Thinking of trading the Loonie? Take a quick look at Canada’s main economic components and see if you can find any forex trade opportunities!

Growth

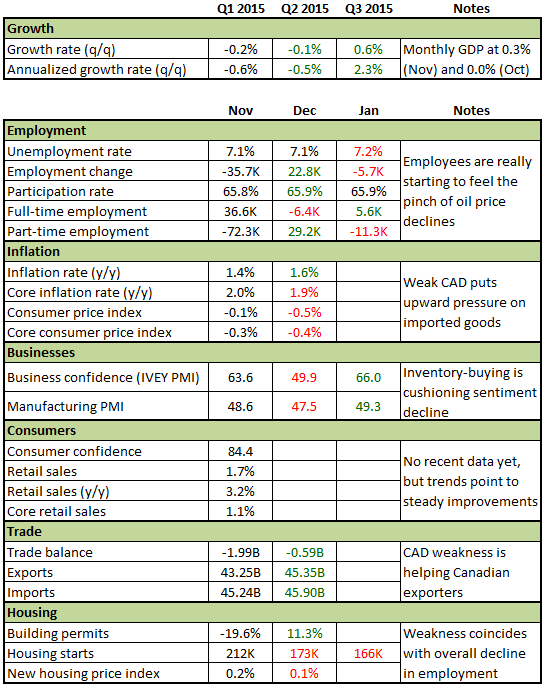

Economic activity in Canada picked up by 0.6% in Q3 2015 after falling into a mild recession in Q2 2015. Monthly numbers also show improvements with the monthly GDP clocking in a 0.3% growth in November after stagnating in October and falling by 0.5% in September. Will the GDP continue its uptrend in Q4 2015? The BOC doesn’t think so. In fact, its members have predicted that GDP has stalled during the quarter. Yipes!

Employment

As I mentioned in my recent jobs data matchup, Canadian workers are starting to really feel the pinch of lower oil prices. Oil-producing provinces like Alberta, for example, are seeing dramatic declines in employment opportunities. The unemployment rate climbed in January even as participation rate remained at 65.9%. Meanwhile, part-time and full-time employment aren’t showing any trends, as their numbers mostly vary by province.

Inflation

Though the annual rate was boosted by the higher value of imported in December, the other inflation components aren’t as rosy. The core inflation rate registered below 2.0% for the first time in 17 months while monthly consumer prices also point to downtrends. Time to hoard maple syrup, then?

Businesses

Business and manufacturing numbers showed improvements in January after falling to contractionary levels in December. Some aren’t too excited though, as they point to start-of-year inventory-buying as reason for the upticks. Guess we’ll have to wait for the next reports to see if businesses sustain their optimism!

Consumers

Most of the data on consumer spending and activity tend to be delayed, but trends in consumer confidence and retail sales are showing steady uptrends all the way up to November. Will Canadian consumers extend their optimism in the next few months, or will lower employment prospects soon weigh on their buying activities?

Trade

One of the biggest benefits of having a weaker currency is a more competitive export market. This is probably why Canada’s trade deficit narrowed down in December as gains in exports outpaced improvements in imports.

Housing

We have yet to see January numbers for building permits and new housing prices, but the housing starts report is already reflecting the declining demand for new housing amidst lower employment prospects.

What’s next for Canada?

There’s no question that Canada’s economic prospects are affected by the dramatic declines in oil prices. Right now Black Crack’s prices are already making oil-related businesses jittery.

Low business sentiment and employment opportunities could eventually take their toll on consumer spending, housing demand, and inflation, and prompt the BOC to drop its interest rates to stimulate economic activity. Not all hope is lost though, as there are bright spots like Canada’s trading sector that are providing some support for the Loonie and optimism for the BOC.

For now it’s a waiting game for the BOC and forex traders to see if Canada’s economic components continue to suffer from the effects of lower oil prices. How about you? What’s your take on the economy? Have we seen the worst of the oil price decline impact or is Canada just getting started?

BabyPips.com does not warrant or guarantee the accuracy, timeliness or completeness to its service or information it provides. BabyPips.com does not give, whatsoever, warranties, expressed or implied, to the results to be obtained by using its services or information it provided. Users are trading at their own risk and BabyPips.com shall not be responsible under any circumstances for the consequences of such activities. Babypips.com and its affiliates will not, in any event, be liable to users or any third parties for any consequential damages, however arising, including but not limited to damages caused by negligence whether such damages were foreseen or unforeseen.

Recommended Content

Editors’ Picks

AUD/USD jumps above 0.6500 after hot Australian CPI data

AUD/USD extended gains and recaptured 0.6500 in Asian trading, following the release of hotter-than-expected Australian inflation data. The Australian CPI rose 1% in QoQ in Q1 against 0.8% forecast, providing extra legs to the Australian Dollar upside.

USD/JPY hangs near 34-year high at 154.88 as intervention risks loom

USD/JPY is sitting at a multi-decade high of 154.88 reached on Tuesday. Traders refrain from placing fresh bets on the pair as Japan's FX intervention risks loom. Broad US Dollar weakness also caps the upside in the major. US Durable Goods data are next on tap.

Gold price cautious despite weaker US Dollar and falling US yields

Gold retreats modestly after failing to sustain gains despite fall in US Treasury yields, weaker US Dollar. XAU/USD struggles to capitalize following release of weaker-than-expected S&P Global PMIs, fueling speculation about potential Fed rate cuts.

Ethereum ETF issuers not giving up fight, expert says as Grayscale files S3 prospectus

Ethereum exchange-traded funds theme gained steam after the landmark approval of multiple BTC ETFs in January. However, the campaign for approval of this investment alternative continues, with evidence of ongoing back and forth between prospective issuers and the US SEC.

US versus the Eurozone: Inflation divergence causes monetary desynchronization

Historically there is a very close correlation between changes in US Treasury yields and German Bund yields. This is relevant at the current juncture, considering that the recent hawkish twist in the tone of the Fed might continue to push US long-term interest rates higher and put upward pressure on bond yields in the Eurozone.