- Market movers: Weekly technical outlook

- Doves are re-circling the Aussie

- Look ahead: Stocks

- Look ahead: Commodities

- Global data highlights

Market movers: Weekly technical outlook

- Technical Developments to Watch:

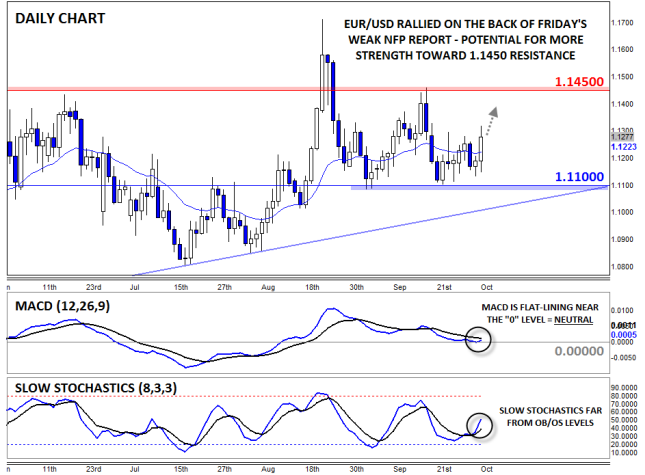

- EUR/USD bulls may look to target the top of the recent range at 1.1450 this week

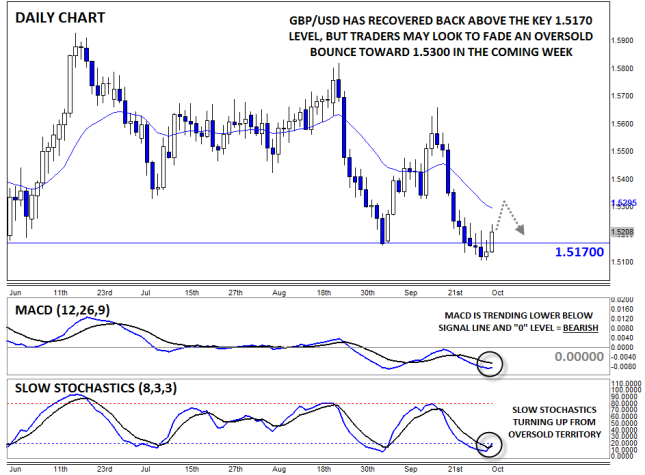

- GBP/USD short squeeze possible, but medium-term bias remains lower

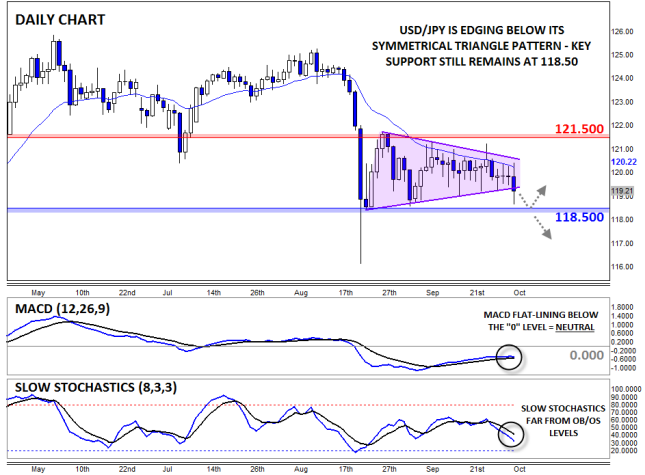

- USD/JPY traders watching 118.50 support closely

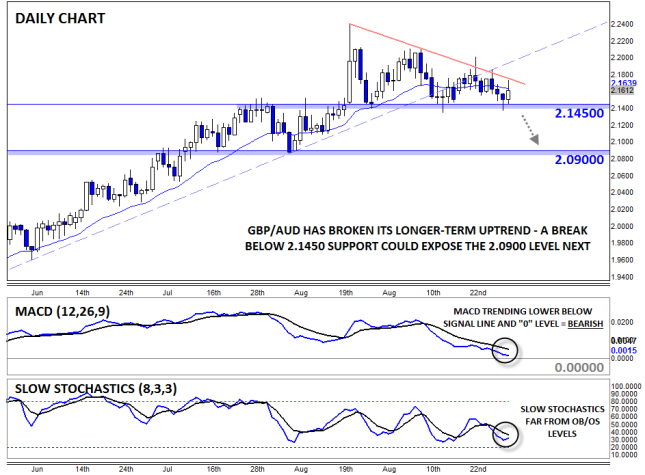

- GBP/AUD in play, holding above 2.1450 support for now

* Bias determined by the relationship between price and various EMAs. The following system determines bias (numbers represent how many EMAs the price closed the week above): 0 = Strongly Bearish, 1 = Slightly Bearish, 2 = Neutral, 3 = Slightly Bullish, 4 = Strongly Bullish.

