What is this report all about?

The Australian jobs report has two main components: the employment change figure and the unemployment rate. Since the former indicates the change in the number of employed people in the previous month, it is considered a gauge of job creation. Meanwhile, the latter measures the percentage of the work force that is employed or actively seeking employment during the reporting period.As discussed in the School of Pipsology lesson on fundamental analysis, employment is an important economic aspect because it serves as a leading indicator of consumer spending. A stable jobs market inspires financial confidence, which then encourages consumers to spend more instead of holding tight to their hard-earned cash. In turn, stronger consumer spending then spurs increased business production and eventually overall economic growth.

What happened last time?

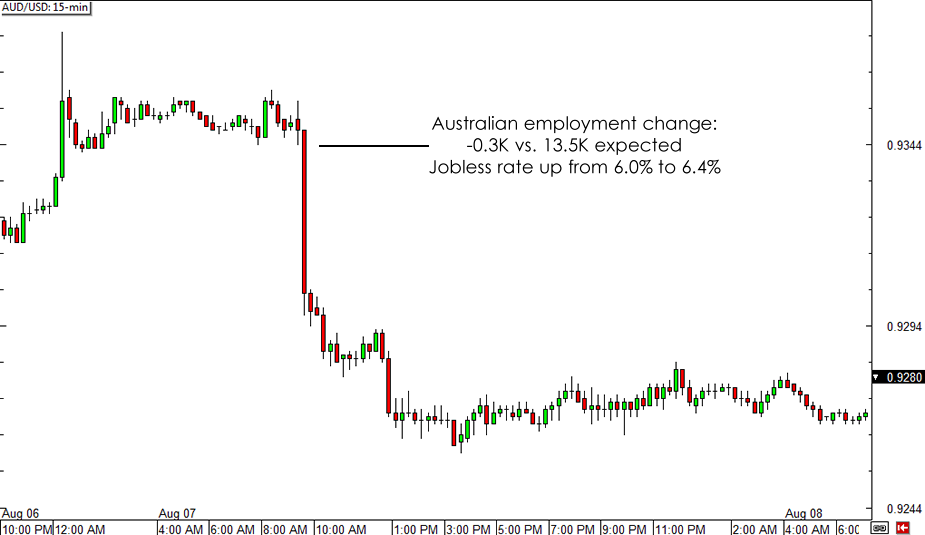

Unfortunately for the Australian economy, the previous jobs release was much weaker than expected, as it showed a 0.3K drop in hiring for July. This brought the unemployment rate up from 6.0% to 6.4%, leading to speculations of a labor market meltdown for the Land Down Under.A closer look at the underlying figures, however, revealed that a significant improvement in the participation rate was mostly accountable for the jobless rate jump. Apart from that, some market analysts have remarked that changes in the labor survey method may have also been one of the reasons for the skewed results.

AUD/USD 15-min Forex Chart

Reviewing AUD/USD’s reaction to the event suggests that traders may have focused purely on the headline figures. After a bit of consolidation prior to the actual release, AUD/USD tumbled by close to 50 pips when the employment figures came in the red then followed through with more losses at the start of the next trading session.

What is expected?

For the month of August, hiring is expected to have rebounded by 15.2K, which might be enough to bring the jobless rate a notch lower to 6.3%. Based on the reaction to the July report, another round of weaker than expected jobs figures might lead to roughly 100 pips in losses for AUD/USD hours after the release.On the other hand, a strong recovery in Australia’s jobs market might lead to an AUD/USD bounce during the Asian trading session. Price tends to continue in the same direction as the reaction candle until the start of the London trading session, before consolidating for the rest of the day.

Recommended Content

Editors’ Picks

EUR/USD climbs to 10-day highs above 1.0700

EUR/USD gained traction and rose to its highest level in over a week above 1.0700 in the American session on Tuesday. The renewed US Dollar weakness following the disappointing PMI data helps the pair stretch higher.

GBP/USD extends recovery beyond 1.2400 on broad USD weakness

GBP/USD gathered bullish momentum and extended its daily rebound toward 1.2450 in the second half of the day. The US Dollar came under heavy selling pressure after weaker-than-forecast PMI data and fueled the pair's rally.

Gold rebounds to $2,320 as US yields turn south

Gold reversed its direction and rose to the $2,320 area, erasing a large portion of its daily losses in the process. The benchmark 10-year US Treasury bond yield stays in the red below 4.6% following the weak US PMI data and supports XAU/USD.

Here’s why Ondo price hit new ATH amid bearish market outlook Premium

Ondo price shows no signs of slowing down after setting up an all-time high (ATH) at $1.05 on March 31. This development is likely to be followed by a correction and ATH but not necessarily in that order.

Germany’s economic come back

Germany is the sick man of Europe no more. Thanks to its service sector, it now appears that it will exit recession, and the economic future could be bright. The PMI data for April surprised on the upside for Germany, led by the service sector.