A quick review of the U.S. dollar index reveals that the currency has been on a tear for almost an entire month, as forex traders cashed in on improving U.S. economic data and the possibility of earlier Fed rate hikes. After all, Fed Chairperson Janet Yellen did mention in her Jackson Hole Summit testimony that the U.S. central bank is open to tightening earlier if “progress in the labor market continues to be more rapid than anticipated.”

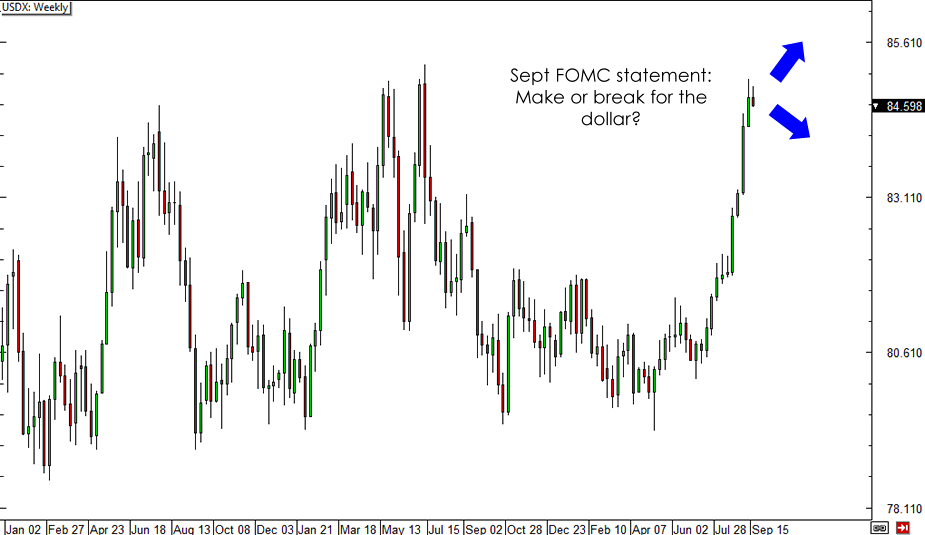

USDX Weekly Chart

However, the same chart reveals that the USDX is testing an established resistance area, which has been holdin’ like a boss over the past couple of years. With that, the upcoming FOMC statement could determine whether the Greenback can extend its rallies or if it will retreat from its current levels.

In particular, market watchers will be paying close attention to the Fed’s interest rate forecasts, as some believe that policymakers would drop the phrase on keeping rates low for a “considerable time” after easing ends. If so, dollar bulls could charge as markets start to price in rate hike expectations for the first quarter of 2015.

Bear in mind though that Yellen does have a penchant for keeping market expectations in check, which suggests that she is likely to downplay hawkish forecasts during the press conference after the actual FOMC announcement. As always, she will probably remind everyone that the U.S. economy still has a long way to go before achieving full recovery and that policy adjustments will continue to be data-dependent.

Forex market participants might also be able to draw more clues from the Fed’s economic projections, which could contain positive revisions in GDP and employment for this year and the next. Apart from that, the Fed is expected to carry on with their $10 billion monthly reduction of asset purchases and confirm that QE will officially end next month.

All in all, the sentiment for the September FOMC statement is generally upbeat, but these expectations have been priced in a long while back. Even if the Fed statement is as expected, there’s still a good chance that profit-taking could drive the dollar lower in the short term before reestablishing its longer-term trend. Are you planning on taking any dollar trades for the FOMC statement?

Recommended Content

Editors’ Picks

EUR/USD rebounds to 1.0650 on renewed USD weakness

EUR/USD gained traction and rose to the 1.0650 area in the early American session on Tuesday. Disappointing housing data from the US seem to be weighing on the US Dollar, helping the pair stretch higher.

GBP/USD climbs above 1.2450 after US data

GBP/USD extended its recovery from the multi-month low it touched near 1.2400 and turned positive on the day above 1.2450. The modest selling pressure surrounding the US Dollar after dismal housing data supports the pair's rebound.

Gold retreats to $2,370 as US yields push higher

Gold stages a correction on Tuesday and fluctuates in negative territory near $2,370 following Monday's upsurge. The benchmark 10-year US Treasury bond yield continues to push higher above 4.6% and makes it difficult for XAU/USD to gain traction.

XRP struggles below $0.50 resistance as SEC vs. Ripple lawsuit likely to enter final pretrial conference

XRP is struggling with resistance at $0.50 as Ripple and the US Securities and Exchange Commission (SEC) are gearing up for the final pretrial conference on Tuesday at a New York court.

US outperformance continues

The economic divergence between the US and the rest of the world has become increasingly pronounced. The latest US inflation prints highlight that underlying inflation pressures seemingly remain stickier than in most other parts of the world supported by a strong US labour market.