** All data and comments in this report as of Friday afternoon **

EUR/USD

- EUR/USD held near key support at the 1.1100 level last week before bouncing on Friday

- MACD still below its signal line, showing that momentum has not yet turned bullish

- Near-term range between 1.1100 and 1.1450 remains intact

GBP/USD

- GBP/USD dipped below key 1.5170 support before rallying on NFP Friday

- MACD showing bearish momentum, but the Slow Stochastics remain in oversold territory

- A near-term short squeeze is possible, but medium-term bias remains lower

USD/JPY

- USD/JPY chopped around last week before breaking lower on NFP

- Secondary indicators show generally balanced, two-way trade

- All eyes on key support at 118.50

GBP/AUD

- GBP/AUD has rolled over to break its near-term bearish trend line

- The MACD is trending lower and about to cross the “0” level, showing bearish momentum

- A drop through 2.1400-50 support could expose 2.0900 next

Doves are recircling the Aussie

The Reserve Bank of Australia is under pressure to loosen monetary policy further due to the risks facing the Australian economy. While it’s true that parts of the economy are performing well, the broader economy is exposed to falling commodity prices and worsening economic conditions in some of its main trading partners, especially China. This is outpacing an ongoing transition away from being so heavily reliant on resource and related sectors.

Ongoing concerns about the health of China’s all-important economy and emerging markets are fuelling fears about the outlook for the global economy. In fact, the poisoned atmosphere in the global marketplace has resulted in a widespread sell-off of risk assets, and brought into question prior assumptions about growth, inflation and monetary policy in economies throughout the world. Even the Fed is likely questioning the need for tighter monetary policy in this kind of toxic environment.

In Australia, the economy is one of the most exposed in the developed world, largely because of its reliance on its resource demand. While non-resource based states are broadly performing well, a collapse in mining investment is dragging down overall growth, with the economy expanding a measly 0.2% in q/q (much less than the expected) last quarter. Only household and government spending kept the economy heading in the right direction in Q2.

There’s not much light on the horizon either, with growth expected to remain below trend for the foreseeable future. Businesses are cutting spending and there’s not enough life in non-mining parts of the economy to pick up the slack being left behind by diminishing mining investment, despite a softer exchange rate.

However, the RBA remains in neutral due to the aforementioned weakness in the Aussie and a somewhat resilient labor market down under. The unemployment has remained around 6%, led by strong and consistent growth in full-time employment. Meanwhile, the Aussie has fallen around 25% over the last couple of years, revitalizing the services sector. This fuels the argument that the current accommodative level of monetary policy is enough to support the economy through its transition away from being wholly reliant on mining investment.

What this means for the Aussie

Despite the RBA’s position on the sidelines in the past couple of months, the deterioration of the global economy raises the stakes for the bank as it attempts to support the changing nature of the Australian economy. If the RBA looks more dovish than it has in the past due to the aforementioned concerns about global growth, it could keep the Australian dollar pinned down. AUDUSD is currently flirting with 0.7000 and looks like it’s waiting for direction; thus, a dovish RBA could help cement the pair’s position below 0.7000. In any event, traders should also keep a close eye on the release of the highly anticipated US NFP report (not released at the time of writing) and the Fed’s latest meeting minutes later in the week, either of which could significant move the world’s reserve currency and possibly overshadow developments in Australia and their respective impact(s) on the Aussie.

Look ahead: Stocks

Stocks fell sharply on Friday, reversing earlier gains, on the back of a very disappointing US jobs report. The world’s largest economy added just 142 thousand jobs in September which was far below the 200 thousand expected, while the prior months’ payroll data were also revised substantially lower. On top of this, the average hourly earnings were flat, disappointing expectations of a 0.2% increase. The news weighed heavily on the dollar, lifting the EUR/USD currency pair to above 1.1300 from around 1.1150 earlier in the day. The DAX index thus suffered heavily as the stronger euro further reduced the appeal of German exporters, which have already had a rough time of late due to slowing Chinese growth concerns and VW’s emissions-fixing scandal. Things could go from bad to worse for the German index if next week’s macroeconomic data from Europe also disappoint expectations. The key data to watch includes Eurozone retail sales and Sentix Investor Confidence on Monday, German factory orders on Tuesday and German industrial production on Wednesday. That being said, there is an argument that the Federal Reserve may now decide against hiking interest rates in 2015, which could help support equities. The US quarterly earnings season is also about to start soon, which may also provide some support.

