Polish Zloty (EUR/PLN) – time for appreciation

The geopolitical situation in the world remains uncertain. Stock markets though keep increasing with the S&P500 reaching new highs. In this environment we would expect emerging market currencies to be swinging back and forth. They are not. There are days are weeks where we see some action, but in general, currency markets remain stable. The Zloty is the currency that historically has given traders lots of potential but in the last couple of weeks we can describe the PLN market with one word – boring. Economic data and indictors from the economy could be giving impulses but traders seem to ignore them. Average wages in October increased by 3.8% (yearly basis) what was above expectations. PPI inflation was at -1.2% (slightly better than forecasts), which confirmed deflation in the producers’ sector. Industrial production is slacking off with an October reading (yearly basis) of 1.6%. Nothing new we learned from the interview given to the WSJ by the central bank governor, Marek Belka. He stated the MPC still has room to cut interest rates in Poland and that the current deflationary state is not a neutral to the economy. Belka also discussed the current value of the Zloty – he said that a relatively cheap PLN is good to the central bank and it mitigates the global decline of prices. As I said, nothing new. Despite the fact it will be December, local analysts along with global investment bank forecast the MPC will cut interest rates on more time before Christmas time.

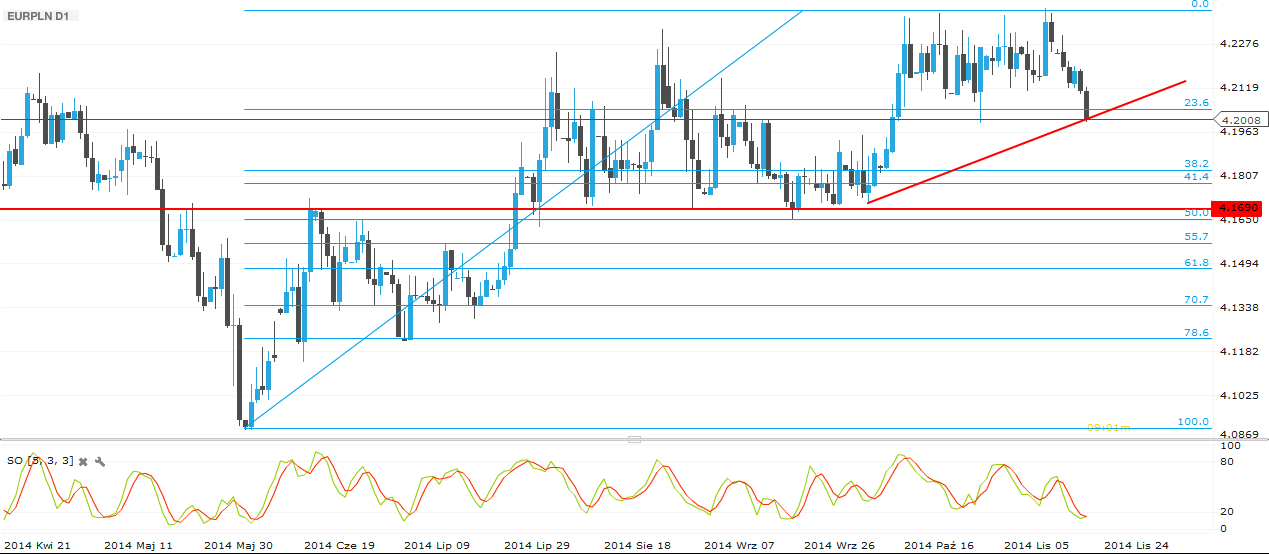

As we see on the daily chart, the EUR/PLN was unable to break the 4.23 resistance for the fourth time in a row. Will it have the power and determination to try one more time? I doubt it can happen this year unless global events provide an impulse. This past week the PLN steadily has been declining to the 4.20 area. Meaning it has not broken from the 4.20 – 4.23 range it has been trading for the last four weeks. My analysis then cannot change much from that from last week. For a larger downward move the 4.20 support needs to be broken. It might happen next week as currently the market is fighting this support. The stochastic oscillator suggests the market is oversold and we that we should expect an upward move though. I believe that is a probable scenario taking into account the fact of low volatility on the marketplace. The targets for the EUR/PLN remain the same – 4.17 if the support if broken and 4.26 if the resistance is crushed.

