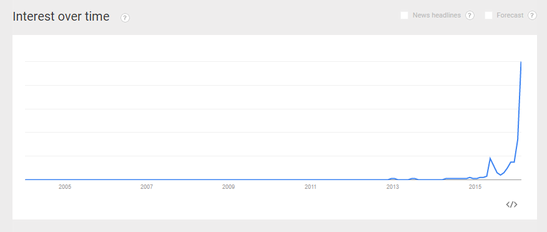

Greetings, forex chaps! There has recently been a surge in interest over the possibility of a Brexit, but what is the sudden hubbub all about? And why did interest spike lately? Well, stay awhile and listen.

Brexit? What’s that?

Brexit is just short for “British Exit” or “Britain’s Exit”. Specifically, it pertains to the possibility that the United Kingdom (UK) may be leaving the European Union (EU). Why does the UK want to leave the EU, you ask? To answer that, let’s take a very quick stroll down memory lane.

A long time ago (around 1973), the UK joined an organization called the European Economic Community (EEC). However, the EEC and its policies began to evolve over the years and even later changed its name into the EU.

During that period of evolution, some Britons began to feel and think that the EU was infringing upon UK sovereignty and/or were unhappy with the perceived red tape, as well as the influx of economic immigrants. Some Britons were also not happy with the fact that the UK has been doing better than most of the other EU members, not to mention the possibility that the UK could be doing even better if it were not weighed down by the EU.

So why the sudden interest in a potential Brexit?

I’ve already given a quick rundown of Brexit fears a few months ago, but I think I need to give y’all another quick history lesson to answer this question. As many Britons were got disillusioned with the EU over the years, euro-sceptic parties like UKIP began to gain popularity and power.

To counter this growing sentiment (or to pander to it, if you’re cynical), the Conservative Party under David Cameron promised in their Party Manifesto for the 2015 elections to hold a referendum by the end of 2017, with June 23, 2016 supposedly being the preferred date, although it could be as late as October.

Since we’re only a few months away from the highly anticipated referendum, it therefore makes sense that interest in a potential Brexit will surge. However, there’s also the fact that a draft deal between the EU and the UK has been, uh, drafted.

What’s this draft deal thing?

Cameron and his fellow Conservatives aren’t really that enthusiastic about leaving the EU. With that, the Conservative Party promised to hold a referendum only after Cameron has renegotiated the UK’s relationship with the EU in the hopes that the renegotiation would convince some Britons to vote against a Brexit. And as it turns out, the initial renegotiations were apparently completed and a draft deal was published on February 2, 2016.

The draft deal attempts to give a point-for-point response to the four items for reform that Cameron identified in his letter to European Council President Donald Tusk (Nope, not that other Donald who is just running for President!). The four items or issues for reform are as follows:

Economic Governance – The UK wants the EU to recognize that the EU has more than currency, and that non-eurozone member countries like the UK should not be at a disadvantage and should not be dragged into bailout programs like what recently happened in Greece.

Competitiveness – “The burden from existing regulation is still too high” (i.e. lots of red tape and lots of fees), so the EU should cut back on those.

Sovereignty – The EU is working towards an “ever closer union” between and among its members. The UK doesn’t want political integration with the rest of the EU, so the UK should be allowed to opt out forever. Also, the European Parliament is too powerful, so National parliaments acting together should be empowered to block unwanted EU legislation.

Immigration – Education, health, and other systems and institutions in the UK are overburdened. Economic migrants add to that burden. The UK can limit migrants from non-EU countries, but has limited control over migrants from EU countries due to the principle of “free movement” within the EU. To dissuade economic migrants, the UK proposes tighter restrictions on migrants and “that people coming to Britain from the EU must live here and contribute for four years before they qualify for in-work benefits or social housing.” Also, migrants should be blocked from sending money overseas to their children.

Below are the European Council President Donald Tusk’s responses in the draft deal. Oh, you can go ahead and read the entire draft here, if you have insomnia and need help falling asleep.

Economic Governance – Okay, the EU has more than currency. Also, non-eurozone member countries like the UK will not be at a disadvantage and will not be dragged into bailout programs. Happy now?

