Since NFP Friday is fast approaching, it’s about time we take a closer look at the U.S. labor market and figure out how the upcoming jobs release could affect dollar movement. Let’s go through our usual Forex Trading Guide routine, shall we?

What is this report all about?

The U.S. non-farm payrolls release shows the change in the number of employed Americans during the reporting period. With that, it is considered an indicator of job creation and a gauge of whether the labor sector is improving or not.

As you’ve learned in the School of Pipsology lesson on economic data, employment is an important component of the economy, as consistent gains in hiring could lead to stronger consumer spending. In turn, this could translate to increased manufacturing and production activity, which eventually lead to more job creation.

What happened last time?

The June NFP Report showed much stronger than expected results, as the U.S. economy added 288,000 jobs while the previous month’s reading was upgraded to show more gains in hiring. In addition to the jobless rate improvement from 6.3% to 6.1%, underlying labor components such as average hourly earnings also showed upbeat figures.

What is expected for the upcoming release?

A slight slowdown in hiring is expected for July, as analysts estimate that the U.S. added only 230,000 jobs. The jobless rate is projected to hold steady at 6.1%.

Jobs components of the latest manufacturing surveys hint of a strong pickup in hiring in that sector, while government payrolls are expected to weaken. Initial jobless claims have been steadily improving, as the four-week moving average is at 302K so far – its lowest level since May 2007. Meanwhile, average hourly earnings could see another 0.2% uptick and reflect consistent wage growth.

How might the U.S. dollar react?

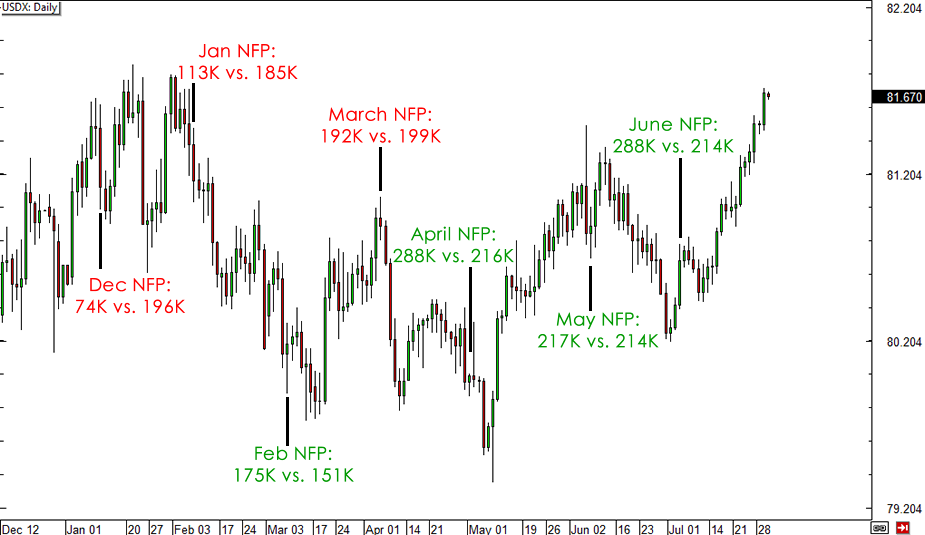

A quick review of past NFP releases reveals that the U.S. dollar continues to react to fundamentals, as stronger than expected data tends to be dollar-bullish while weaker than expected figures usually lead to dollar weakness.

USD Reaction to NFP Releases

Take note that the NFP figure has been coming in better than expected for the past three months so there’s a good chance that the positive trend might continue. In that case, the U.S. dollar could be in for more gains against its forex counterparts, as a strong NFP reading might put rate hike expectations back on the table.

Recommended Content

Editors’ Picks

EUR/USD retreats below 1.0700 after US GDP data

EUR/USD came under modest bearish pressure and retreated below 1.0700. Although the US data showed that the economy grew at a softer pace than expected in Q1, strong inflation-related details provided a boost to the USD.

GBP/USD declines below 1.2500 as USD rebounds

GBP/USD declined below 1.2500 and erased the majority of its daily gains with the immediate reaction to the US GDP report. The US economy expanded at a softer pace than expected in Q1 but the price deflator jumped to 3.4% from 1.8%.

Gold drops below $2,320 as US yields shoot higher

Gold lost its traction and turned negative on the day below $2,320 in the American session on Thursday. The benchmark 10-year US Treasury bond yield is up more than 1% on the day above 4.7% after US GDP report, weighing on XAU/USD.

XRP extends its decline, crypto experts comment on Ripple stablecoin and benefits for XRP Ledger

Ripple extends decline to $0.52 on Thursday, wipes out weekly gains. Crypto expert asks Ripple CTO how the stablecoin will benefit the XRP Ledger and native token XRP.

After the US close, it’s the Tokyo CPI

After the US close, it’s the Tokyo CPI, a reliable indicator of the national number and then the BoJ policy announcement. Tokyo CPI ex food and energy in Japan was a rise to 2.90% in March from 2.50%.