Ahoy, forex mateys! Another NFP Friday is fast approaching! And if you’re gonna trade this event and you need to get up to speed on what happened last time and what to expect, then gear up by reading up on another edition of my Forex Trading Guide.

Why is this report important?

For the newbie forex traders who are just tuning in, NFP stands for non-farm payrolls. And the NFP report shows the net change in the number of employed people in non-farming industries during the reporting period.

The NFP report also gives forex traders (and policy makers) a good snapshot on how the U.S. labor market is faring via various labor indicators, with wage growth, the jobless rate, and labor force participation rate being the most important ones.

Gauging the overall health of the labor market is important because a strong labor market usually leads to stronger consumer spending, which then supports overall economic growth, and drives up inflation. And since the U.S. Fed is now expected to hike rates within the year, it is therefore natural that forex traders have their sights on the NFP report, especially since the recent FOMC statement was a bit dovish.

What happened last time?

Non-farm payrolls: 292K vs. 200K expected, 252K previous

Jobless rate: held steady at 5.0% as expected

Average hourly earnings: 0.0% vs. 0.2% expected, 0.2% previous

Labor force participation rate: uptick to 62.6% vs. 62.5% previous

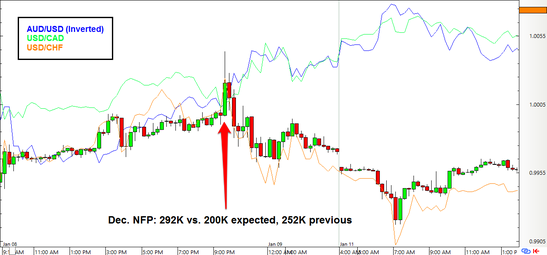

I mentioned in my previous Forex Trading Guide that leading labor indicators skewed “the NFP report slightly towards an upside surprise.” Well, we did get an upside surprise. In fact, the Jan. 6 release of the NFP report for the December period was pretty awesome on the surface, printing a net increase of 292K jobs when an increase of only 200K was expected.

In addition, the previous reading was significantly upgraded from an increase of 211K to 252K. But despite the large net inrease in jobs, the jobless rate held steady at 5.0%. This was likely because the labor force participation rate ticked higher from 62.5% to 62.6%, which means that the U.S. economy was able to absorb the influx of workers who entered or reentered the U.S. labor market, and that is great.

The only dent to the otherwise awesome (on the surface at least) NFP report was that wage growth stagnated, which will likely impact consumer spending and inflation down the road. However, digging deeper into the details of the report slowly erodes the awesomeness since the number of multiple jobholders jumped from 7,414K to 7,738K. And if we also consider that wages stagnated, the implication is that most of the net increase in jobs was because of an increase in low-wage earners and/or that the economic situation of the ordinary American is deteriorating that more of them are holding multiple jobs.

This is supported by the fact that employment in professional and business services increased by 73K, but temporary help services account for 34K of the job gains and that food services and drinking places added 37K jobs (e.g. food services personnel over at McDonald’s, your bartender friend, the friendly waitress at your local diner).

What do forex analysts expect?

Non-farm payrolls: 190K expected vs. 292K previous

Jobless rate: expected to hold steady at 5.0%

Average hourly earnings: 0.3% expected vs. 0.0% previous

For the upcoming January period NFP report, the general consensus among economists and forex traders is that the net increase in non-farm payrolls will only be 190K, which is expected to be enough to keep the jobless rate steady at 2.0%. Wages, meanwhile, are expected to grow by 0.3%.

Looking at the available labor indicators, Markit’s manufacturing PMI reading increased from from 51.2 to 52.4. However, commentary from the report noted that “Payroll numbers expanded again at the start of the year, but the rate of job creation eased since December and was slightly slower than seen during 2015 as a whole.” Markit’s services PMI reading, meanwhile, slid down from December’s 54.3 to 53.2, but commentary from the report was upbeat since “Employment growth was nonetheless sustained in January and the latest rise in payroll numbers was the fastest since September 2015.”

Moving onto other leading indicators, ISM’s manufacturing PMI reading held steady at 48.2, but the manufacturing employment sub-index dropped hard from 48.0 to 45.9. Meanwhile, ISM’s non-manufacturing PMI report dropped from 55.3 to 53.5, with the employment sub-index dropping from 56.3 to 52.1. As for ADP’s jobs report, it printed a 205K net increase in non-farm employment when an increase of only 193K was expected, but its lower than the previous reading’s 267K increase.

Overall, most of the leading indicators are leaning heavily towards a possible slowdown in employment growth, so a lower net increase in jobs is to be expected for the upcoming NFP report.

How might the Greenback react?

Usually, a better-than-expected reading convinces forex traders to buy up the Greenback as a short-term reaction while a worse-than-expected reading usually triggers a quick selloff. And the previous NFP report was an example of the former scenario since the Greenback was bought up, as seen on that there 15-minute chart for the USD Index.

The Greenback’s forex price action diverged after that since its gains against the other safe-haven currencies (CHF and JPY) were quickly erased, but it continued to win out against its other forex rivals, namely the higher-yielding comdolls (CAD, AUD, and NZD). This was probably due to the severe risk aversion that persisted at the time because of the global equities rout. Also, the stagnant wage growth was a real disappointment for most forex traders and the details of the report weren’t that awesome, which is probably why the strong-on-the-surface NFP report didn’t drive longer-term, broad-based demand for the Greenback, so make sure to keep an eye on wage growth for the upcoming NFP report as well.

BabyPips.com does not warrant or guarantee the accuracy, timeliness or completeness to its service or information it provides. BabyPips.com does not give, whatsoever, warranties, expressed or implied, to the results to be obtained by using its services or information it provided. Users are trading at their own risk and BabyPips.com shall not be responsible under any circumstances for the consequences of such activities. Babypips.com and its affiliates will not, in any event, be liable to users or any third parties for any consequential damages, however arising, including but not limited to damages caused by negligence whether such damages were foreseen or unforeseen.

Recommended Content

Editors’ Picks

EUR/USD regains traction, recovers above 1.0700

EUR/USD regained its traction and turned positive on the day above 1.0700 in the American session. The US Dollar struggles to preserve its strength after the data from the US showed that the economy grew at a softer pace than expected in Q1.

GBP/USD returns to 1.2500 area in volatile session

GBP/USD reversed its direction and recovered to 1.2500 after falling to the 1.2450 area earlier in the day. Although markets remain risk-averse, the US Dollar struggles to find demand following the disappointing GDP data.

Gold climbs above $2,340 following earlier drop

Gold fell below $2,320 in the early American session as US yields shot higher after the data showed a significant increase in the US GDP price deflator in Q1. With safe-haven flows dominating the markets, however, XAU/USD reversed its direction and rose above $2,340.

XRP extends its decline, crypto experts comment on Ripple stablecoin and benefits for XRP Ledger

Ripple extends decline to $0.52 on Thursday, wipes out weekly gains. Crypto expert asks Ripple CTO how the stablecoin will benefit the XRP Ledger and native token XRP.

After the US close, it’s the Tokyo CPI

After the US close, it’s the Tokyo CPI, a reliable indicator of the national number and then the BoJ policy announcement. Tokyo CPI ex food and energy in Japan was a rise to 2.90% in March from 2.50%.