Competitiveness – Okay! Uh, we’ll do our best.

Sovereignty – The EU recognized that the UK doesn’t want political integration with the rest of the EU. National parliaments acting together can now block unwanted EU legislation, although the UK has to jump through a lot of hoops and hurdles before it can use such an action.

Immigration – Hah! In your dreams, Cameron! Okay, okay. Cameron is granted limited power to stop individuals who may pose a threat to UK security, even if the threat is not imminent. However, the UK’s proposal to ban giving migrants welfare benefits is rejected. The UK must give benefits, but at a graduated pace, so new migrants only get a few benefits, but get more as time passes. Migrants must also be allowed to send money to their children overseas, but the valid amounts will depend on the standard of living where the child resides.

Okay, so the next step is the referendum, right?

Nope, not yet. Other EU members will also have their say and Cameron can try and get more than what he got in the draft deal during the EU Summit in Brussels this coming February 18-19, 2016. If a deal fails to push through, then Cameron will get another shot during the March 17-18 meeting since no major agenda has been set on those dates yet. If a deal still can’t be made then, then Cameron can just postpone the referendum date. After all, the referendum date has not yet been set in stone.

What do Britons think about a potential Brexit?

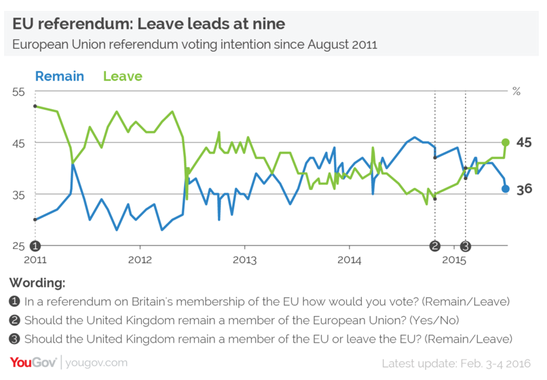

Interestingly enough, a widely-cited poll conducted by YouGov shows that the number of people who support a Brexit increased (45%) after the draft deal was released, leading those who want to stay in the EU by nine percentage points (36%). In addition, YouGov noted that even if Cameron manages to get everything he wants during the February 18-19 EU Summit, the number of people who want to leave the EU still lead by three percentage points (41% leave vs. 38% stay).

BabyPips.com does not warrant or guarantee the accuracy, timeliness or completeness to its service or information it provides. BabyPips.com does not give, whatsoever, warranties, expressed or implied, to the results to be obtained by using its services or information it provided. Users are trading at their own risk and BabyPips.com shall not be responsible under any circumstances for the consequences of such activities. Babypips.com and its affiliates will not, in any event, be liable to users or any third parties for any consequential damages, however arising, including but not limited to damages caused by negligence whether such damages were foreseen or unforeseen.

Recommended Content

Editors’ Picks

AUD/USD turns south toward 0.6400 after mixed Australian jobs data

AUD/USD has come under renewed selling pressure and turned south toward 0.6400 after Australian employment data pointed to loosening labor market conditions, fanning RBA rate cut expectations and weighing on the Aussie Dollar.

USD/JPY remains below 154.50 amid weaker US Dollar

USD/JPY keeps losses for the second successive session, trading below 154.50 in Asian trading on Thursday. The pair is undermined by the latest US Dollar pullback, Japan's FX intervention risks and a softer risk tone.

Gold price finds buyers again near $2,355 as USD licks its wounds

Gold price is attempting a tepid bounce in the Asian session, having found fresh demand near $2,355 once again. Gold price capitalizes on a softer risk tone and an extended weakness in the US Treasury bond yields, despite the recent hawkish Fed commentary.

OMNI post nearly 50% loss after airdrop and exchange listing

Omni network lost nearly 50% of its value on Wednesday after investors dumped the token following its listing on top crypto exchanges. A potential reason for the crash may be due to the wider crypto market slump.

Investors hunkering down

Amidst a relentless cautionary deluge of commentary from global financial leaders gathered at the International Monetary Fund and World Bank Spring meetings in Washington, investors appear to be taking a hiatus after witnessing significant market movements in recent weeks.