Much has been said about Canada following in the footsteps of the U.S. economy, so is the Great White North really performing as well as Uncle Sam? Here’s a rundown of the latest economic reports from Canada and what these could mean for the Loonie’s forex price action.

Inflation

Weak inflation no longer seems to be the bee in every economy’s bonnet these days since price levels are starting to recover from the spillover effects of the oil price slump.

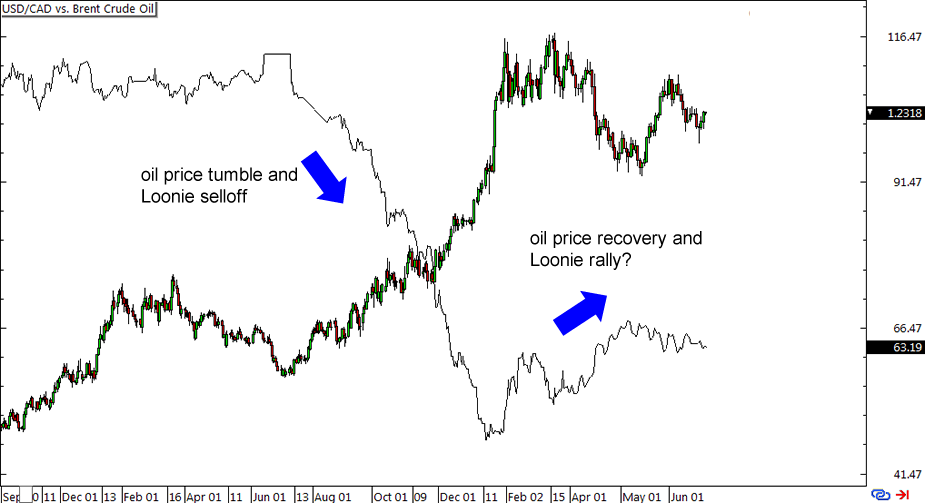

Crude oil prices have been gradually climbing since the start of the year, allowing the positively correlated Canadian dollar to regain ground as well. This puts upward pressure on energy and transportation costs, commodities, beef jerky and maple syrup prices… You name it!

Because of that, it’s no surprise that Canada’s inflation figures for May surpassed expectations. Core CPI showed a 0.4% gain, higher than the projected 0.3% uptick, while headline CPI printed a 0.6% increase versus the 0.4% consensus. On an annualized basis, core inflation is up 2.2% in May.

Trade Activity

Since Canada is an export-dependent economy, its trade figures have a huge say in overall economic growth. For the month of April, the country’s trade balance fell short of expectations when it printed a 3.0 billion CAD deficit, worse than the projected 2.1 billion CAD shortfall. To make things worse, the previous month’s reading was downgraded from an initially reported 3.0 billion CAD shortfall to a 3.9 billion CAD trade gap –its widest deficit in its history of deficits.

Digging a little deeper into the report’s components shows that exports slumped 0.7% in April, chalking up their fourth consecutive monthly decline. On a brighter note, the value of energy shipments actually picked up by 5.9% during the month, reflecting a rebound in the natural resources sector. However, non-energy exports fell by 2% while forest product exports were down 5%, signaling a downturn in external demand for other Canadian products.

Manufacturing

Manufacturing activity in Canada is also hinting at a potential rebound, as lagging indicators were subpar while leading indicators suggest better days ahead. In particular, the manufacturing sales report for April marked a 2.1% slump, worse than the projected 1.3% decline. To top it off, the previous month’s report showed a negative revision from 2.9% to 2.7%.

In contrast, the Ivey PMI for May surprised to the upside with its 62.3 reading when analysts were expecting to see a drop from 58.2 to 55.1. Underlying figures show that the jump was spurred by significant gains in the employment and inventory levels sub-indices, which indicates that businesses are ramping up their production and operations once more.

Employment

True enough, Canada’s employment report for May reflected strong hiring gains of 58.9K, outpacing the consensus of a 10.2K increase. This was enough to keep the country’s unemployment rate steady at 6.8% for the month, even as labor force participation also picked up.

Other underlying labor figures showed promising results, with private sector hiring and full-time employment accelerating. Wage growth was evident since average earnings of employees rose by 2.9% in May from a year ago, faster than the 2.4% annualized increase in April, while the number of hours worked climbed 1.2%.

Most industries such as manufacturing, health care, finance, and retail trade reported gains while the public administration and agricultural sectors indicated layoffs. In Alberta, Canada’s oil industry hub, the number of jobs fell by 6.4K while the city’s unemployment rate climbed from 5.5% to 5.8%.

Consumer Spending

Employment gains and wage growth have yet to translate to stronger consumer spending, though, as both headline and core retail sales figures missed expectations and showed negative readings for April. Headline retail sales dipped 0.1% instead of printing the projected 0.7% increase while core retail sales indicated a 0.6% decline versus the estimated 0.3% uptick.

On a more positive note, the results for March were upgraded to show a 0.9% increase in headline retail sales and a 0.7% gain in core consumer spending. Bear in mind that these are lagging reports also, which means that the economic improvements in May have yet to be reflected in the upcoming retail sales figures for the same month.

All in all, these data points paint a relatively hopeful picture for the Canadian economy, as inflation, manufacturing. and employment figures suggest a potential rebound for trade activity and consumer spending. Compared to its other commodity-driven peers Australia and New Zealand, Canada ain’t doing so bad!

Recommended Content

Editors’ Picks

AUD/USD rises to two-day high ahead of Aussie CPI

The Aussie Dollar recorded back-to-back positive days against the US Dollar and climbed more than 0.59% on Tuesday, as the US April S&P PMIs were weaker than expected. That spurred speculations that the Federal Reserve could put rate cuts back on the table. The AUD/USD trades at 0.6488 as Wednesday’s Asian session begins.

EUR/USD holds above 1.0700 on weaker US Dollar, upbeat Eurozone PMI

EUR/USD holds above the 1.0700 psychological barrier during the early Asian session on Wednesday. The weaker-than-expected US PMI data for April drags the Greenback lower and creates a tailwind for the pair.

Gold price cautious despite weaker US Dollar and falling US yields

Gold retreats modestly after failing to sustain gains despite fall in US Treasury yields, weaker US Dollar. XAU/USD struggles to capitalize following release of weaker-than-expected S&P Global PMIs, fueling speculation about potential Fed rate cuts.

Ethereum ETF issuers not giving up fight, expert says as Grayscale files S3 prospectus

Ethereum exchange-traded funds theme gained steam after the landmark approval of multiple BTC ETFs in January. However, the campaign for approval of this investment alternative continues, with evidence of ongoing back and forth between prospective issuers and the US SEC.

Australia CPI Preview: Inflation set to remain above target as hopes of early interest-rate cuts fade

An Australian inflation update takes the spotlight this week ahead of critical United States macroeconomic data. The Australian Bureau of Statistics will release two different inflation gauges on Wednesday.