Pic.1 EUR/PLN D1 source: xStation

Hungarian Forint (EUR/HUF) – More power on the Forint side

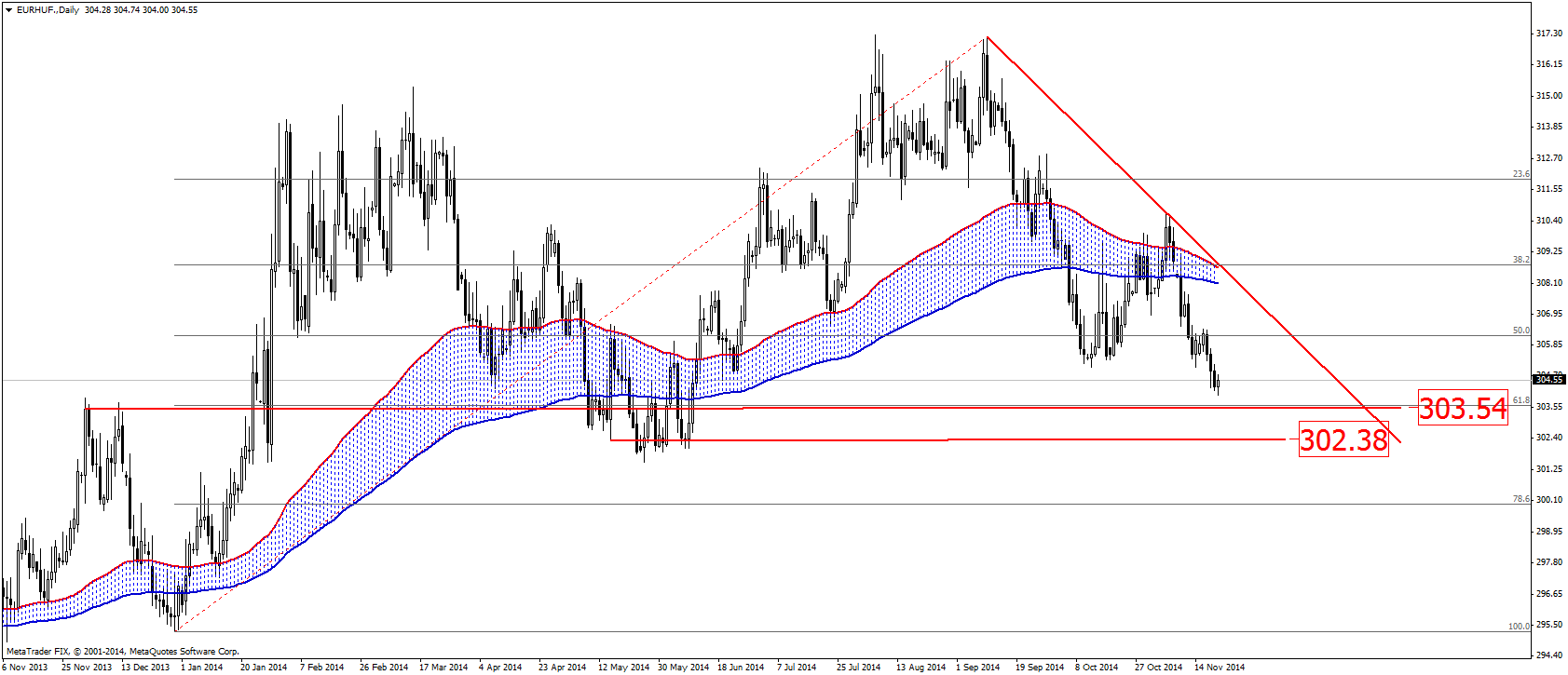

As most emerging market currencies, the Hungarian Forint remained stable this past week. Despite the fact that Economy Minister, Mihály Varga, told in a commercial television channel he sees a weaker HUF next year, the Hungarian currency has not depreciated dramatically. Actually, Varga is expecting that if the conversion of foreign currency loans into forints happens, it will bring the EUR/HUF exchange rate higher. Due to the lack of local macro news, investors had to focus on Mario Draghi, PMI and CPI publications. Next week might be more volatile as the National Bank of Hungary has to set the benchmark rate on its Tuesday meeting. We are expecting that the easing cycle will continue and the main policy rate will be maintained at low levels for an extended period of time. Currently, the interest rate is at 2.10% and the NBH has not changed on the last three meetings. Hungary's CPI also stays close to 0%, which can push the Monetary Policy Council to cut the rate again. If it happens, this step can stop Forint buyers for a couple of days.There are some crucial support areas on the EUR/HUF chart but only till the 302.00 level. Before that, the 303.50 level is also a possible zone, where the market can turn around. As we see, back nad forth movements have already started close to the 303-304 levels and it would not be surprising if next week will bring some Euro bull power and the EUR/HUF will jump back to back to 305-306 territory.

Pic.2 EUR/HUF H4 source: Metatrader

Romanian Lei (EUR/RON) – ECB vs. NBR, who wins?

ECB aims for a weaker Euro. Risk appetite and reasonable carry potential would go against the RON, were not for the National Bank. Through careful and persistent communication, the Governor made it possible that the Euro gained ground against the Leu, well not just by words, but also guiding the interbank rates lower. The markets have been neutral to slightly content after the presidential elections, allowing for T-Note yields to modestly decline and push the currency lower. The market