From a technical point of view, there are contradictory signals to be observed when looking at the daily chart of the DAX index, which means that both the bulls and the bears should proceed with an extra degree of caution until the trend becomes clearer. The bulls, for example, would point to the fact that the index has refused to hold below the previous low of the 9320/5 area, which suggests that a double bottom reversal pattern may have been created. What’s more, the long-term bullish trend line that has been in place since September 2011 has also been defended once again. In addition, the momentum indicator RSI has formed a clear bullish divergence (i.e. it has made a higher low compared with a lower low on the underlying DAX index). So far this correctly suggested that the bearish momentum was waning.

However, the bears would argue that, so far, no major resistance levels have been taken out. Indeed, this week’s small rebound could easily have been driven by profit-taking from the sellers rather than aggressive buying pressure. The good news is that soon we will find out which of these scenarios is the case. Conservative traders may therefore wish to wait until the signal becomes clearer before jumping in or alternatively be more nimble in this market environment.

Traders may have also noticed that the last significant rebound from the 9320/5 support level ended at the relatively shallow 38.2% Fibonacci retracement level (around 10500) of the downswing from this year’s record high, suggesting the buyers had lacked conviction in their trades then. Are we now witnessing a similar pattern unfold? The high of this week’s candle is around 9780 i.e. just above the 38.2% Fibonacci retracement level of the most recent downswing (around 9765). If the previous price action is anything to go by, then a rejection at this shallow retracement level would suggest that the index may go for another test of the 9320/5 support area before deciding on its next move.

If and when the 9320/5 support area breaks down decisively then things could turn ugly for the German index fairly quickly. It would be a psychological blow for the bulls, forcing more to rush for the exits while fresh sellers may also be tempted to join in. The fact that there are not much further short-term supports below this level means the bears may consequently aim for 9000 as their initial target in the case of a breakdown. Not only is this a psychologically important level but here we also have two Fibonacci levels converging: the 38.2% retracement of the upswing from the post financial crisis low (at 9035/7) with the 127.2% extension of the most recent bounce (at 8995). The 161.8% extension level could be the next bearish target at just below 8580. Conversely, if the bulls win control here, they would then also need to break several other resistances such as 10,000 and 10,500 before they grow in confidence and come back in force. So there’s more wood to chop for the bulls than the bears.

Look ahead: Commodities

Earlier on Friday, gold was down for the sixth consecutive trading day and looked like it would be heading further lower. This was a sharp contrast to just last Thursday when it looked like the metal had finally woken up from its slumber as it momentarily traded above $1155 and a bearish trend line that has been in place since the start of this year. Then, both the dollar and equity markets were looking pretty weak, with the latter falling on Chinese concerns and the former on disappointment that the Federal Reserve delayed hiking rates in September. For most of this week, both the dollar and stock markets managed to gain some ground, which reduced the appeal of gold. With Chinese investors on holiday, some market participants undoubtedly took advantage of lower stock prices and the bearish sentiment to find good trading and investment opportunities in companies with sound fundamental backdrop, especially those that have been heavily oversold. The dollar meanwhile rose due mainly to a fall in the EUR/USD currency pair on the back of some weaker Eurozone data and mixed-bag US numbers.

However, things changed dramatically once the US jobs report was released on Friday, which surprised even the most pessimistic of forecasters. The world’s largest economy added just 142 thousand jobs in September, which was far below the 200 thousand expected, while the prior months’ payroll data were also revised substantially lower. On top of this, the average hourly earnings were flat, disappointing expectations of a 0.2% increase. Following the data release, the dollar fell and US stock index futures dropped. As a result, gold surged higher, but crude oil actually fell back, extending its decline from the previous day. The contrasting performance of gold and oil on the back of the poor US jobs report suggests investors are clearly now worried about weakening economic growth, which is why the equity markets have also fallen. With China already struggling and growth remaining lackluster in Europe, future demand for oil may not be as strong as had been previously anticipated.

Despite Friday’s massive rally, the current economic climate (e.g. the lack of inflation) argues against a sustained recovery for gold. That being said, more short-term gains could be on the way if the metal manages to break above the bearish trend line that has been in place since the start of the year, around $1140/2. A decisive break could lead to a rally early next week towards (some of) the following levels next:

- $1165/70: previous resistance and 38.2% Fibonacci retracement of XA price swing

- $1178/80: 200-day moving average

- $1190/92: point D of an ABCD pattern, 127.2% Fibonacci extension of BC and 50% retracement of XA price swings

- $1215/20: extended point D (1.618) of an ABCD pattern, 161.8% Fibonacci extension of BC and 61.8% Fibonacci retracement of XA price swing; in other words, a Bearish Gartley entry point

Global Data Highlights

Monday, October 5

0830GMT – UK Services PMI (September)

Britain’s dominant services sector is very important to the overall health of the economy. In August, this Index missed expectations, resulting in a sell-off in the GBP. Another miss could weaken the pound once more, while a strong reading could reinforce the upbeat currency.

