical perspective, the EUR/PLN broke the 4.20 support and continued its descent towards 4.17. This is a very strong support and if broken, the market could dive all the way to 4.15. I rather expect a rebound (as the stochastic oscillator suggests) next week and a possible test of the 4.20 resistance.

Pic.1 EUR/PLN D1 source: xStation

Hungarian Forint (EUR/HUF) – EURHUF - waiting for Fitch Ratings

We are expecting an exciting week for the EURHUF currency pair. On Friday we saw one Eurozone data point, the CPI Flash Estimate drop 0.1% so the next week on Thursday ECB will likely have to act with further expansive measures. All that is good for the emerging markets. On Friday after the markets close, Fitch Ratings will review Hungary’s debt rating and our expectation is to change from stable to positive. On Monday Manufacturing PMI numbers are coming from all over the Eurozone which will affect the mood of the trading. On Wednesday we are expecting GDP numbers for the Q3 and our prognosis as analysts is to have worse numbers than in Q2. Fundamental news flow ends with industrial production where we expect a little expansion. All in all from the perspective of the fundamentals, we think that the Hungarian Forint could start its downward motion again.On the other hand the technical analysis encourages us to look for EURHUF short (HUF positions because on daily chart around 307.80-308.50 there is a strong resistance area. It’s first stop could be around 305 after that 303.80.

Pic.2 EUR/HUF H4 source: Metatrader

Romanian Lei (EUR/RON) – Intermezzo of strength for RON

One may view the rally of the RON as some intermezzo – a dynamic one – inside a larger downtrend, and looking at the fundamentals (including the NBR’s view) it may seem so. Tuesday stands out from the crowd and it has little to do with published reports. The news that a new government may be formed in 2015 has been taken as a sign of more liberal policies and giving up an increase in taxation that was discussed at some point. Macro data looks bland, with unemployment at 6.7% stable m/m but 0.4 percent below the 2013 level. Some worries survive regarding the structure of the budget for next year and the likelihood that revenues may be overestimated to help reach theoretically the deficit target. And of course the Governor signals every now and then that RON should not get too strong, and the market pays attention, so the pressure after a brief shiny moment is still on the upside for EURRON. Later in December however a bit more volatility is estimated as the current trend encounters reverse pressures from workers returning from abroad, cash (EUR, GBP) included.Technically talking, the trend is in force and what we have seen is a natural review of the line. As of now, the resistance at 4.4315 seems vulnerable, and the next one at 4.4525 may come into discussion next week. We view however the market probably taking a rest at around 4.4450 as if too much would have happened by then. The support slowly moves higher to 4.4120 and then round base of 4.4000 is strong enough to withstand any wave of RON bullishness.

Pic.3 EUR/RON D1 source: xStation

Recommended Content

Editors’ Picks

AUD/USD rises to two-day high ahead of Aussie CPI

The Aussie Dollar recorded back-to-back positive days against the US Dollar and climbed more than 0.59% on Tuesday, as the US April S&P PMIs were weaker than expected. That spurred speculations that the Federal Reserve could put rate cuts back on the table. The AUD/USD trades at 0.6488 as Wednesday’s Asian session begins.

EUR/USD now refocuses on the 200-day SMA

EUR/USD extended its positive momentum and rose above the 1.0700 yardstick, driven by the intense PMI-led retracement in the US Dollar as well as a prevailing risk-friendly environment in the FX universe.

Gold price cautious despite weaker US Dollar and falling US yields

Gold retreats modestly after failing to sustain gains despite fall in US Treasury yields, weaker US Dollar. XAU/USD struggles to capitalize following release of weaker-than-expected S&P Global PMIs, fueling speculation about potential Fed rate cuts.

Ethereum continues hinting at rally following reduced long liquidations

Ethereum has continued showing signs of a potential rally on Tuesday as most coins in the crypto market are also posting gains. This comes amid speculation of a potential decline following FTX ETH sales and normalizing ETH risk reversals.

Australia CPI Preview: Inflation set to remain above target as hopes of early interest-rate cuts fade

An Australian inflation update takes the spotlight this week ahead of critical United States macroeconomic data. The Australian Bureau of Statistics will release two different inflation gauges on Wednesday.