If you’re looking for a likely catalyst for the Greenback after the FOMC statement, your best bet is this Thursday’s (April 28, 1:30 pm GMT) advanced Q1 2016 U.S. GDP estimate. And it just so happens that I have a nifty Forex Trading Guide for that event.

Why is the GDP report important?

For the newbie forex traders out there, as well as traders who fell asleep during their macroeconomics class (shame on you, buddy), Gross Domestic Product or GDP gives the most comprehensive snapshot of how the economy is performing within a country. This is why it is extremely important to both forex traders and decision makers alike.

In the case of the United States, the Bureau of Economic Analysis (BEA) releases three GDP estimates: (1) the advanced reading, (2) the preliminary reading, and (3) the final reading. The advanced reading is the least accurate and is often subject to revision, but it provides the earliest look at how the U.S. economy is faring, so it tends to trigger the biggest reaction.

The GDP report is also tied to the Fed’s future monetary policy bias since the Fed is usually more inclined to hike rates when GDP is growing at a faster pace in order to stop the U.S. economy from overheating. Conversely, if economic growth continues to slow down, then the Fed would likely hold off on further rate hikes to help support the economy with lower rates for longer.

How did Q4 2015’s advanced reading turn out?

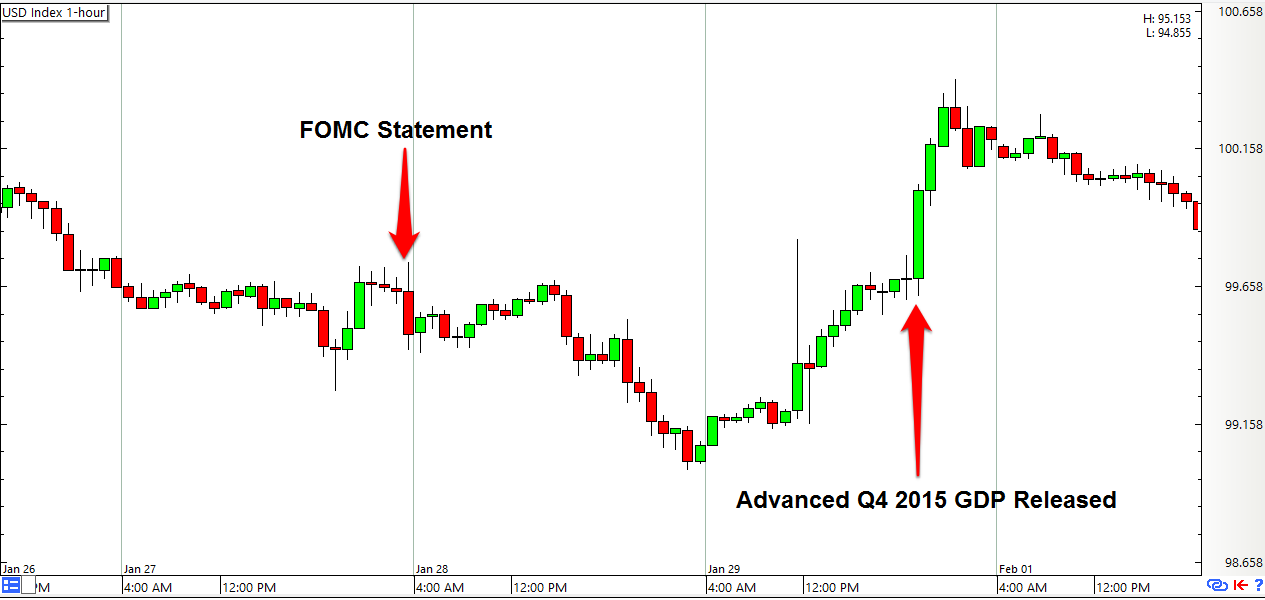

The advanced estimate for Q4 2015’s GDP growth was released back in January 29, and it came in at 0.7% quarter-on-quarter, which was just a tick lower than the consensus reading of 0.8%, but a severe disappointment when compared to Q3 2015’s final reading of 2.0%.

According to the details of the report, the slowdown was due to consumer spending only growing by 2.2% (3.0% previous). Also, private investment contracted faster by 2.5% (-0.7% previous), which subtracted 0.41% from total GDP growth. Moreover, net trade was a major drag since it subtracted 0.47% from total GDP growth.

All in all, the advanced Q4 2015 GDP report was a disappointment, but still not too far off from the consensus reading. Also, forex traders were already bracing themselves for a poor GDP report because the Fed outright spelled out in their January FOMC statement just a couple of days before that “economic growth slowed late last year.”