1400GMT – US ISM non-Manufacturing PMI (September)

This gauge of activity of non-manufacturing sectors of the US is going to be closely watched by US dollar traders ahead of another important meeting at the FOMC later this month. This time around we’re expecting the index to drop to 58.0 in September, from 59.0 in August. While this print isn’t going to help dollar bulls, it shouldn’t dent the possibility of rate raises this year.

Tuesday, October 6

0030GMT – Australian trade data (August)

This release will likely take a backseat to a policy meeting at the RBA on the same day, but it’ll still provide the market will a look at the health of Australia’s trade exposed sectors. Falling exports would further dampen the mood down under and increase the need for support from policy makers.

0330GMT – Reserve Bank of Australia Monetary Policy Meeting

The Reserve Bank of Australia (RBA) is widely expected to leave the official cash rate at 2.00% this time around, but the possibly of further policy loosening is growing alongside falling commodity prices. A softer exchange rate is helping to offset some of the impact of lower commodity prices, but it’s not doing enough. If the bank is more dovish than expected at this meeting it could secure AUDUSD’s position below 0.7000 in the short term, depending on movements in the pair prior to today’s meeting.

Wednesday, October 7

Tentative – BoJ

The Bank of Japan (BoJ) isn’t expect to alter it’s already extremely dovish policy stance this time around as it remains blissfully optimistic. However, the bank will likely reiterate that it stands ready to act if the outlook for inflation deteriorates further or doesn’t improve soon. Overall, it may be a non-event for the market unless the BoJ is uncharacteristically downbeat due to the recent attractiveness of the yen amidst these volatile market conditions or if it even surprises the market with further easing, both of which could weigh on the yen.

0830GMT – UK manufacturing production (August)

Manufacturing production fell a disappointing 0.8% in July, raising concerns about the overall health of the sector as sentiment deteriorates. A weak print here could encourage GBP bears over the short term.

Thursday, October 8

1100GMT – UK Monetary Policy Committee

Monetary policy is expected to remain unchanged in the UK for the time being. There’s a divergence amongst MPC members as to where to head next, which should keep the bank on the sidelines for a while. In saying that, risks have increased to the downside due to concern about the global economy, particularly focused on emerging markets and China.

1800GMT – FOMC meeting minutes

One of the biggest themes in the market at the moment is the prospect of tighter monetary policy in the US this year and the Fed’s meeting minutes provide the market with an invaluable look into the minds of policy makers as they discuss just such an event. We expect the bank to reinforce the notion that rate hikes are still on the table, but it’ll be interesting to see if the bank is considering delaying rates due to a global economic slowdown. Yellen has attempted to dispel these rumors recently, but it’s still a factor in the FOMC’s policy meetings.

This research is for informational purposes and should not be construed as personal advice. Trading any financial market involves risk. Trading on leverage involves risk of losses greater than deposits.

Recommended Content

Editors’ Picks

EUR/USD clings to daily gains above 1.0650

EUR/USD gained traction and turned positive on the day above 1.0650. The improvement seen in risk mood following the earlier flight to safety weighs on the US Dollar ahead of the weekend and helps the pair push higher.

GBP/USD recovers toward 1.2450 after UK Retail Sales data

GBP/USD reversed its direction and advanced to the 1.2450 area after touching a fresh multi-month low below 1.2400 in the Asian session. The positive shift seen in risk mood on easing fears over a deepening Iran-Israel conflict supports the pair.

Gold holds steady at around $2,380 following earlier spike

Gold stabilized near $2,380 after spiking above $2,400 with the immediate reaction to reports of Israel striking Iran. Meanwhile, the pullback seen in the US Treasury bond yields helps XAU/USD hold its ground.

Bitcoin Weekly Forecast: BTC post-halving rally could be partially priced in Premium

Bitcoin price shows no signs of directional bias while it holds above $60,000. The fourth BTC halving is partially priced in, according to Deutsche Bank’s research.

Week ahead – US GDP and BoJ decision on top of next week’s agenda

US GDP, core PCE and PMIs the next tests for the Dollar. Investors await BoJ for guidance about next rate hike. EU and UK PMIs, as well as Australian CPIs also on tap.