Trading position (short-term; our opinion): Short positions with a stop-loss order at $54.12 and initial (!) target price at $35.72 are justified from the risk/reward perspective.

On Friday, crude oil lost 3.31% as a stronger greenback weighed on the price of the commodity. Thanks to these circumstances, light crude moved away from its key resistance area and closed another week below it. Will this event encourage oil bears to act in the coming days?

On Friday, the USD Index extended gains as expectations for a December rate hike continued to support the U.S. currency. As a result, the index climbed to an intraday high of 100.25, approaching the Mar high of 100.38 and making crude oil more expensive for buyers holding other currencies. In this environment, light crude reversed and declined sharply, moving away from its key resistance area and closed another week below it. Will this event encourage oil bears to act in the coming days? Let’s examine charts and find out.

On Wednesday, we wrote the following:

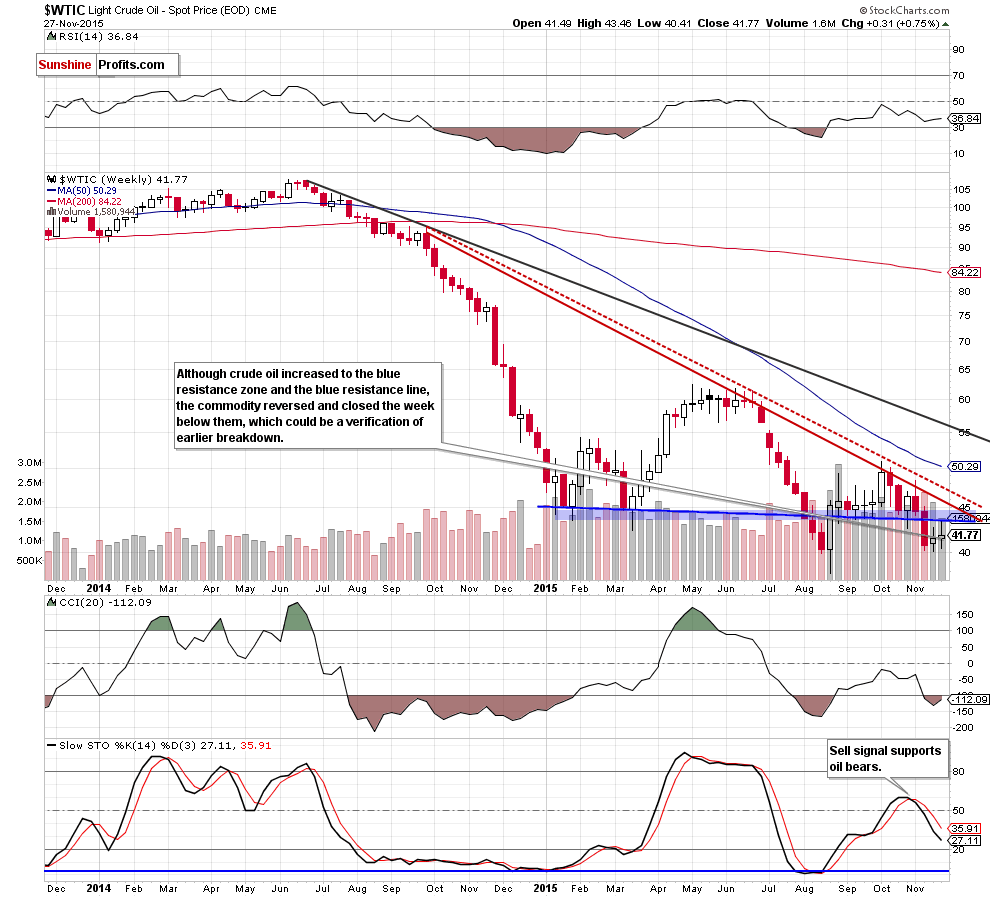

(…) crude oil extended gains and climbed to the blue resistance zone created by the Jan and Feb lows and reinforced by the blue resistance line (marked o the weekly chart). With this upswing, the commodity also reached the blue resistance zone created by the Sept and Oct lows and reinforced by the 38.2% Fibonacci retracement (based on the Nov declines).

