It’s a make-or-break week for the pound, as the U.K. has a couple of top-tier events lined up for tomorrow: the July jobs release and the BOE inflation report. In this edition of my Forex Trading Guide, I’ll be focusing on the employment report and what it could mean for the pound. Let’s go through our usual routine, shall we?

What is this report all about?

The U.K. jobs report is composed of two main components: the claimant count change and the jobless rate.

The claimant count change is the number of people claiming unemployment-related benefits every month. A number that is lower than the previous figure or lower than the estimated count means there’s a fewer number of unemployed people, which is better for the U.K. economy.

The unemployment rate measures the number of unemployed workers as a percentage of the U.K. labor force. Similar to the claimant count, a lower figure compared to the previous one or the estimate is good for the U.K. economy.

What happened last time?

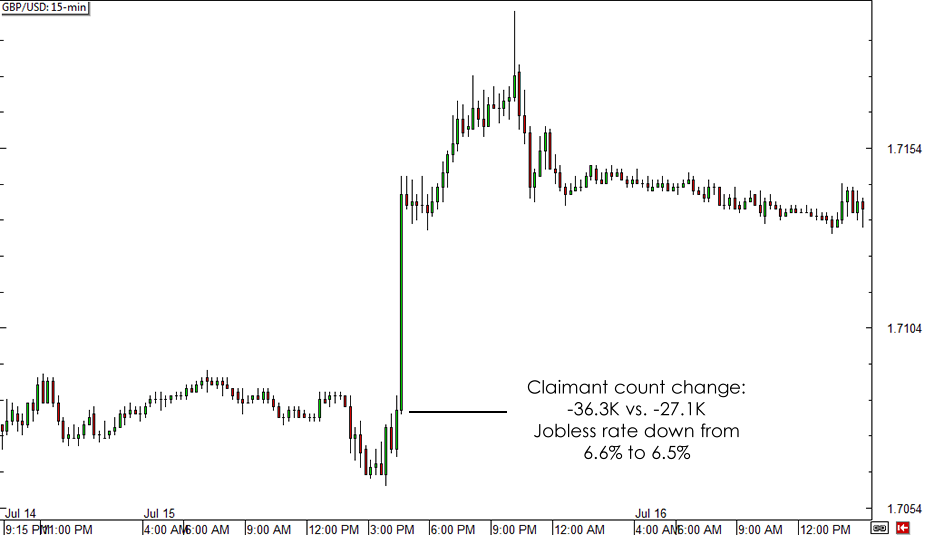

For the month of June, the U.K. economy printed a stronger than expected jobs report as the number of claimants dropped by 36.3K during the period. This followed the better than expected jobs report for May, which showed a 32.8K decline in claimants.

The unemployment rate improved from 6.6% to 6.5% in June as expected, yet market participants appeared to dwell on the lack of wage growth at that time. Average wages posted a mere 0.7% increase, far less than the pace of inflation. This concern was echoed by BOE policymakers in the latest MPC meeting minutes, which hinted that central bank officials might pay closer attention to wage growth in the next jobs releases.

What is expected for the upcoming release?

For the month of July, the U.K. claimant count is expected to fall by 29.7K, a slower pace of decrease compared to the previous months’ figures. The jobless rate is slated to show another improvement from 6.5% to 6.4%.

Bear in mind though that labor market trends appear to be slowing down in the past months, as I’ve discussed in my jobs data roundup article yesterday. This means that there could be a chance for a downside surprise, as U.K. manufacturing reports have also been reflecting a downturn for July.

Data on average wages might also steal the spotlight, as BOE policymakers and market watchers are keen to see if further weaknesses in spending are to be expected.

How might the pound react?

As seen in previous jobs releases, GBP/USD tends to consolidate hours before the report is released then reacts strongly to headline figures.

GBP/USD 15-min Forex Chart

Based on the price reaction to the previous jobs release, there is enough follow through for the next few hours, as the rally lasted by a little over a hundred pips until the start of the U.S. trading session.

If you’re not a fan of volatile forex price action, then it might be better to sit on the sidelines and just watch the event play out. Make sure you get your hands on the details of the jobs release though, as these could determine the longer-term movement of the pound.

Recommended Content

Editors’ Picks

EUR/USD extends gains above 1.0700, focus on key US data

EUR/USD meets fresh demand and rises toward 1.0750 in the European session on Thursday. Renewed US Dollar weakness offsets the risk-off market environment, supporting the pair ahead of the key US GDP and PCE inflation data.

USD/JPY keeps pushing higher, eyes 156.00 ahead of US GDP data

USD/JPY keeps breaking into its highest chart territory since June of 1990 early Thursday, recapturing 155.50 for the first time in 34 years as the Japanese Yen remains vulnerable, despite looming intervention risks. The focus shifts to Thursday's US GDP report and the BoJ decision on Friday.

Gold closes below key $2,318 support, US GDP holds the key

Gold price is breathing a sigh of relief early Thursday after testing offers near $2,315 once again. Broad risk-aversion seems to be helping Gold find a floor, as traders refrain from placing any fresh directional bets on the bright metal ahead of the preliminary reading of the US first-quarter GDP due later on Thursday.

Injective price weakness persists despite over 5.9 million INJ tokens burned

Injective price is trading with a bearish bias, stuck in the lower section of the market range. The bearish outlook abounds despite the network's deflationary efforts to pump the price.

US Q1 GDP Preview: Economic growth set to remain firm in, albeit easing from Q4

The United States Gross Domestic Product (GDP) is seen expanding at an annualized rate of 2.5% in Q1. The current resilience of the US economy bolsters the case for a soft landing.