looks ahead a little worried about the lack of guidance for the 2015 budget and trying to guess how the deficit will really look like puts some surplus pressure, leading only to a fine-tuning currency value. We may see the slight upward pressure of EURRON continue despite a general pro-risk appetite (via ECB and PBOC).Inside the technical analysis view an uptrend is alive. Will it slow down or gather more energy? Jumping towards 4.4525 is possible, with interim resistance at 4.4450. A breakout is possibly going to need some time/consolidation, and while this may be in the range of a few days, a further push above 4.4830 but before 4.5000 is also in the realm of possibilities. Support is now at the 4.4200 level and then around 4.41, where the trendline is.

Pic.3 EUR/RON D1 source: xStation

Recommended Content

Editors’ Picks

EUR/USD clings to daily gains above 1.0650

EUR/USD gained traction and turned positive on the day above 1.0650. The improvement seen in risk mood following the earlier flight to safety weighs on the US Dollar ahead of the weekend and helps the pair push higher.

GBP/USD recovers toward 1.2450 after UK Retail Sales data

GBP/USD reversed its direction and advanced to the 1.2450 area after touching a fresh multi-month low below 1.2400 in the Asian session. The positive shift seen in risk mood on easing fears over a deepening Iran-Israel conflict supports the pair.

Gold holds steady at around $2,380 following earlier spike

Gold stabilized near $2,380 after spiking above $2,400 with the immediate reaction to reports of Israel striking Iran. Meanwhile, the pullback seen in the US Treasury bond yields helps XAU/USD hold its ground.

Bitcoin Weekly Forecast: BTC post-halving rally could be partially priced in Premium

Bitcoin price shows no signs of directional bias while it holds above $60,000. The fourth BTC halving is partially priced in, according to Deutsche Bank’s research.

Week ahead – US GDP and BoJ decision on top of next week’s agenda

US GDP, core PCE and PMIs the next tests for the Dollar. Investors await BoJ for guidance about next rate hike. EU and UK PMIs, as well as Australian CPIs also on tap.