Last Thursday the Bank of Japan (BOJ) caused ruckus in the markets by not making any changes to its monetary policies. Wait, what?!

How can a no-change decision have so much impact on the major currencies? Let’s break down the details.

1. The BOJ didn’t make any changes to its policies

As I mentioned in my preview earlier this week, a lot of market players were expecting the BOJ to add more stimulus into the economy. And why not? Japan’s indicators have been deteriorating, domestic inflationary pressures remain muted, and the yen has gained a lot of ground against its counterparts this year.

Instead, Kuroda and his gang have decided to keep their monetary policies steady. See, they believe that two months is too short to assess the impact of their latest policy changes (remember the NIRP?). Their interest rates is kept at -0.1% while the asset-buying program remains at a pace of 80 trillion JPY a year.

2. But it did change its inflation and growth estimates

With no changes to its policies, analysts paid closer attention to the BOJ’s assessment of the economy. Here’s the gist of the BOJ’s fiscal year adjustments since its January release:

-

2016 growth down from 1.5% to 1.2%

-

2016 inflation (y/y) down from 0.8% to 0.5%

-

2017 growth down from 0.3% to 0.1%

-

2017 inflation (y/y) down from 2.8% to 2.7%

-

2018 inflation (y/y) 1.9%

There are two takeaways from the figures above. First, the central bank has further delayed the achievement of its 2.0% inflation target from the first half of 2017 to the 2017-2018 fiscal year. Next, the low growth AND high inflation estimates in 2017 is consistent with speculations of an increase in the value added tax, something that PM Shinzo Abe is expected to implement in April 2017. Will this mean that Abe won’t be delaying the tax increase?

Overall the BOJ has mixed assessment for the economy, saying that growth and business investment are still on a moderate recovery trend while exports recovery had paused and some consumption indicators have shown weaknesses.

3. The BOJ allotted budget for earthquake-related projects

By a unanimous vote the BOJ crew has decided to help restoration and rebuilding operations in Kumamoto following an earthquake a few days ago. The central bank is set to provide loans of up to 300 billion JPY at 0.0% interest rate to its financial institutions.

Since the BOJ’s NIRP charges a 0.1% rate to banks, the BOJ says that twice the amount that the banks will borrow will go to their macro add-on balances, to which a 0.0% rate is applied. Talk about giving incentives!

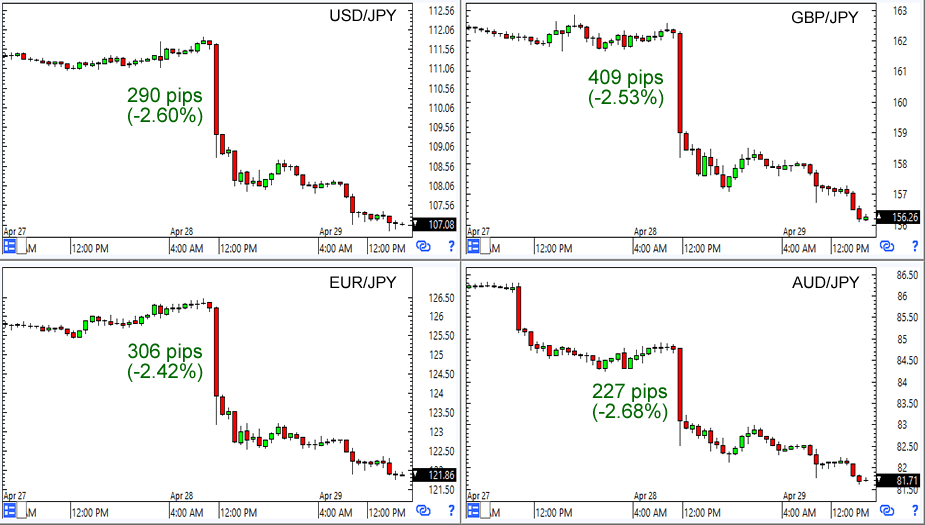

4. The yen shot up across the board

What surprised a lot of forex newbies was how the yen STRENGTHENED when market players were actually disappointed with the BOJ’s non-action. Shouldn’t the yen WEAKEN in times like these? There are two possible reasons for this.

First, the lack of additional stimulus disappointed a lot of equities traders, which created a risk-averse trading environment. Ironically, it’s the low-yielding currencies like the yen that are usually pushed higher in times of risk aversion.

Another reason for the yen’s sudden and sharp strength is that forex traders have deduced that the BOJ isn’t worried about the yen’s recent gains after all. If you recall, the yen was already around 8.6% higher against the Greenback even before the BOJ printed its decision. A non-action signaled to traders that there won’t be much opposition from Kuroda if they push the yen higher… and so they did.

Just because the BOJ didn’t make any policy changes doesn’t mean that it will continue to stand pat next month. Right now the central bank is willing to wait for a couple more months to see the impact of their negative interest rate policy. However, Kuroda and his team might not wait if inflation continues to disappoint, weak global growth continues to threaten Japan’s exports, or if the notable yen increases persist.

BabyPips.com does not warrant or guarantee the accuracy, timeliness or completeness to its service or information it provides. BabyPips.com does not give, whatsoever, warranties, expressed or implied, to the results to be obtained by using its services or information it provided. Users are trading at their own risk and BabyPips.com shall not be responsible under any circumstances for the consequences of such activities. Babypips.com and its affiliates will not, in any event, be liable to users or any third parties for any consequential damages, however arising, including but not limited to damages caused by negligence whether such damages were foreseen or unforeseen.

Recommended Content

Editors’ Picks

EUR/USD clings to daily gains above 1.0650

EUR/USD gained traction and turned positive on the day above 1.0650. The improvement seen in risk mood following the earlier flight to safety weighs on the US Dollar ahead of the weekend and helps the pair push higher.

GBP/USD recovers toward 1.2450 after UK Retail Sales data

GBP/USD reversed its direction and advanced to the 1.2450 area after touching a fresh multi-month low below 1.2400 in the Asian session. The positive shift seen in risk mood on easing fears over a deepening Iran-Israel conflict supports the pair.

Gold holds steady at around $2,380 following earlier spike

Gold stabilized near $2,380 after spiking above $2,400 with the immediate reaction to reports of Israel striking Iran. Meanwhile, the pullback seen in the US Treasury bond yields helps XAU/USD hold its ground.

Bitcoin Weekly Forecast: BTC post-halving rally could be partially priced in Premium

Bitcoin price shows no signs of directional bias while it holds above $60,000. The fourth BTC halving is partially priced in, according to Deutsche Bank’s research.

Geopolitics once again take centre stage, as UK Retail Sales wither

Nearly a week to the day when Iran sent drones and missiles into Israel, Israel has retaliated and sent a missile into Iran. The initial reports caused a large uptick in the oil price.