Think the second version of the U.S. GDP report doesn’t have much of an impact on forex price action? Think again!

For the newbie traders just tuning in, you should know that the U.S. economy typically releases three versions of its GDP report: advanced, preliminary, and final. While the advanced GDP release tends to have the strongest market impact since it provides the first glimpse of how the economy fared in the reporting period, revisions for the second and third releases also usually have an effect on long-term dollar movement.

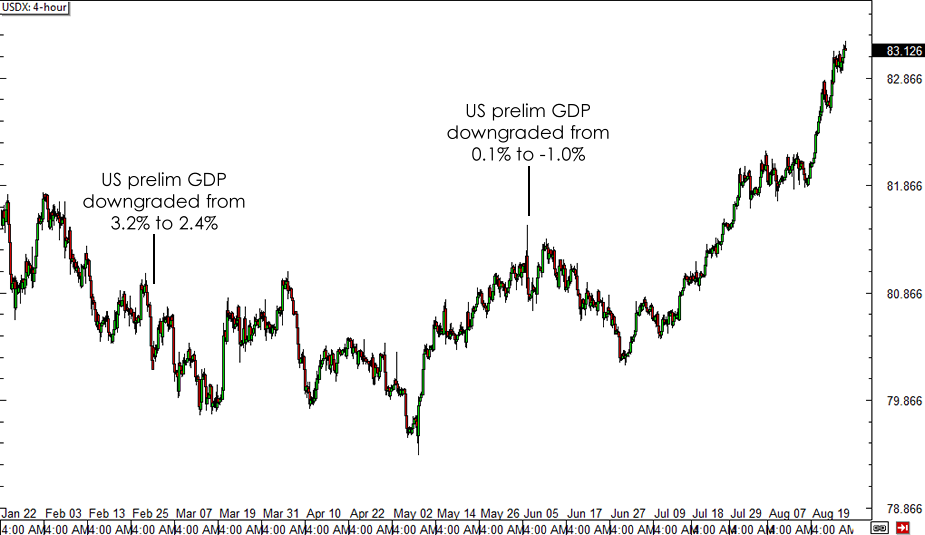

A quick review of past releases on the economic calendar reveals that the U.S. preliminary GDP report happens to contain significant revisions from the initial release. Heck, the GDP reading was dramatically downgraded from 0.1% to -1.0% in the previous quarter! Prior to that, the Q4 2013 GDP reading was revised from 3.2% to 2.4% while the Q3 2013 figure was upgraded from 2.8% to 3.6% during the second release.

With that, market participants are probably bracing themselves for a potential revision on the latest U.S. GDP reading, which showed a 4.0% expansion for Q2 2014. Economic experts predict that only a small downgrade to 3.9% might be seen for now, as retail sales figures have been lowered. Some expect to see upgrades in business investment and net exports, which might be enough to keep the GDP reading steady.

Another sharp downgrade could force the Greenback to return some of its recent losses, as previous downward revisions have resulted to dollar weakness in the weeks that followed.

On the other hand, no revisions or an upgrade could allow the U.S. dollar to extend its gains against its forex counterparts, as many are already taking a bullish dollar bias in anticipation of a rate hike next year. Strong growth figures could add support to these speculations, which might then lead to better business and consumer confidence. Eventually, this could lead to higher spending and investment, adding more fuel to growth prospects and potential Fed tightening.

Recommended Content

Editors’ Picks

EUR/USD holds steady near 1.0650 amid risk reset

EUR/USD is holding onto its recovery mode near 1.0650 in European trading on Friday. A recovery in risk sentiment is helping the pair, as the safe-haven US Dollar pares gains. Earlier today, reports of an Israeli strike inside Iran spooked markets.

GBP/USD recovers toward 1.2450 after UK Retail Sales data

GBP/USD is rebounding toward 1.2450 in early Europe on Friday, having tested 1.2400 after the UK Retail Sales volumes stagnated again in March, The pair recovers in tandem with risk sentiment, as traders take account of the likely Israel's missile strikes on Iran.

Gold: Middle East war fears spark fresh XAU/USD rally, will it sustain?

Gold price is trading close to $2,400 early Friday, reversing from a fresh five-day high reached at $2,418 earlier in the Asian session. Despite the pullback, Gold price remains on track to book the fifth weekly gain in a row.

Bitcoin Price Outlook: All eyes on BTC as CNN calls halving the ‘World Cup for Bitcoin’

Bitcoin price remains the focus of traders and investors ahead of the halving, which is an important event expected to kick off the next bull market. Amid conflicting forecasts from analysts, an international media site has lauded the halving and what it means for the industry.

Geopolitics once again take centre stage, as UK Retail Sales wither

Nearly a week to the day when Iran sent drones and missiles into Israel, Israel has retaliated and sent a missile into Iran. The initial reports caused a large uptick in the oil price.