In today’s edition of my Forex Trading Guide, let’s zoom in on another potential market-mover for the week: the U.K. retail sales release. Let’s stick to our usual routine of understanding why this report is important, what happened last time, what is expected, and how the pound might react, shall we?

Why is this report important?

The U.K. retail sales report measures the month-on-month growth of sales on the retail level. It basically measures whatever British consumers spend their hard earned pounds on. This includes household goods, clothing, footwear, fuel and other consumer goods.

Many traders and analysts pay attention to the report, because it is reflective of the current state of the economy. If sales growth is high, people are spending and the economy should be booming. If growth is stagnant or even negative, it could mean that the economy is struggling.

What happened last time?

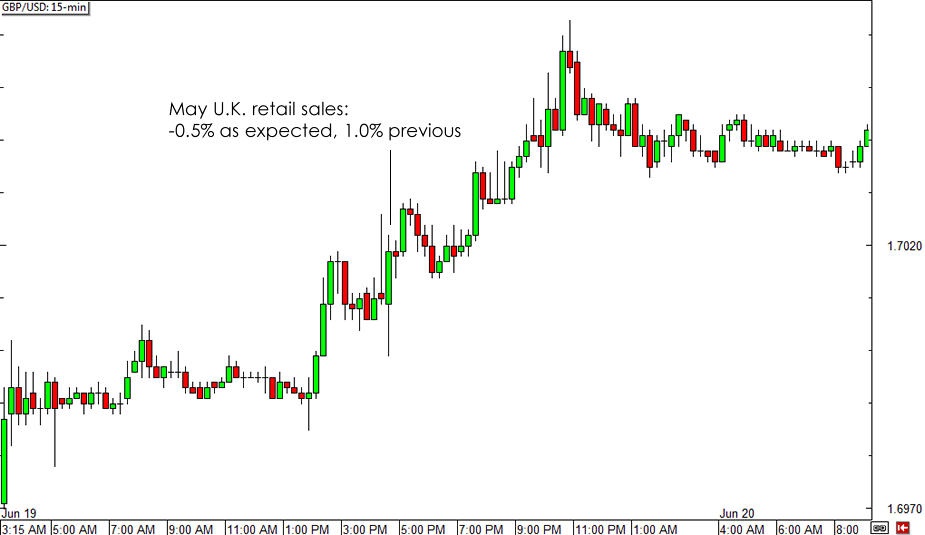

For the month of May, the U.K. reported a 0.5% decline in retail sales, erasing part of the previous month’s 1.0% gain. Prior to that, the U.K. economy has chalked up three consecutive months of stronger than expected consumer spending figures.

Despite the negative reading for May, GBP/USD still made a strong climb after the report was released, as the actual figure came in line with expectations.

GBP/USD 15-min Forex Chart

Some say that the May figure wasn’t so bad, considering the correction was anticipated to follow three months of strong data. At that time, pound bulls were also feeling giddy about BOE rate hike prospects for the year, as the central bank’s upbeat policy meeting minutes were released the previous day.

What is expected this time?

For the month of June, U.K. retail sales might show a 0.2% rebound, enough to recover some of the losses in the previous month. However, many are still crossing their fingers for a huge upside surprise, as the U.K. economy has printed consistent improvements in employment.

Bear in mind that the BOE meeting minutes are also set to be printed the day before the U.K. retail sales release, which suggests that any changes in the MPC’s bias could also influence how traders react to the consumer spending figures.

How might the pound react?

A stronger than expected reading, perhaps one that is more than enough to erase the 0.5% drop in May retail sales, could allow the pound to resume its rallies against its forex counterparts. A quick review of pound pairs’ price action would show that retracements were made recently, yet the trends still appear to be intact.

A much weaker than expected report, on the other hand, could lead to deeper pullbacks for the pound as this could undermine any upbeat remarks from the BOE. If the actual figure simply hits the mark though, the pound might still have a chance at regaining ground later on.

If you’re planning on trading the news, keep in mind that a bit of consolidation might be seen hours before the London session, creating a potential Asian box play. Price tends to start moving during the London open, as some traders are eager to place their bets, and volatility could pick up during the actual release. Stay on your toes!

Recommended Content

Editors’ Picks

AUD/USD pressures as Fed officials hold firm on rate policy

The Australian Dollar is on the defensive against the US Dollar, as Friday’s Asian session commences. On Thursday, the antipodean clocked losses of 0.21% against its counterpart, driven by Fed officials emphasizing they’re in no rush to ease policy. The AUD/USD trades around 0.6419.

EUR/USD extends its downside below 1.0650 on hawkish Fed remarks

The EUR/USD extends its downside around 1.0640 after retreating from weekly peaks of 1.0690 on Friday during the early Asian session. The hawkish comments from Federal Reserve officials provide some support to the US Dollar.

Gold price edges higher on risk-off mood hawkish Fed signals

Gold prices advanced late in the North American session on Thursday, underpinned by heightened geopolitical risks involving Iran and Israel. Federal Reserve officials delivered hawkish messages, triggering a jump in US Treasury yields, which boosted the Greenback.

Bitcoin Price Outlook: All eyes on BTC as CNN calls halving the ‘World Cup for Bitcoin’

Bitcoin price remains the focus of traders and investors ahead of the halving, which is an important event expected to kick off the next bull market. Amid conflicting forecasts from analysts, an international media site has lauded the halving and what it means for the industry.

Is the Biden administration trying to destroy the Dollar?

Confidence in Western financial markets has already been shaken enough by the 20% devaluation of the dollar over the last few years. But now the European Commission wants to hand Ukraine $300 billion seized from Russia.