So much for being nicknamed after a flightless bird! Here are four reasons why the New Zealand dollar or the Kiwi could fly soon.

1. Finance Minister English’s exchange rate comments

In a recent interview with Bloomberg TV, New Zealand Finance Minister Bill English remarked that NZD/USD is trading at sustainable levels, which is around the “mid-to-high 70s.” He added that the recent Kiwi depreciation has been positive for exporters, boosting their productivity and competitiveness.

“We’re pretty comfortable with the kind of adjustment we’ve seen,” English mentioned, which was enough to convince most forex traders that another ecret RBNZ currency intervention is no longer likely.

2. Positive inflation expectations

Finance Minister English also pointed out that inflationary pressures might pick up, as wage growth could be seen later on. However, he cautioned that it would take some time before overall consumer prices increase, as annual CPI is currently at 1%.

“It could be it’s just going to take a while to show up or it could be that the global deflationary pressures are keeping our inflation rate down,” he noted, citing the potential drag from months of falling producer prices in China.

3. Recent pickup in economic data

The latest set of reports from New Zealand has been pretty impressive, as quarterly retail sales and employment figures have exceeded expectations. Headline retail sales jumped by 1.5% versus the estimated 0.8% uptick in Q3 while core retail sales showed a 1.4% gain, higher than the projected 1.0% increase.

The country’s jobless rate has improved from 5.6% to 5.4% in the same period, better than the estimated 5.5% reading. This was spurred by a 0.8% rise in hiring for Q3 and an upward revision from 0.4% to 0.5% in the Q2 employment change figure.

4. Reversal pattern on NZD/USD’s daily chart

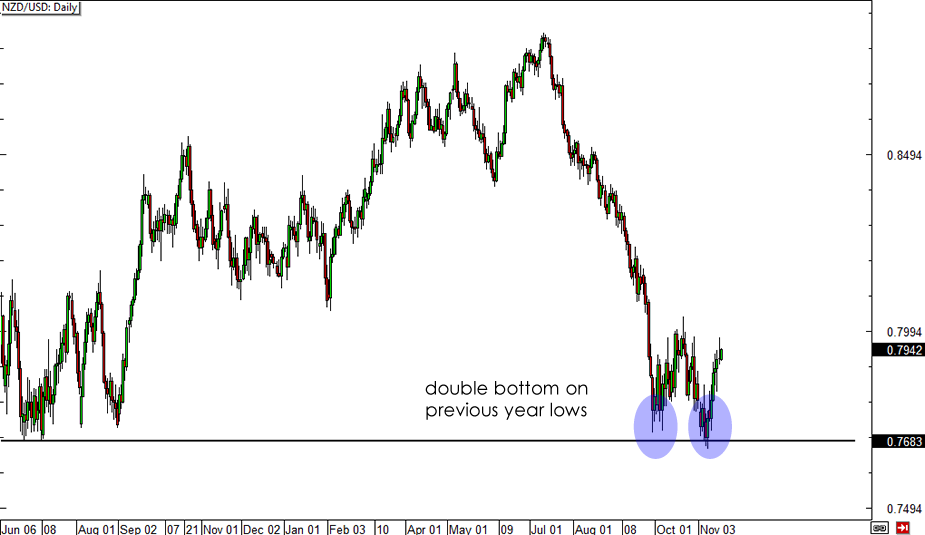

Last but most definitely not least… Check out this neat double bottom formation on NZD/USD’s daily forex time frame!

NZD/USD Daily Forex Chart

NZD/USD Daily Forex ChartThe pair seems to have bottomed out right around the previous year lows and may be showing more bullish momentum, as price gears up to break past the neckline around .8000. Gains past this resistance level could spur a 300-pip climb, which is the same height as the reversal chart pattern.

Recommended Content

Editors’ Picks

EUR/USD climbs to 10-day highs above 1.0700

EUR/USD gained traction and rose to its highest level in over a week above 1.0700 in the American session on Tuesday. The renewed US Dollar weakness following the disappointing PMI data helps the pair stretch higher.

GBP/USD extends recovery beyond 1.2400 on broad USD weakness

GBP/USD gathered bullish momentum and extended its daily rebound toward 1.2450 in the second half of the day. The US Dollar came under heavy selling pressure after weaker-than-forecast PMI data and fueled the pair's rally.

Gold rebounds to $2,320 as US yields turn south

Gold reversed its direction and rose to the $2,320 area, erasing a large portion of its daily losses in the process. The benchmark 10-year US Treasury bond yield stays in the red below 4.6% following the weak US PMI data and supports XAU/USD.

Here’s why Ondo price hit new ATH amid bearish market outlook Premium

Ondo price shows no signs of slowing down after setting up an all-time high (ATH) at $1.05 on March 31. This development is likely to be followed by a correction and ATH but not necessarily in that order.

Germany’s economic come back

Germany is the sick man of Europe no more. Thanks to its service sector, it now appears that it will exit recession, and the economic future could be bright. The PMI data for April surprised on the upside for Germany, led by the service sector.