Heads up, forex fellas! Geopolitical tension may be dominating the newswires recently, but we’ve got a potential market-mover this week. Here’s my forex trading guide on the upcoming RBNZ interest rate decision.

What is this event all about?

As discussed in the School of Pipsology lesson on monetary policy, central bank statements tend to have a strong impact on forex price action since these influence the rate of return on holding the local currency.

When the economy is doing well, the central bank can tighten monetary policy by hiking interest rates, thereby boosting demand for the currency. On the other hand, when the economy is performing poorly, policymakers can ease monetary policy by cutting rates or implementing quantitative easing, leading to lower demand for the currency.

What happened last time?

In their June rate statement, the RBNZ decided to hike interest rates for the third time in a row this year. This was enough to bring their benchmark rate to 3.25%, the highest among major central banks and offering a large positive interest rate differential for buying the Kiwi against other major currencies.

Aside from that, RBNZ Governor Wheeler also hinted that more rate hikes are in the cards. After all, policymakers agreed that economic growth has gained strong momentum and that inflationary pressures need to be contained.

What’s expected this time?

With that, almost everyone is expecting another 0.25% rate hike from the RBNZ in this week’s rate decision. Despite the weaker than expected quarterly GDP reading for Q2 and the consecutive declines in dairy exports and prices, most market analysts still believe that the RBNZ will not waver from its hawkish stance.

However, there’s a good chance that the RBNZ might place a little more emphasis on the recent weaknesses in the New Zealand economy and caution that they could pause from their rate hike streak.

How might NZD/USD react?

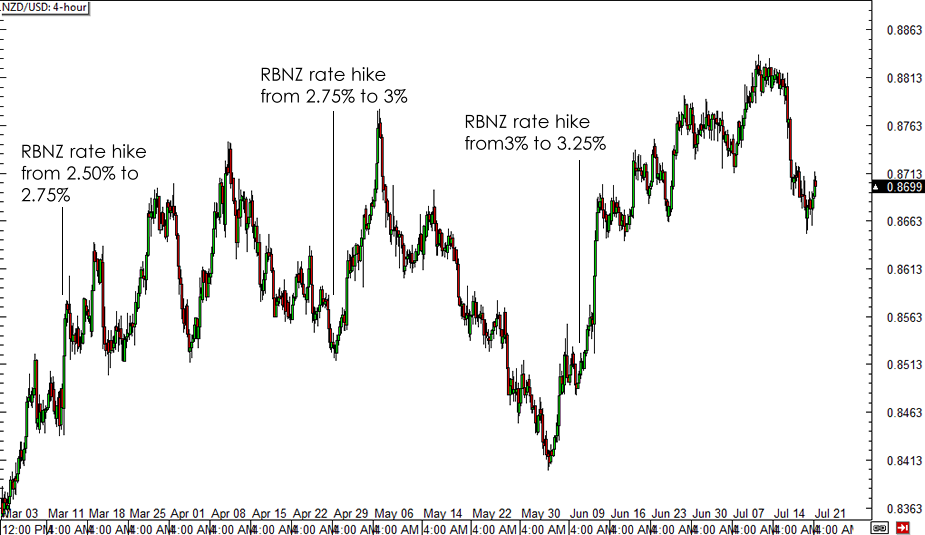

A quick look at how NZD/USD reacted to the past three rate hikes indicates that the impact has gotten stronger each time:

NZD/USD 4-hour Forex Chart

While another rate hike could give the Kiwi more upside, a less hawkish tone from the RBNZ might prevent any potential rallies from being sustained. Bear in mind that geopolitical risks are still weighing on overall market sentiment after all, which means that traders might not be too keen on parking their money in riskier higher-yielding currencies for now.

Recommended Content

Editors’ Picks

AUD/USD rises to two-day high ahead of Aussie CPI

The Aussie Dollar recorded back-to-back positive days against the US Dollar and climbed more than 0.59% on Tuesday, as the US April S&P PMIs were weaker than expected. That spurred speculations that the Federal Reserve could put rate cuts back on the table. The AUD/USD trades at 0.6488 as Wednesday’s Asian session begins.

EUR/USD now refocuses on the 200-day SMA

EUR/USD extended its positive momentum and rose above the 1.0700 yardstick, driven by the intense PMI-led retracement in the US Dollar as well as a prevailing risk-friendly environment in the FX universe.

Gold struggles around $2,325 despite broad US Dollar’s weakness

Gold reversed its direction and rose to the $2,320 area, erasing a large portion of its daily losses in the process. The benchmark 10-year US Treasury bond yield stays in the red below 4.6% following the weak US PMI data and supports XAU/USD.

Ethereum continues hinting at rally following reduced long liquidations

Ethereum has continued showing signs of a potential rally on Tuesday as most coins in the crypto market are also posting gains. This comes amid speculation of a potential decline following FTX ETH sales and normalizing ETH risk reversals.

Australia CPI Preview: Inflation set to remain above target as hopes of early interest-rate cuts fade

An Australian inflation update takes the spotlight this week ahead of critical United States macroeconomic data. The Australian Bureau of Statistics will release two different inflation gauges on Wednesday.