What does it mean for light crude? In our opinion, this solid resistance zone will be strong enough to stop further improvement and trigger a pullback. The reason? Firstly, (…) the commodity gave up some of earlier gains and closed the day under the black dashed resistance line. Secondly, the size of volume that accompanied yesterday’s upswing was smaller than day before, which doesn’t confirm oil bulls’ strength. Thirdly, although daily indicators generated buy signals, the sell signal generated by the weekly Stochastic Oscillator remains in place supporting oil bears.

Taking all the above into account, we think that reversal and lower values of the commodity are more likely than not.

As you see on the daily chart, the situation developed in line with the above scenario and crude oil moved sharply lower on Friday. With this downswing, the commodity invalidated a small breakout above the black dashed resistance line and erased all Wednesday’s gains, which is a strong negative signal that suggests further deterioration in the coming week (even if oil bulls will try to re-test the key resistance area once again). If this is the case, and light crude declines from here, we’ll see another test of the barrier of $40 in near future.

How did this price action affect the medium-term picture? Let’s check.

From this perspective we see that although crude oil moved higher in the previous week, the blue resistance area stopped further improvement. As a result, the commodity reversed and declined, which suggests that could see a verification of earlier breakdown. At this point it is also worth noting that light crude closed another week under this zone, which means that the breakdown is confirmed by three consecutive weekly closures (a bearish signal). On top of that, a sell signal generated by the Stochastic Oscillator remains in place, which suggests that further deterioration is just around the corner.

Summing up, the key resistance zone stopped oil bulls, triggering a sharp decline. As a result, light crude closed another week below it, which suggests that earlier upward move was just a verification of earlier breakdown. Taking all the above into account, we believe that light crude will re-test the barrier of $40 in near future. Therefore, short positions (which are already profitable as we opened them when crude oil was trading around $46.69) continue to be justified from the risk/reward point of view.

Very short-term outlook: bearish

Short-term outlook: bearish

MT outlook: bearish

LT outlook: mixed with bearish bias

Trading position (short-term; our opinion): Short positions with a stop-loss order at $54.12 and initial (!) target price at $35.72 are justified from the risk/reward perspective.

All essays, research and information found above represent analyses and opinions of Przemyslaw Radomski, CFA and Sunshine Profits' employees and associates only. As such, it may prove wrong and be a subject to change without notice. Opinions and analyses were based on data available to authors of respective essays at the time of writing. Although the information provided above is based on careful research and sources that are believed to be accurate, Przemyslaw Radomski, CFA and his associates do not guarantee the accuracy or thoroughness of the data or information reported. The opinions published above are neither an offer nor a recommendation to purchase or sell any securities. Mr. Radomski is not a Registered Securities Advisor. By reading Przemyslaw Radomski's, CFA reports you fully agree that he will not be held responsible or liable for any decisions you make regarding any information provided in these reports. Investing, trading and speculation in any financial markets may involve high risk of loss. Przemyslaw Radomski, CFA, Sunshine Profits' employees and affiliates as well as members of their families may have a short or long position in any securities, including those mentioned in any of the reports or essays, and may make additional purchases and/or sales of those securities without notice.

Recommended Content

Editors’ Picks

EUR/USD clings to daily gains above 1.0650

EUR/USD gained traction and turned positive on the day above 1.0650. The improvement seen in risk mood following the earlier flight to safety weighs on the US Dollar ahead of the weekend and helps the pair push higher.

GBP/USD recovers toward 1.2450 after UK Retail Sales data

GBP/USD reversed its direction and advanced to the 1.2450 area after touching a fresh multi-month low below 1.2400 in the Asian session. The positive shift seen in risk mood on easing fears over a deepening Iran-Israel conflict supports the pair.

Gold holds steady at around $2,380 following earlier spike

Gold stabilized near $2,380 after spiking above $2,400 with the immediate reaction to reports of Israel striking Iran. Meanwhile, the pullback seen in the US Treasury bond yields helps XAU/USD hold its ground.

Bitcoin Weekly Forecast: BTC post-halving rally could be partially priced in Premium

Bitcoin price shows no signs of directional bias while it holds above $60,000. The fourth BTC halving is partially priced in, according to Deutsche Bank’s research.

Week ahead – US GDP and BoJ decision on top of next week’s agenda

US GDP, core PCE and PMIs the next tests for the Dollar. Investors await BoJ for guidance about next rate hike. EU and UK PMIs, as well as Australian CPIs also on tap.