Yesterday, after 5 days of declines, we saw a corrective upswing, which took crude oil to an intraday high of $104.20. Did this show of “strength” invalidate any of bearish technical factors that we noticed in recent days?

Although crude oil moved higher after the market’s open, this improvement was only very temporarily and light crude reversed as fears that military conflicts in the Middle East will disrupt supplies continued to wane. Additionally, oil investors also avoided the commodity ahead of the release of the Federal Reserve's minutes from its June policy meeting. Taking into account the fact that the above-mentioned circumstances had a negative impact on the price, let’s check the technical picture of light crude. Are there any factors that could drive the price of crude oil higher in the near future? (charts courtesy of http://stockcharts.com).

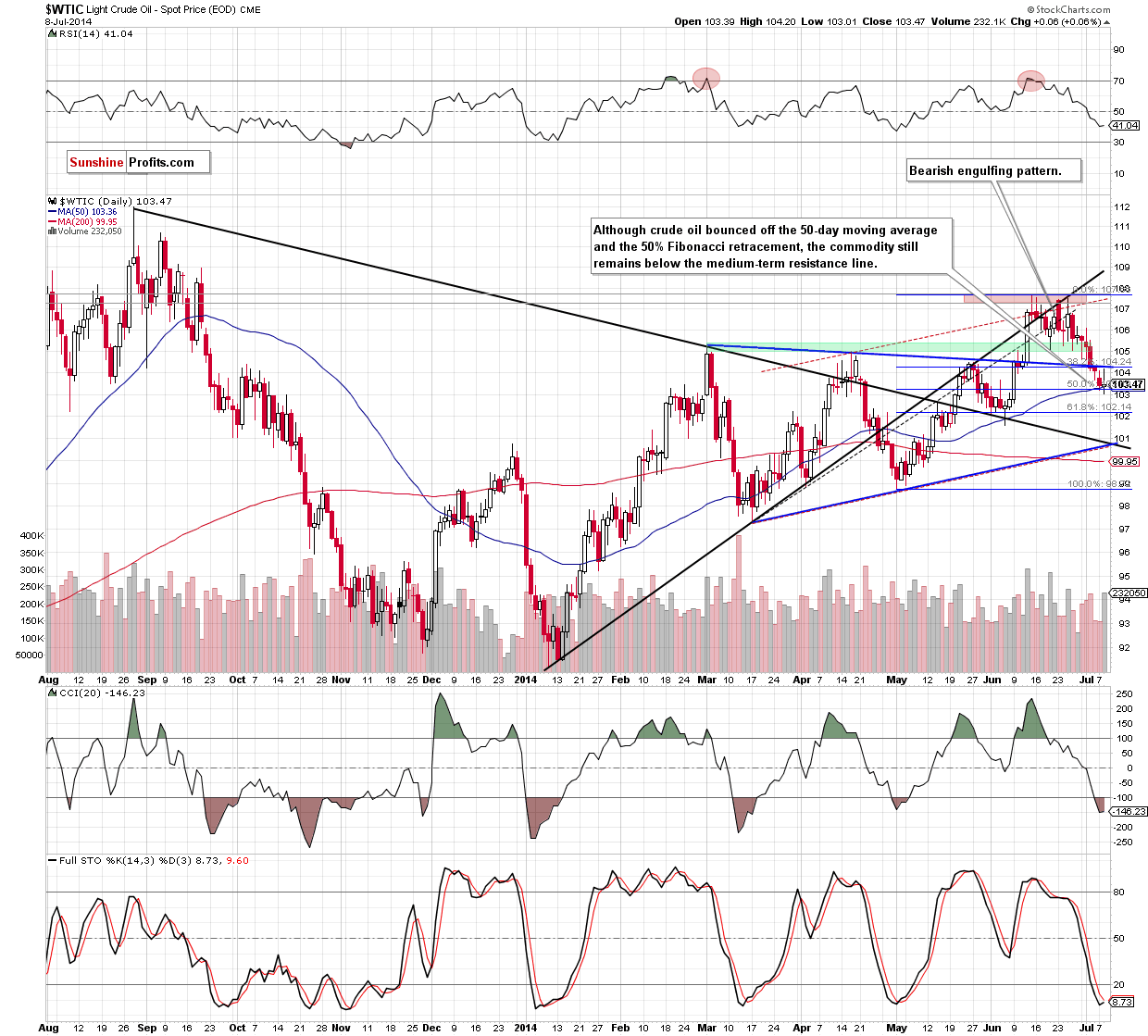

From the medium-term perspective the situation hasn’t change as crude oil still remains below the previously-broken upper line of the blue triangle, while sell signals generated by the indicators favor oil bears. Therefore, we are convinced that our last commentary is still up-to-date:

(…) crude oil will extend the current correction and the initial downside target will be around $101.60, where the June low is. At this point it’s worth noting that slightly below this level is a strong support zone created by the 50-week moving average (currently at $101.26) and the lower line of the trend channel (and lower border of the blue triangle), which may pause further deterioraion.

Once we know the medium-term picture, let’s check the very short-term outlook.

Quoting our last oil Trading Alert:

(…) if (…) crude oil moves lower, the initial downside target will be the 50-day moving average (currently at $103.27). (…) this area is supported by the 50% Fibonacci retracement (based on the Apr.-June rally). Therefore, if it holds, we’ll likely see an attempt to move above the blue resistance line.

Yesterday, the situation developed in line with the above-mentioned scenario as crude oil rebounded to the blue line after a drop to its downside target. As you see on the daily chart, despite this upswing, the overall situation hasn’t changed much as light crude is trading in a narrow range between the medium-term resistance line and the support zone. If oil investors push the buy button and the commodity climbs above its nearest resistance later in the day, crude oil will invalidate the breakdown (which would be a strong positive signal) and we’ll see an increase to the previously-broken green zone, which currently serves as resistance (around $105-$105.50). However, if oil bulls fail, we’ll see another attempt to break below the support zone. If it happens, the next downside target will be around $102.14, where the 61.8% Fibonacci retracement is. Please keep in mind that sell signals generated by the indicators remain in place, supporting the bearish case at the moment.

Summing up, although crude oil bounced of its support zone, the previously-broken medium-term support/resistance line stopped further improvement. In our opinion, yesterday’s move might be nothing more than a verification of the breakdown and if this is the case, we’ll see another attempt to break below the 50% Fibonacci retracement and the 50-day moving average. Connecting the dots, we are still bearish and think that further correction and lower values of crude oil are still ahead us. Therefore, short positions (which are already profitable) are still justified from the risk/reward perspective. We realize that keeping a short position when the market moves even a bit higher is not a pleasant thing to do, but let's keep in mind that the hardest investment decisions that one makes are often the most profitable ones.

Very short-term outlook: bearish

Short-term outlook: mixed with bearish bias

MT outlook: mixed

LT outlook: mixed

Trading position (short-term; our opinion): Short. Stop-loss order at $109.20.

Recommended Content

Editors’ Picks

AUD/USD posts gain, yet dive below 0.6500 amid Aussie CPI, ahead of US GDP

The Aussie Dollar finished Wednesday’s session with decent gains of 0.15% against the US Dollar, yet it retreated from weekly highs of 0.6529, which it hit after a hotter-than-expected inflation report. As the Asian session begins, the AUD/USD trades around 0.6495.

USD/JPY finds its highest bids since 1990, approaches 156.00

USD/JPY broke into its highest chart territory since June of 1990 on Wednesday, peaking near 155.40 for the first time in 34 years as the Japanese Yen continues to tumble across the broad FX market.

Gold stays firm amid higher US yields as traders await US GDP data

Gold recovers from recent losses, buoyed by market interest despite a stronger US Dollar and higher US Treasury yields. De-escalation of Middle East tensions contributed to increased market stability, denting the appetite for Gold buying.

Ethereum suffers slight pullback, Hong Kong spot ETH ETFs to begin trading on April 30

Ethereum suffered a brief decline on Wednesday afternoon despite increased accumulation from whales. This follows Ethereum restaking protocol Renzo restaked ETH crashing from its 1:1 peg with ETH and increased activities surrounding spot Ethereum ETFs.

Dow Jones Industrial Average hesitates on Wednesday as markets wait for key US data

The DJIA stumbled on Wednesday, falling from recent highs near 38,550.00 as investors ease off of Tuesday’s risk appetite. The index recovered as US data continues to vex financial markets that remain overwhelmingly focused on rate cuts from the US Fed.