Can’t get enough of ’em news reports to trade? Here’s another top-tier economic release coming your way in the form of Australia’s retail sales report for May! Hey, that rhymes!

This report is up for release in tomorrow’s Asian trading session and usually generates a strong forex reaction among Aussie pairs then. If you’re looking to grab quick pips off this event, let’s go through our usual Forex Trading Guide routine, shall we?

What is this report all about?

The Australian retail sales report is basically a measure of whether our mates from the Land Down Under are spending or not. Every surfboard, bottle of sunblock, and boomerang that is purchased will be tallied under retail sales. With that, it gives a picture of how the consumer sector is faring and if they made a positive contribution to overall economic growth.

In Australia, consumer spending accounts for roughly 50% of the country’s GDP. Apart from that, an increase in local consumption tends to encourage businesses to step up their production to meet rising demand, eventually translating to a pickup in hiring. Better employment conditions are good for consumer confidence, which then keeps spending and growth supported.

How did the previous releases turn out?

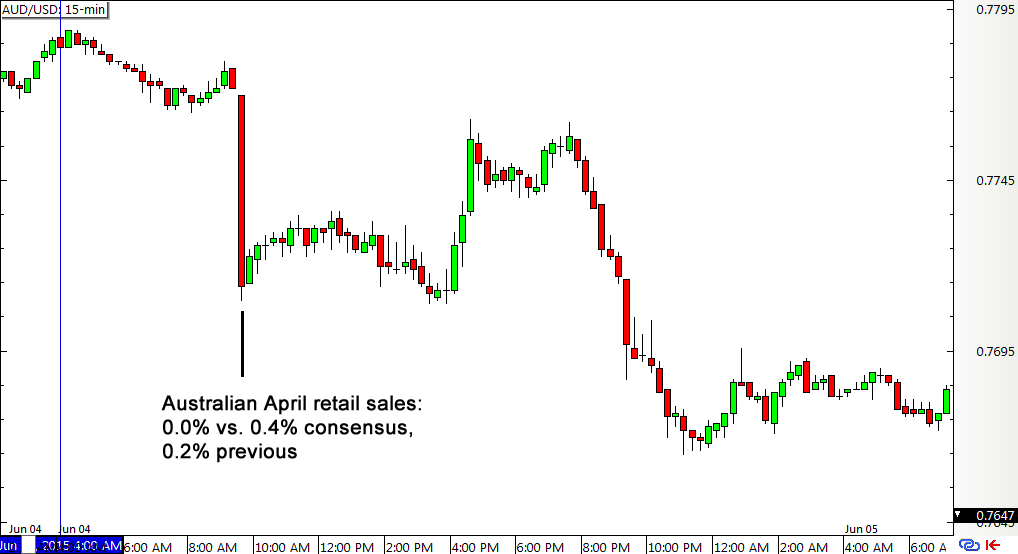

Unfortunately for the Land Down Under, the past couple of retail sales figures didn’t turn out so well. The report printed a measly 0.2% uptick versus the projected 0.4% gain in March, followed by a flat reading in April. AUD/USD sold off sharply upon the release of weaker-than-expected results for April, as analysts were expecting to see a 0.4% rise then.

On a more upbeat note, consumer spending was still up 4.4% in April compared to the same month a year ago. Components of the report indicated that clothing and footwear sales increased by 1.3% on a monthly basis while online purchases picked up by 3%, which suggests that Australians didn’t really hold back on their shopping sprees then. However, department store sales logged in a 0.7% decline while purchases in the “other retailing” category showed a 1.0% drop.

What’s expected this time?

Forex market analysts are expecting to see a 0.5% increase in retail sales for May, which might suggest that the standstill during the previous month was just a temporary setback. Take note, though, that employment data was significantly weaker than expected in May so Australians probably decided to take it easy with their purchases back then.

Consumer confidence remained pretty strong in May, as indicated by the 6.4% jump in the Westpac consumer sentiment index for that month. Aside from that, the start of the winter season in the country (Yep, this is Australia we’re talking about!) probably boosted sales of boots, leather jackets, gloves, and hot cocoa.

How might AUD/USD react?

Since strong retail sales figures support economic growth prospects, a higher-than-expected read could spur Aussie appreciation. In contrast, weaker-than-expected consumer spending data could lead to weaker economic performance and currency depreciation.

As you’ve probably noticed in the forex chart I posted above, AUD/USD typically has a strong initial reaction to the headline figures during the actual release. However, this move is barely sustained in the next few hours, as profit-taking usually takes place right around the end of the Asian trading session. This pattern has been going on for most of the previous releases also, even for reports with stronger-than-expected results.

Recommended Content

Editors’ Picks

EUR/USD clings to daily gains above 1.0650

EUR/USD gained traction and turned positive on the day above 1.0650. The improvement seen in risk mood following the earlier flight to safety weighs on the US Dollar ahead of the weekend and helps the pair push higher.

GBP/USD recovers toward 1.2450 after UK Retail Sales data

GBP/USD reversed its direction and advanced to the 1.2450 area after touching a fresh multi-month low below 1.2400 in the Asian session. The positive shift seen in risk mood on easing fears over a deepening Iran-Israel conflict supports the pair.

Gold holds steady at around $2,380 following earlier spike

Gold stabilized near $2,380 after spiking above $2,400 with the immediate reaction to reports of Israel striking Iran. Meanwhile, the pullback seen in the US Treasury bond yields helps XAU/USD hold its ground.

Bitcoin Weekly Forecast: BTC post-halving rally could be partially priced in Premium

Bitcoin price shows no signs of directional bias while it holds above $60,000. The fourth BTC halving is partially priced in, according to Deutsche Bank’s research.

Week ahead – US GDP and BoJ decision on top of next week’s agenda

US GDP, core PCE and PMIs the next tests for the Dollar. Investors await BoJ for guidance about next rate hike. EU and UK PMIs, as well as Australian CPIs also on tap.