Forex traders probably priced-in the poor GDP report already (and the overall dovish tone of the FOMC statement) since the Greenback got kicked lower after the FOMC statement and before the GDP report came out, as you can see on the chart below. And when the actual GDP report came in roughly within expectations, these same traders then likely used that as an opportunity to liquidate their Greenback shorts, sending the Greenback higher.

How did the final estimate for Q4 2015 GDP end up?

Q4 2015’s GDP reading was upgraded from the advanced estimate of 0.7% to 1.0% for the preliminary estimate. The preliminary reading was then upgraded further so that the final reading came in at 1.4%. It’s still a slower than Q3 2015’s 2.0% expansion, though.

The upward revision was due to net trade being less of a drag on the U.S. economy compared to the advanced reading since it only subtracted 0.14% quarter-on-quarter GDP growth (advanced reading: -0.47%). The downturn in private business investment also had less of a negative impact, subtracting only 0.16% from Q4 2015’s GDP growth (advanced reading: -0.41%).

What’s expected for Q1 2016’s advanced reading?

For Q1 2016’s advanced GDP estimate, the general consensus among economists is that GDP will expand by 0.7%, which is much slower than Q4 2015’s 1.4%. If the actual reading comes in within expectations (or worse), then that will mark the third consecutive quarter that quarter-on-quarter GDP grew at a slower pace and will likely convince traders that further rate hikes are off the table for now.

As I’ve indicated in my recent Forex Snapshot of the U.S. economy, the available economic reports for the Q1 2016 months are pointing to a likely slower pace of growth, at least for the quarter-on-quarter reading.

To add to that, GDP forecasts by other institutions also point to a likely slowdown. The Atlanta Fed’s GDPNow, for example, forecasts that Q1 2016 GDP will grow by a rather depressing 0.4% (as of April 26).

The New York Fed’s recently-introduced NowCast is more optimistic since it forecasts that GDP will grow by 0.8% in Q1 (based on its April 15 forecast), which is a tick higher than the consensus reading of most economists. Moody’s Analytics high frequency model, meanwhile, is as downbeat as the Atlanta Fed’s GDPNow forecast since its real-time estimate is that GDP will grow at 0.5% (as of April 26).

Overall, the available economic reports, as well as the GDP forecasts by other institutions, are pointing to a slowdown in the U.S. economy so Q1 2016’s GDP growth will very likely be lower than Q4 2015’s 1.4% growth rate. The only questions now are: How much lower will it be? And will be enough to trigger a strong reaction from the Greenback?

BabyPips.com does not warrant or guarantee the accuracy, timeliness or completeness to its service or information it provides. BabyPips.com does not give, whatsoever, warranties, expressed or implied, to the results to be obtained by using its services or information it provided. Users are trading at their own risk and BabyPips.com shall not be responsible under any circumstances for the consequences of such activities. Babypips.com and its affiliates will not, in any event, be liable to users or any third parties for any consequential damages, however arising, including but not limited to damages caused by negligence whether such damages were foreseen or unforeseen.

Recommended Content

Editors’ Picks

EUR/USD holds gains above 1.0700, as key US data loom

EUR/USD holds gains above 1.0700 in the European session on Thursday. Renewed US Dollar weakness offsets the risk-off market environment, supporting the pair ahead of the key US GDP and PCE inflation data.

GBP/USD extends recovery above 1.2500, awaits US GDP data

GBP/USD is catching a fresh bid wave, rising above 1.2500 in European trading on Thursday. The US Dollar resumes its corrective downside, as traders resort to repositioning ahead of the high-impact US advance GDP data for the first quarter.

Gold price edges higher amid weaker USD and softer risk tone, focus remains on US GDP

Gold price (XAU/USD) attracts some dip-buying in the vicinity of the $2,300 mark on Thursday and for now, seems to have snapped a three-day losing streak, though the upside potential seems limited.

XRP extends its decline, crypto experts comment on Ripple stablecoin and benefits for XRP Ledger

Ripple extends decline to $0.52 on Thursday, wipes out weekly gains. Crypto expert asks Ripple CTO how the stablecoin will benefit the XRP Ledger and native token XRP.

US Q1 GDP Preview: Economic growth set to remain firm in, albeit easing from Q4

The United States Gross Domestic Product (GDP) is seen expanding at an annualized rate of 2.5% in Q1. The current resilience of the US economy bolsters the case for a soft landing.