Newsflash! The Bank of Canada (BOC) has just shrugged off its hawkish feathers during its latest monetary policy statement, as Governor Stephen Poloz admitted his “serial disappointment” over the Canadian economy.

Although policymakers agreed to keep interest rates on hold for now, they acknowledged that several downside risks remain. In fact, BOC officials decided to cut their growth forecasts for Canada from 2.3% to 2.2% this year and from 2.5% to 2.4% for 2015. Aside from that, they also downgraded their GDP estimates for the U.S. and the global economy.

While Poloz highlighted the pickup in inflation, he also cautioned that this was not a result of economic improvement. He pointed out that temporary factors, such as rising oil prices and a weaker Canadian dollar, were mostly responsible for the above-target annual CPI figure. According to him, continued economic slack and weak investment prospects will drag price levels down later on.

If you’ve been keeping track of the latest economic figures from Canada, then this downbeat monetary policy statement shouldn’t be much of a surprise. It is noteworthy though, as this marks a significant shift in stance for the BOC, which used to be stubbornly hawkish in the past then eased into a neutral stance earlier this year.

Judging from the Loonie’s reaction to the event, it appears that most traders have already priced in this dovish bias for quite some time.

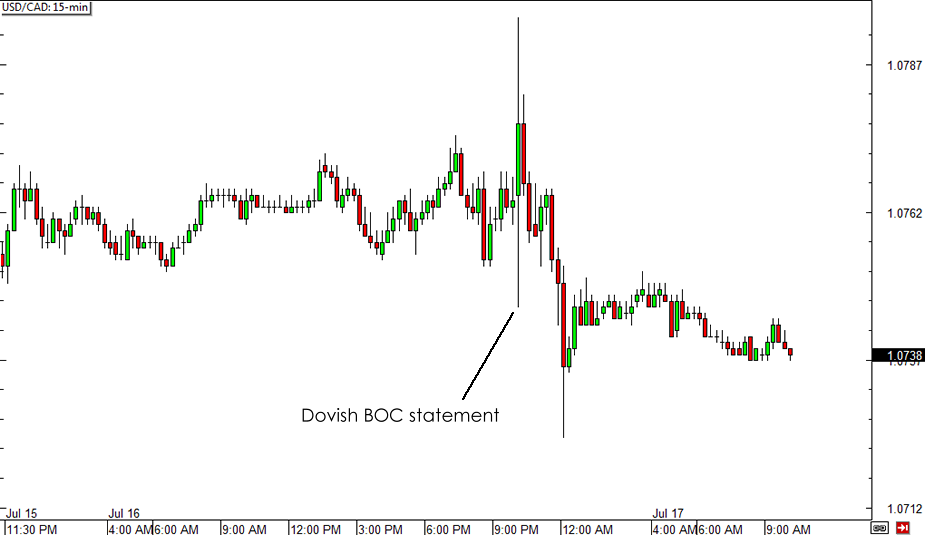

USD/CAD 15-min Forex Chart

As you can see, the Canadian dollar initially sold off sharply during the rate statement but eventually turned back and made a strong rally. This suggests that, while some traders grabbed the opportunity to short the Loonie after the announcement, those who have already shorted the Canadian dollar saw it as a chance to book profits. If the markets could talk, this would be equivalent to saying “Ha! I told you so!”

When it comes to longer-term Loonie direction, this casts doubt on whether the currency can able to sustain its recent rallies or not. Poloz has reiterated that the economy would need to draw support from low interest rates for a longer time, as he projected that the economy could reach full capacity much later than initially anticipated.

Recommended Content

Editors’ Picks

EUR/USD holds gains above 1.0700, as key US data loom

EUR/USD holds gains above 1.0700 in the European session on Thursday. Renewed US Dollar weakness offsets the risk-off market environment, supporting the pair ahead of the key US GDP and PCE inflation data.

GBP/USD extends recovery above 1.2500, awaits US GDP data

GBP/USD is catching a fresh bid wave, rising above 1.2500 in European trading on Thursday. The US Dollar resumes its corrective downside, as traders resort to repositioning ahead of the high-impact US advance GDP data for the first quarter.

Gold price edges higher amid weaker USD and softer risk tone, focus remains on US GDP

Gold price (XAU/USD) attracts some dip-buying in the vicinity of the $2,300 mark on Thursday and for now, seems to have snapped a three-day losing streak, though the upside potential seems limited.

XRP extends its decline, crypto experts comment on Ripple stablecoin and benefits for XRP Ledger

Ripple extends decline to $0.52 on Thursday, wipes out weekly gains. Crypto expert asks Ripple CTO how the stablecoin will benefit the XRP Ledger and native token XRP.

US Q1 GDP Preview: Economic growth set to remain firm in, albeit easing from Q4

The United States Gross Domestic Product (GDP) is seen expanding at an annualized rate of 2.5% in Q1. The current resilience of the US economy bolsters the case for a soft landing.